US Spot Bitcoin ETF Options Approval Could Lead to ‘Regulatory Headache’ + More Crypto News

US Situation Bitcoin ETF Alternate choices Approval Might maybe Lead to ‘Regulatory Headache’ + More Crypto Files

Catch your every single day, chunk-sized digest of blockchain and crypto info – investigating the tales flying below the radar of lately’s info.

In lately’s crypto info roundup edition:

- US Situation Bitcoin ETF Alternate choices Approval Might maybe simply Lead to ‘Regulatory Headache’

- Animoca Producers, Delphi Ventures, Amber Neighborhood, and Other Enormous Gamers Put money into Pixelmon

- BlackRock Ten-folded Bitcoin Mining Stocks: From $76M to $775M

__________

US Situation Bitcoin ETF Alternate choices Approval Might maybe simply Lead to ‘Regulatory Headache’

It could perhaps maybe well perhaps snatch months for alternatives on fresh space Bitcoin alternate-traded funds (ETFs) to blueprint regulatory approval, “potentially dampening the allure of the underlying merchandise,” Reuters reported, citing multiple alternate sources.

The sources explained that alternatives on the Bitcoin ETFs are delayed attributable to there may be no longer one of these thing as a established regulatory route of for approving them.

The US Securities and Exchanges Rate (SEC) typically approves them moral days after an ETF begins trading. Alternatively, the peril is that regulators see Bitcoin as a commodity, so space Bitcoin ETF alternatives may perhaps well perhaps furthermore require approval from the Commodity Futures Procuring and selling Rate (CFTC).

Therefore, space Bitcoin ETF-linked merchandise may perhaps well perhaps elevate questions about jurisdiction and oversight.

In keeping with Martin Leinweber, digital asset product strategist at MarketVector Indexes, which offers the benchmark for VanEck’s space Bitcoin ETF:

“This dual regulatory engagement provides a layer of complexity and capacity for what some may perhaps well perhaps name regulatory headache.”

Leinweber argued it can maybe well perhaps snatch 2-10 months for the approvals.

Meanwhile, analysts possess argued that colossal traders may perhaps well perhaps reduction drive as grand as $100 billion into the ETFs. But that is no longer going to happen with out the alternatives, as they face chance administration considerations.

Yesha Yadav, a guidelines professor at Vanderbilt University, argued that some colossal traders may perhaps well perhaps “live away altogether.”

Moreover, the extend prevents the alternate from bringing extra revolutionary merchandise to market.

“The markets certainly are searching to switch there, however the regulators are the gatekeepers,” opined John Roglieri, head of capital markets at ETF marker-maker FalconX.

Animoca Producers, Delphi Ventures, Amber Neighborhood, and Other Enormous Gamers Put money into Pixelmon

In basically the most modern crypto info, decentralized web3 gaming IP Pixelmon has raised a seed investment of $8 million. It’ll exercise the funding to proceed pattern all the plan in which thru its differentiated portfolio of informal and mid-core video games.

Per the press launch shared with Cryptonews, the spherical saw participation from Animoca Producers, Delphi Ventures, Amber Neighborhood, Bing Ventures, Bitscale Capital, Cypher Capital, Foresight Ventures, Mechanism Capital, Sfermion, Spartan Labs, VistaLabs, and others.

The spherical also saw participation from a prolonged checklist of founders, angels, KOLs, and ecosystem partners, it mentioned. These comprise Ray Chan, founding father of 9GAG Inc.; Kun Gao, founding father of Crunchyroll; Robbie Ferguson, co-founding father of Immutable; Gabby Dizon, co-founding father of Yield Guild Video games (YGG); and founders of cryptocurrency exchanges Bit2Me and Tokocrypto and web3 advisory company Emfarsis.

The funding follows the worthwhile launch of Kevin the Adventurer (KTA), Pixelmon’s first hypercasual sport. Deployed in October 2023 on Coinbase’s native Layer 2 Infamous, the side-scroller saw 36,000 active gamers and 10,100 hours played in its launch month.

A 2nd hypercasual sport, PixelPals, which parts pet and habitat administration blended with trading card mechanics, is decided to launch on Mantle this main quarter.

The crew specializes in major releases for the core Pixelmon IP, in conjunction with a rebuild of its free-to-play desktop title Enviornment, fresh Pixelmon abilities, and core sport loops, focused on a 2024 launch.

Additional, Searching Grounds, an originate-world adventure sport with RPG intention and PvP autobattler tournaments, is decided for the originate beta in 2024 and a full launch in early 2025.

Pixelmon plans to develop its decentralized IP all the plan in which thru verticals by assignment of franchises, sublicenses, and joint ventures. This entails merchandise, trading card video games, moving sequence, comic books, and additional.

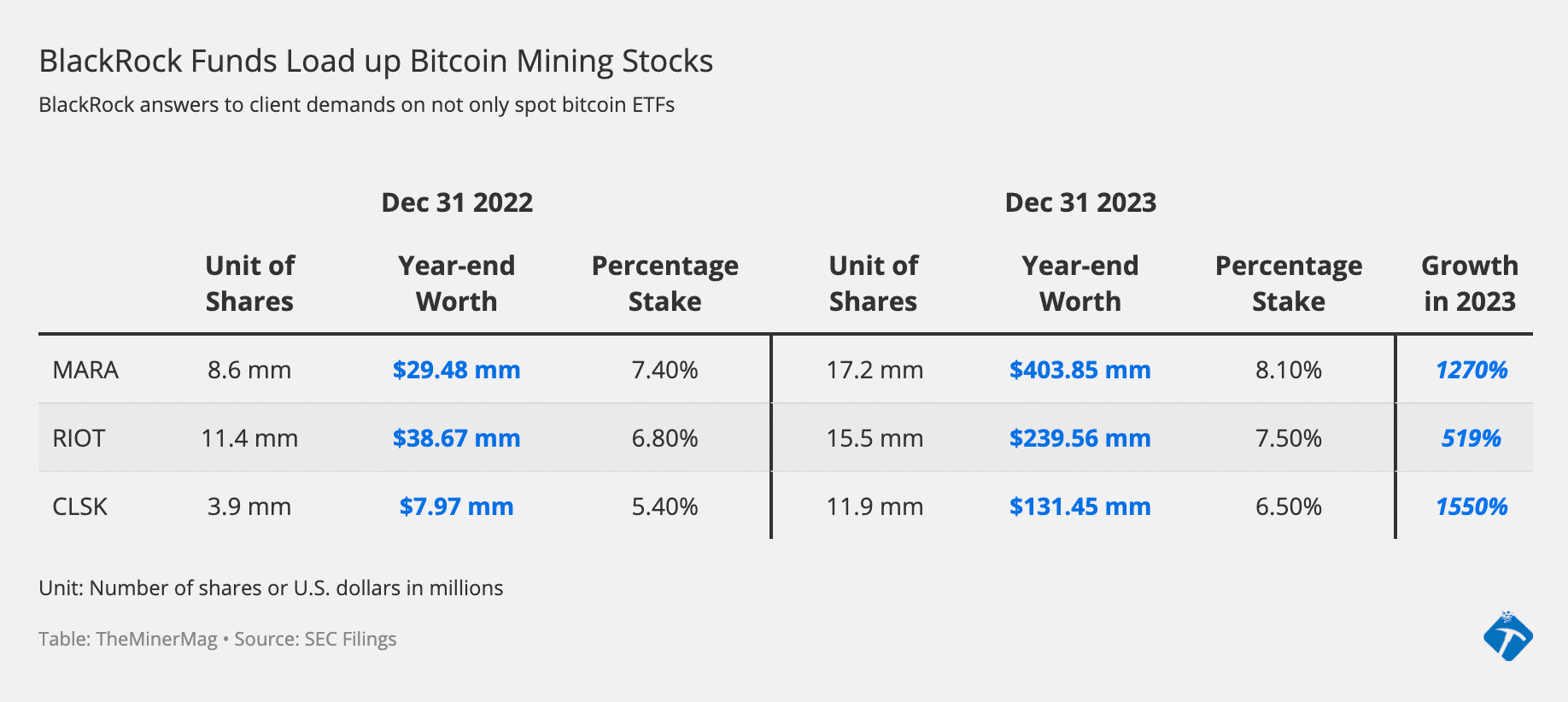

BlackRock Ten-folded Bitcoin Mining Stocks: From $76M to $775M

The realm’s largest asset manager BlackRock “has no longer finest been answering client demands for its space Bitcoin ETF however also scooping up mining shares,” essentially essentially based on basically the most modern Miner Weekly document by BlocksBridge Consulting.

BlackRock’s asset and investment administration subsidiaries already elevated their stakes in Marathon and Riot in 2023.

Per most modern SEC filings, says the document, BlackRock’s subsidiaries purchased even extra shares of CleanSpark.

The firm picked up extra shares in Riot, Marathon, and CleanSpark by 36%, 100%, and 205%, respectively, the document found.

The expand in positions is partly fueling the worth rally of Bitcoin mining shares, it mentioned.

Moreover, it has led BlackRock’s complete holdings in the three mining companies to attain $775 million as of December 31. This is up from $76 million a year ago.

One underlying pattern, says the document, is the scale of fairness dilution among these mining companies. It changed into “feeble to fund their growth and capital expenditure because the alternate learns from the lesson of over-leveraging all the plan in which thru the 2021 bull trot.“

Source : cryptonews.com