Tokenized Treasuries Are An Emerging Asset Class, But RWA Adoption May Take Time

Tokenized Treasuries Are An Rising Asset Class, Nonetheless RWA Adoption Can also simply Rob Time

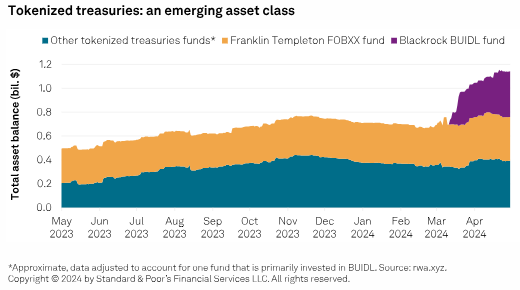

Query for tokenized treasuries is on the upward thrust. Recent data means that bigger than $1 billion in treasury notes has been tokenized on public blockchain networks.

Andrew O’Neill, Digital Sources Managing Director of S&P World Rankings, told Cryptonews that the most modern launch of BlackRock’s BUIDL fund – in the imply time the sector’s greatest tokenized treasury fund – looks to be to be accelerating this vogue.

“As confirmed in the chart, the launch of the BUIDL fund has steepened increase in prominent volume,” mentioned O’Neill.

“It’s also intelligent to existing Larry Fink’s public statements on the role of tokenization in due course of BlackRock and financial markets, to realize the context wherein here’s being executed,” O’Neill added.

What Are Tokenized Treasuries?

Certainly, BlackRock CEO Larry Fink only in the near past mentioned that capital markets will most possible be made more atmosphere pleasant by transferring on-chain.

“Tokenized treasuries are digital tokens created on a blockchain which will most possible be backed by a portfolio of U.S. government duties,” O’Neill outlined. “These belongings are issued both by blockchain-native companies and feeble institutions.”

O’Neill believes that tokenized treasuries are turning into more crucial because they can relief money market funds and their merchants put together liquidity.

Tokenized U.S. Treasuries lawful topped $1B

$26.99T to lunge pic.twitter.com/PDF0uqksj3

— Camila Russo (@CamiRusso) April 5, 2024

Tokenized Treasuries Abet With Liquidity Challenges

For instance, O’Neill illustrious that in times of market volatility, merchants may perchance must meet margin calls on some positions.

“Cash market fund merchants may perchance simply spy to redeem their shares in the fund for money to meet these duties,” mentioned O’Neill.

O’Neill illustrious that if many merchants redeemed in the present day, alternatively, this would invent bigger the fund’s liquidity threat.

Whereas the U.S. Securities and Alternate Fee (SEC) only in the near past increased funds’ minimal liquid belongings requirements to mitigate this threat, O’Neill believes that tokenization will most possible be necessary.

Franklin Templeton's Tokenized Cash Market Fund Accredited & Regulated by The #SEC. Powered by #Stellar Lumens pic.twitter.com/wApp5XLBv1

— 707Crypto (@707_crypto) November 15, 2023

“Traders can now delight in spherical-the-clock get entry to to liquidity on-chain,” he mentioned. “For instance, BlackRock’s BUIDL fund, issued on Ethereum (a public blockchain), enables merchants to redeem their shares for USDC stablecoin by a tidy contract, without relying on any intermediary.”

He extra added that merchants can exercise their tokens as liquid collateral in preference to needing to redeem them. In flip, this would nick the threat of a bustle on a fund.

Franklin Templeton only in the near past enabled seek-to-seek transfers on tokens from its FOBXX fund to toughen such a skill.

Chris Yin, CEO and Co-founder of Plume Community – a layer-2 centered on RWAs – told Cryptonews that FOBXX seeks to fabricate merchants with a gradual and liquid funding vehicle.

“FOBXX makes use of the Stellar blockchain for transaction processing, aiming to enhance transparency and nick operational prices,” mentioned Yin. “It’s accessible by the Benji Investments app, which extra enables for digital wallet integration.”

Tokenized Treasuries Allow RWAs

Yin added that the particular game changer at the abet of tokenized treasuries is the enablement of fractional possession of exact-world belongings (RWAs).

“This form enhances efficiency and enables for fractional possession, increasing get entry to to a broader defective of merchants,” Yin outlined.

Whereas the idea that is collected novel, tokenized treasuries will most possible be divided into smaller units. No longer like feeble treasury notes with excessive minimal funding requirements, tokenization enables for even minute merchants to take part.

“By starting with U.S. Treasuries, which will most possible be low-threat and acquainted, they supply a gateway for merchants to delight in interplay with on-chain belongings,” mentioned Yin.

Will Tokenized Treasuries Charm To Traders?

Whereas tokenized treasuries provide a assortment of advantages, how merchants will have interaction with these novel belongings is unclear.

This asset class is collected emerging, and investor hobby likewise,” mentioned O’Neill. “A first-rate soar in investor hobby requires that merchants can solely realize the benefits of holding a tokenized asset.”

To discontinuance this, O’Neill believes that blockchain interoperability is wished to toughen energetic secondary markets.

“The flexibility to mobilize the tokenized asset itself as collateral, in preference to having to redeem shares in a fund, is stunning, and here’s already technically that you just may perchance perchance have faith in some conditions,” mentioned O’Neill. “On the opposite hand, there’s no longer but a meaningful secondary market for getting and selling these belongings.”

Additionally, O’Neill illustrious that ideas are required to bridge money transactions on-chain.

The numerous crucial component is enabling on-chain money legs to toughen supply-vs-price transactions,” he mentioned. “If a tokenized asset will most possible be transferred on-chain, however the particular payments for a transaction are made off-chain in a feeble draw, there’s shrimp invent for merchants.”

BLACKROCK'S BUIDL SECURES THIRD OF TOKENIZED TREASURIES MARKET

BlackRock's fund has accrued $381M since its March 20 launch.

This positions BUIDL sooner than Franklin Templeton’s fund, which holds $360M in tokenized Treasuries on Polygon and Stellar.

Source: DL Files pic.twitter.com/VH3CQ0CmRH

— Mario Nawfal’s Roundtable (@RoundtableSpace) Can also simply 16, 2024

Whereas this may perchance perchance be the case, Blackrock’s BUIDL fund illustrates how merchants can get entry to 24/7 liquidity by a tidy contract the utilization of a stablecoin. O’Neill believes that regulatory readability around stablecoins will relief merchants have interaction with a lot of these aspects transferring forward.

Tokenization Will Abet Institutions, Nonetheless Challenges Remain

Bloomberg Intelligence ETF Be taught Analyst James Seyffart told Cryptonews that companies including BlackRock, Franklin Templeton, and WisdomTree are demonstrating how blockchain can streamline facets of feeble finance.

“We’re in the very early innings for all of this, however companies are attempting many alternative issues and the market will in a roundabout method resolve what sticks,” mentioned Seyffart.

But, for tokenized treasuries to attain success, O’Neill believes that merchants require advise get entry to to the blockchains on which the tokenized belongings are constructed. He also mentioned that institutions must join their legacy programs to those blockchains.

With this in mind, Yin outlined that Plume Community seeks to simplify the technique of RWA mission deployment, while presenting merchants with a blockchain ecosystem to incorrect-pollinate and make investments in a form of RWAs.

“Plume Community permits RWA composability by its thriving DeFi functions and affords get entry to to excessive-quality investors to invent bigger liquidity for all RWAs,” he mentioned. “Via the a lot of initiatives in our ecosystem, we provide crypto exercise conditions – borrow/lend, trade, speculate, yield farm, etc. – to RWAs in portray to uncover fetch novel liquidity.”

Yin also thinks that as institutional merchants increasingly undertake RWAs, a brand novel wave of retail merchants will inject capital into blockchain ecosystems fancy never sooner than.

“By in the starting effect specializing in constructing traction internal this community and gradually increasing in direction of institutional adoption, where the ride is on the total slower, sustainable increase and mainstream acceptance will most possible be executed,” Yin remarked.

O’Neill extra mentioned that emerging regulatory frameworks in key jurisdictions will enhance merchants’ urge for meals to delight in interplay with stablecoins and the aspects they enable.

“Such because the BUIDL fund example of disintermediated redemption by a tidy contract,” he mentioned.

Source : cryptonews.com