New Zealand Begins Plans To Introduce CBDC

Contemporary Zealand Begins Plans To Introduce CBDC

The Reserve Monetary institution of Contemporary Zealand (RBNZ) has begun its public consultation on “Digital Cash,” a proposed central monetary institution digital forex (CBDC), as disclosed in a consultation paper released by the central monetary institution on April 17.

The consultation is in its second stage and must final 101 days, between April 17 and July 26. After ideas and the enchancment of a trade case from Stage 2, a determination is anticipated to be made on advancing to Stage 3.

To stamp the rationale on the relieve of the Contemporary Zealand CBDC, one must seek the motivations and goals outlined within the consultation paper.

Contemporary Zealand CBDC Motivation & Dreams

In accordance with the Consultation Paper, Contemporary Zealand’s Digital Cash will probably be a retail-focused CBDC, essentially concentrated on patrons and company users.

We’re taking a study at introducing a brand fresh price option for Contemporary Zealanders – Digital Cash – an electronic version of cash, that would sit alongside nonetheless now not substitute bodily cash. Learn more within the video and revel in your screech right here: https://t.co/FcRyY69TPI pic.twitter.com/Je4q3Q9IE6

— Reserve Monetary institution of NZ (@ReserveBankofNZ) April 16, 2024

The Reserve Monetary institution talked about its motivation for issuing a CBDC is the decline within the usage of bodily cash. This would possibly perchance maybe well adversely luxuriate in an influence on monetary inclusion for individuals who rely on cash.

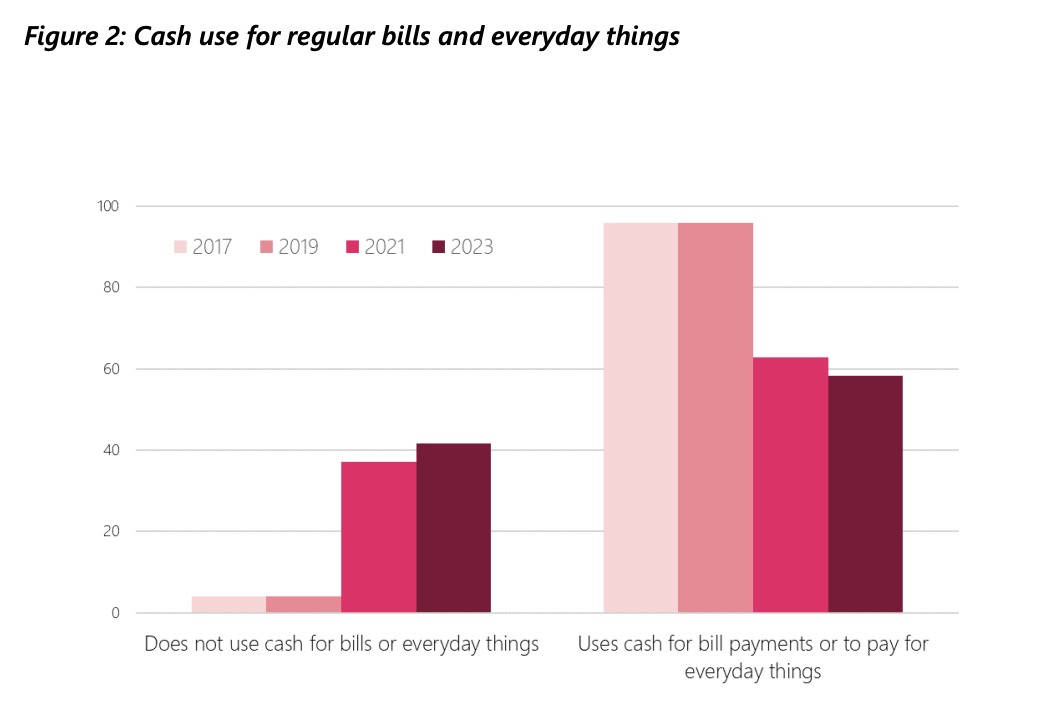

The consultation paper also integrated a take a look at showing that about 58% of purchasers passe bodily cash as of 2023, a fall from 63% recorded in 2021, indicating a unhurried reduction in fiat usage.

Besides declining cash usage, the RBNZ wants to present digital cash to fulfill wants and play a key role in monetary innovation.

The consultation paper also highlighted the immediate model of innovations in crypto belongings, allotted ledgers, and digital currencies issued by global technology firms.

If innovation in these sectors occurs essentially inaugurate air the Contemporary Zealand buck, the country’s fiat forex, there would possibly perchance be a anguish that voters would possibly perchance maybe well decide for different currencies for transactions, doubtlessly ensuing in an absence of financial sovereignty.

To address these concerns, the RBNZ sees digital cash as a methodology to guarantee there are innovative price companies in Contemporary Zealand and offer protection to the country’s monetary sovereignty.

“Contemporary Zealand’s price companies luxuriate in seriously change less innovative than diverse international locations. Digital cash would serve hiss down barriers to entry to the associated price map,” the central monetary institution wrote within the consultation paper. “Digital cash would also be a brand fresh half of digital public infrastructure that helps digital transformation.”

The RBNZ has outlined a comprehensive four-stage plan to scheme and put in power the Contemporary Zealand CBDC.

Contemporary Zealand’s Four-Stage Path In the direction of a Central Monetary institution Digital Currency (CBDC)

RBNZ has adopted a four-stage plan to rising digital cash. The predominant stage began in 2021 and engaging publishing an factors paper that assessed the want for digital profit Contemporary Zealand (Aotearoa). The RBNZ bought over 6,000 responses.

The RBNZ is at the moment within the second stage of its CBDC initiative, delving into fetch alternatives for Digital Cash, conducting consultations, and setting up budgetary frameworks.

The @ReserveBankofNZ has correct launched a consultation on a #CBDC for Contemporary Zealand known as “digital cash” and lays out principles and fetch alternatives for Contemporary Zealand’s digital profit its fresh consultation paper – comments accredited unless 26 July 🇳🇿https://t.co/xLIYQEC085 pic.twitter.com/7tyy3fryQJ

— Central Monetary institution Payments Files (@cbpaymentsnews) April 16, 2024

As soon as the consultation piece concludes, the RBNZ will continue rising the structure and policy requirements, with an anticipated completion date in June 2025. After this piece, a price-profit prognosis will probably be conducted.

The RBNZ anticipates winding up Stage 2 in 2026. At this level, ideas will probably be made on whether to progress to Stage 3 of the Contemporary Zealand CBDC issuance job.

Stage 3 involves rising and testing prototypes to guarantee the functionality of the digital cash map. The final stage, Stage 4, will impress the legit initiate of the Contemporary Zealand CBDC, anticipated by 2030.

🇰🇷 South Korean Central Monetary institution to ‘Velocity up’ CBDC Mission

The South Korean Central Monetary institution is explain to “tempo up” its CBDC mission, and must pilot its digital KRW with a neighborhood of 100,000 voters later this year.#CryptoNews #newshttps://t.co/zfzltVAjRU

— Cryptonews.com (@cryptonews) April 17, 2024

Other countries are also actively exploring CBDCs. South Korea is expediting its mission, concentrated on to take a look at the usability of the digital Korean Obtained (KRW) by the tip of 2024.

Within the meantime, Hong Kong has entered the second piece of its e-HKD program, additional investigating the prospects of a digital forex.

Source : cryptonews.com