Aave Introduces New Proposal to Adjust MakerDAO DAI Risk Parameters

Aave Introduces Contemporary Proposal to Regulate MakerDAO DAI Likelihood Parameters

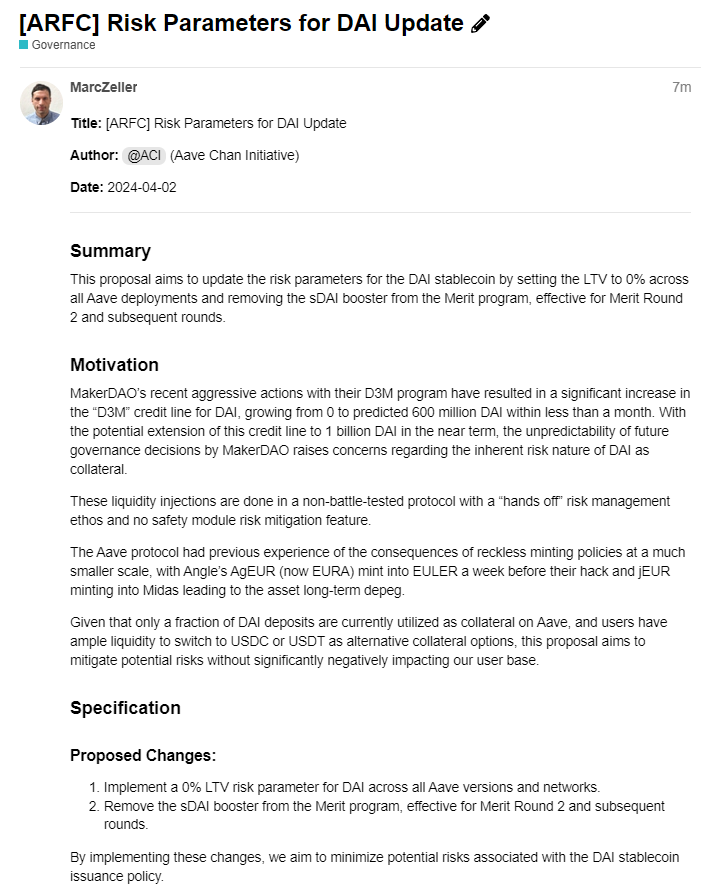

Aave, a number one lending protocol, has unveiled a original proposal by its Aave Likelihood Framework Committee (ARFC) to modify the probability parameters linked to the MakerDAO stablecoin, DAI.

The proposal, detailed in a blog publish titled “[ARFC] Likelihood Parameters for DAI Change,” printed on April 2, is centered on updating the probability parameters particularly for DAI. By imposing these adjustments, Aave targets to slice potential dangers associated with the issuance protection of the DAI stablecoin.

Aave Chan Initiative Proposes 0% LTV for DAI on Aave Deployments in Response to MakerDAO’s Aggressive D3M Program

The proposal, indicate by the Aave Chan Initiative (ACI) workforce by Mark Zeller, founding father of the Aave Chan Initiative, recommends adjusting DAI’s loan-to-cost ratio (LTV) to 0% across all Aave deployments. Additionally, it suggests putting off sDAI incentives from the Advantage program, efficient from Advantage Round 2 onwards.

This initiative is a response to MakerDAO’s recent aggressive actions, particularly their D3M program, which has seen a immediate plot bigger within the “D3M” credit score line for DAI, reaching an estimated 600 million DAI inner a short length. There are issues about MakerDAO’s governance selections and the aptitude extension of the credit score line to 1 billion DAI, highlighting the inherent probability associated with DAI as collateral.

Furthermore, the proposal highlights the dangers associated with liquidity injections in a non-war-examined protocol with a “fingers-off” probability administration ethos and no safety module probability mitigation feature.

The proposal targets to address these dangers, particularly in gentle of Aave’s previous encounters with the penalties of reckless minting insurance policies. Cases much like Perspective’s AgEUR (now EURA) minted into EULER, hacked inner per week, highlight the aptitude dangers of utilizing DAI as loan collateral on Aave. This proposal targets to remain stablecoin depegging eventualities and safeguard the steadiness and integrity of the Aave protocol.

Despite these challenges, the proposal targets to mitigate potential dangers without drastically impacting Aave’s person defective, as handiest a piece of DAI deposits are within the meanwhile utilized as collateral on the platform. Customers even enjoy different collateral alternate choices cherish USDC or USDT, offering abundant liquidity and suppleness.

MakerDAO Evaluates Proposal to Make investments $600 Million in DAI into USDe and sUSDe Through DeFi Protocol Morpho Labs

🔗 MakerDAO Considers $600 Million DAI Allocation into USDe and sUSDe

MakerDAO is within the meanwhile reviewing a proposal to take a position $600 million in DAI into USDe and its staked model sUSDe.#CryptoNews #newshttps://t.co/2teq1BVc9B

— Cryptonews.com (@cryptonews) April 2, 2024

MakerDAO is evaluating a proposal to take a position $600 million in DAI into USDe and its staked model, sUSDe. This proposal, outlined in a community forum publish by MonetSupply from Block Analitica, a probability intelligence firm for decentralized finance (DeFi), targets to leverage the capabilities of the DeFi lending protocol developed by Morpho Labs.

The causes for investing in USDe and sUSDe are multifaceted. MonetSupply highlighted person preferences for obvious monetary products and leverages inner the DeFi procedure, indicating a significant desire for USDe over sUSDe pools and better leverage over decrease leverage.

The proposal also outlines monetary and strategic advantages, including vital incentives for utilizing USDe and sUSDe collateral on Morpho, lowering liquidity probability, boosting Ethena’s insurance protection fund income, and adorning investment security over time.

The initial recommendation suggests environment MakerDAO’s USDe publicity restrict at $600 million, with the aptitude to plot bigger as Ethena’s platform expands. To be obvious monetary steadiness, the investment would be capped at $800 million to offer protection to in opposition to extraordinary losses.

Source : cryptonews.com