OKX Ceases Operations in India, Citing Regulatory Hurdles

OKX Ceases Operations in India, Citing Regulatory Hurdles

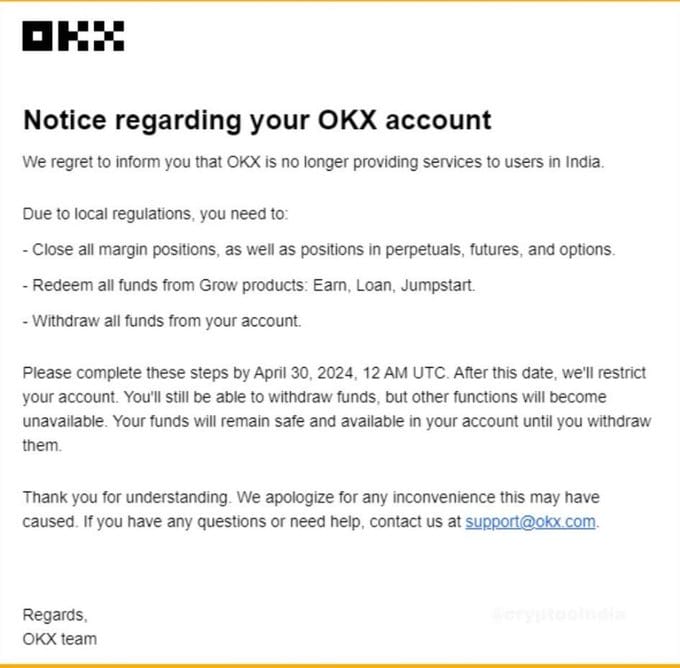

Cryptocurrency alternate OKX has emailed its customers in India to expose them that this may possibly well stop its products and services there, urging them to withdraw their funds by the tip of April.

OKX turn out to be among the many nine international crypto exchanges blocked in India after the local regulators issued compliance notices.

OKX Shuts Down Companies and products In India

In a investigate cross-test sent to Indian customers on Thursday, March 21, OKX instructed its clients to shut their accounts and redeem funds outdated to April 30.

To account for the motion, the CEX cited local regulatory hurdles because the dear motive in the befriend of the resolution. The consciousness acknowledged, “We remorse to expose you that OKX isn’t any longer offering products and services to customers in India.”

As a consequence, OKX customers in India had been instructed to shut all margin positions, perpetuals, futures, and alternatives and redeem funds from products esteem Waste, Mortgage, and Jumpstart outdated to the April 30 time restrict at nighttime.

Moreover, OKX clients are also instructed to expedite the withdrawal of their funds outdated to the time restrict to attend away from any losses. Moreover, the OKX alternate assures customers that their funds will stay actual and in the market till withdrawn. This resolution got here after the FIU requested that the Ministry of Electronics and Recordsdata Abilities block the websites of the notified crypto exchanges within two weeks; OKX faced web space and utility blocks in January.

No matter making an try to comply by making exhaust of for a recent registration direction of with stringent Know Your Customer assessments following a block on its web space and utility in January, OKX’s investigate cross-test means that it may possibly well no longer successfully complete the registration direction of.

On December 28, 2023, India’s Ministry of Finance’s Financial Intelligence Unit (FIU) issued notices to several cryptocurrency exchanges, including Binance, Huobi, Kraken, Gate.io, KuCoin, Bitstamp, MEXC World, Bittrex, and Bitfinex, for operating unlawfully within the country.

The FIU directive mandated that any alternate serving Indian customers register as a “reporting entity” and submit statements to the earnings tax department. Failure to comply resulted in suggestions for the Ministry of Electronics and Recordsdata Abilities to dam these exchanges’ websites.

Regulatory Uncertainty Persists for Cryptocurrency Exchanges in India

On December 28, 2023, the FIU served notices of noncompliance to several exchanges, including Binance, Kraken, Huobi, and Gate.io, aimed at gathering financial intelligence below the Prevention of Money Laundering Act.

Severely, OKX turn out to be no longer named in the public assertion. While some local exchanges, similar to CoinSwitch and CoinDCX, complied with the FIU’s requirements, varied world exchanges did not follow Indian regulation, as acknowledged by the FIU.

Attributable to this fact, Apple’s App Retailer and Google Play Retailer in India blocked apps from Binance, KuCoin, Bitget, Huobi, OKX, Gate.io, and MEXC crypto exchanges weeks after the Indian government issued the noncompliance investigate cross-test.

Navigating the cryptocurrency panorama in India remains no longer easy for international exchanges, essentially which capacity that of the absence of particular regulatory pointers and stringent government actions.

No matter ongoing discussions spanning as regards to four years, the Indian government has yet to outline a formal regulatory framework for the burgeoning crypto market. This lack of readability has left exchange gamers perilous about their accurate standing and duties within the country.

Compounding the difficulty, the Indian tax regime imposes a hefty 30% tax on crypto earnings without provisions for offsetting losses, alongside with a 1% tax deducted at supply (TDS) on every crypto transaction. These stringent tax regulations have triggered several established gamers to relocate their operations someplace else.

Source : cryptonews.com