Stablecoin Issuer Tether Hits Back Deutsche Bank’s Argument Over its Solvency

Stablecoin Issuer Tether Hits Support Deutsche Bank’s Argument Over its Solvency

In a most contemporary response, Tether, the arena’s most titillating stablecoin, has vehemently criticized Deutsche Bank’s observation, which puzzled the sustainability of stablecoins and Tether’s solvency.

A Deutsche Bank research, printed Tuesday, studied 334 foreign money pegs for the reason that 300 and sixty five days 1800 and concluded that only 14% survived. Applying the research to stablecoins, the monetary institution’s analysts well-known that the asset class is inclined to “turbulence and de-pegging events.”

“Whereas some can even merely dwell on, most will doubtless fail, specifically which capacity of the lack of transparency in stablecoin operations and vulnerability to speculative sentiment.”

The research analyzed the crumple of TerraUSD stablecoin, leaving a ripple assemble on the total crypto market. “These incidents highlight the volatility and risks related to stablecoins, and the need for elevated transparency and law in the cryptocurrency market,” the document read.

Extra, Deutsche Bank criticized Tether – a dominant stablecoin – questioning its solvency and its industry long-established for crypto derivatives.

“A ‘Tether peso 2nd’ can even role off vital losses, negatively impacting leveraged traders and causing excessive repercussions for the total crypto system.”

Additionally, the document pressured the challenges in developing earn foreign money pegs, despite the novelty of cryptocurrencies. “It is doubtless that we are going to look at grand extra instability in the prolonged flee years inspire,” it added.

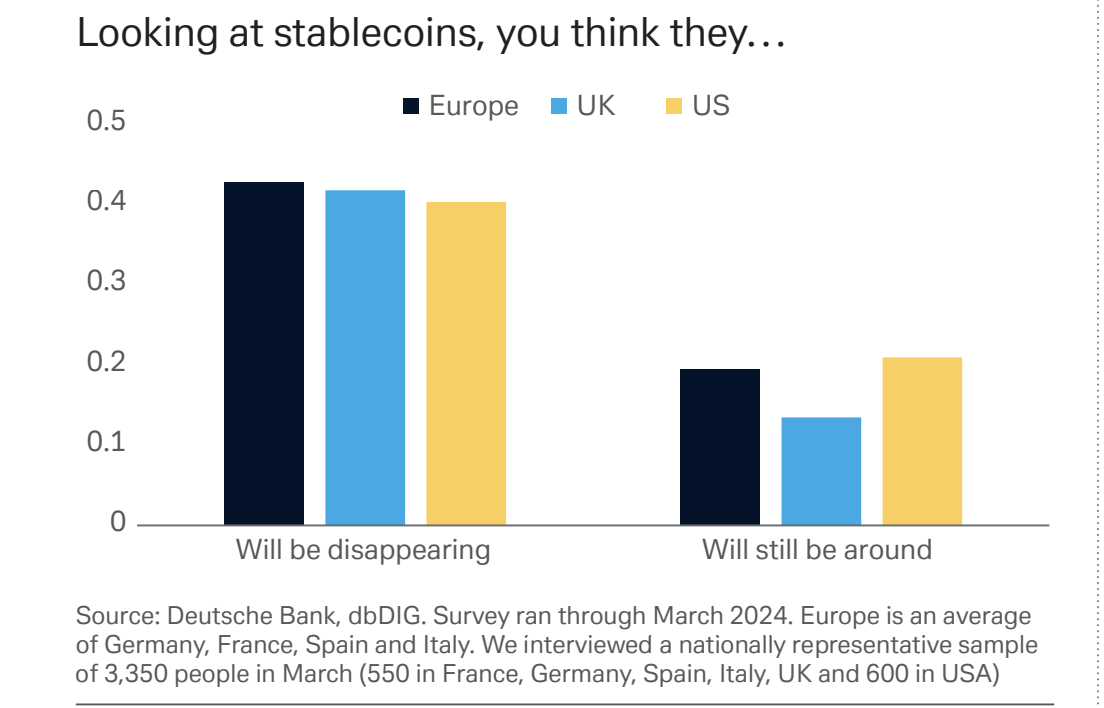

The German banking large surveyed over 3,350 customers in March (550 in France, Germany, Spain, Italy, UK every and 600 in USA), questioning the steadiness of stablecoins.

“Only 18% of customers awaiting them to thrive, while 42% request them to recede,” the glimpse stumbled on.

Tether Slams Deutsche Bank’s Stablecoin Warning

Notably, the research team wrote that they’re fascinating on Tether, given its implications amid “monopoly in the stablecoin market.” According to a Bloomberg document, the analysts additionally pointed out reliance on Tether in the crypto derivatives market.

“The 30% de-peg price among some stablecoins is therefore rarely shapely, and loads defunct stablecoins are laborious to legend for.”

Retaliating inspire to Deutsche Bank’s stablecoin claims, Tether said that the research “lacks clarity and immense evidence, counting on imprecise assertions barely than rigorous prognosis.”

“Whereas it makes an are trying to forecast the decline of stablecoins, it fails to provide concrete recordsdata to give a increase to its claims.”

Source : cryptonews.com