Komodo CTO Exclusive: Large TradFi Players Will Be Entering Crypto This Year, DeFi Poised to Grow Once Again

Komodo CTO Gripping: Broad TradFi Gamers Will Be Entering Crypto This 300 and sixty five days, DeFi Poised to Grow Once Again

Kadan Stadelmann, CTO of originate-source technology supplier Komodo Platform, talked to Cryptonews about the present crypto investment sentiment, incoming “indispensable” institutional investments, and the renewed rise of decentralized finance (DeFi).

The knowledgeable additional shared appealing insights into indispensable themes that will outline 2024, non-fungible token (NFT) employ circumstances leading to elevated passion, the US SEC Chair’s disinterest in the crypto enterprise’s thought, and extra.

Read on to study what he told us.

Investors are Fervent, However Cautious

Investor sentiment in the cryptocurrency region is difficult to foretell as it’s ever-altering. That said, Stadelmann shared that for many retail merchants, enthusiasm is pushed by the functionality of crypto. At the same time, caution persists due to the market volatility and regulatory uncertainties.

By manner of institutional merchants, he said,

“I tell the approval of the predominant jam Bitcoin ETFs in the US has created a wave of optimism and alerts rising self assurance that crypto will completely assign extra momentum over the following couple of years.”

Stadelmann popular that the crypto market’s transient trends stay tied to macroeconomic elements. These seriously impression investor sentiment.

Talking of arduous-to-predict areas: crypto market’s value trends and news events. However, Stadelmann said there are some doable themes to tell.

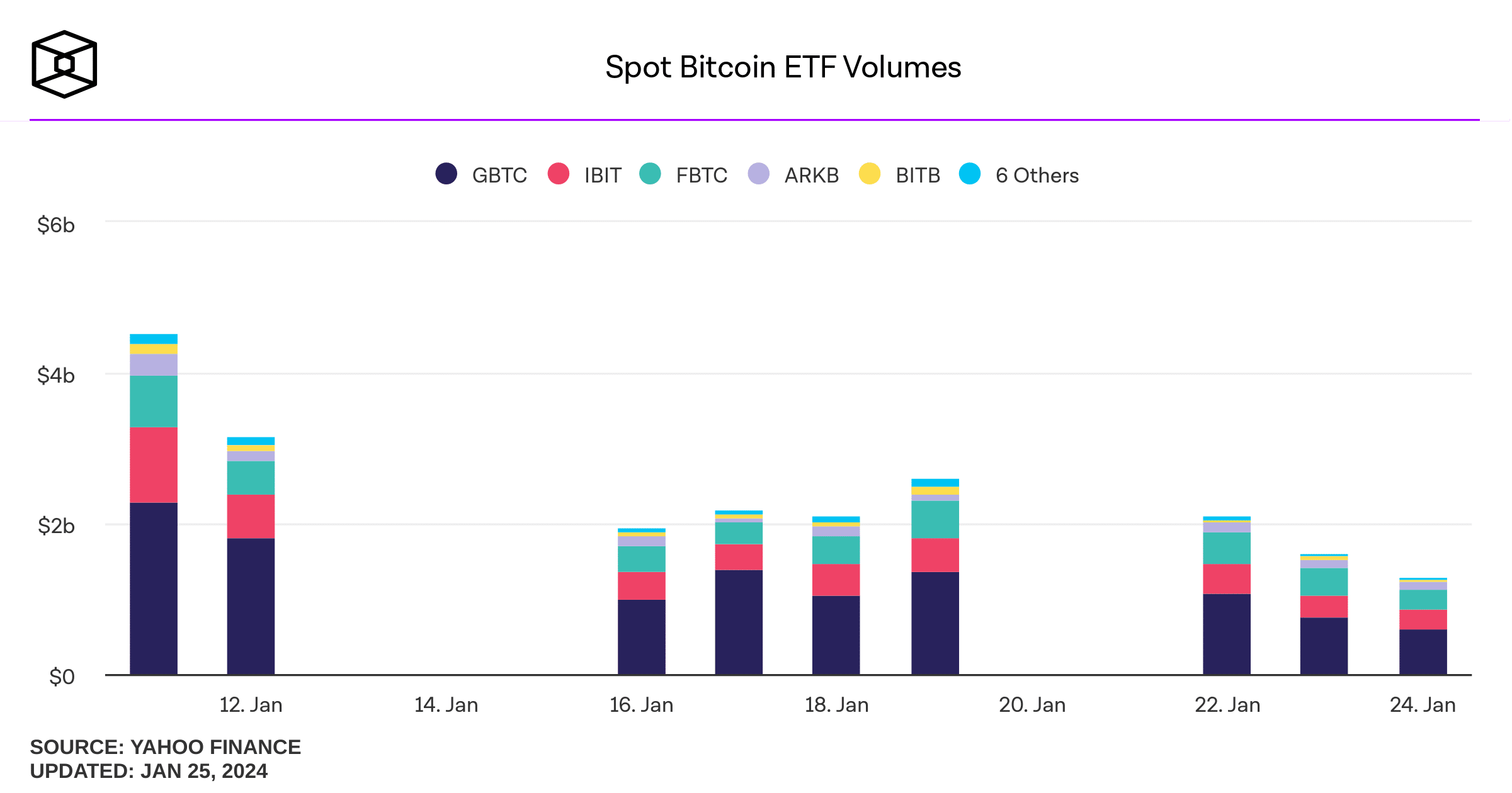

As said, the US Securities and Exchanges Commission (SEC) in the kill authorized the predominant round of jam Bitcoin exchange-traded funds (ETFs) in January. Per the CTO,

“Even supposing the preliminary hype around this news has since worn, indispensable investments from institutions are completely origin.”

Therefore, throughout February and the relaxation of 2024, we’ll tell extra of these natty avid gamers from TradFi birth up to enter the crypto region.

Therefore, we’ll soon tell to what extent institutional merchants and ETFs aspect into the market’s value motion.

At closing, it’s miles serious to demonstrate the anticipation constructing around the following Bitcoin halving, expected in April.

Halvings on the total signal the birth up of a brand fresh bull market cycle for BTC – but to boot for altcoins. This is also appealing to tell, Stadelmann said, if BTC and/or altcoins can attain fresh all-time highs submit-halving.

DeFi Market Poised to Grow Again

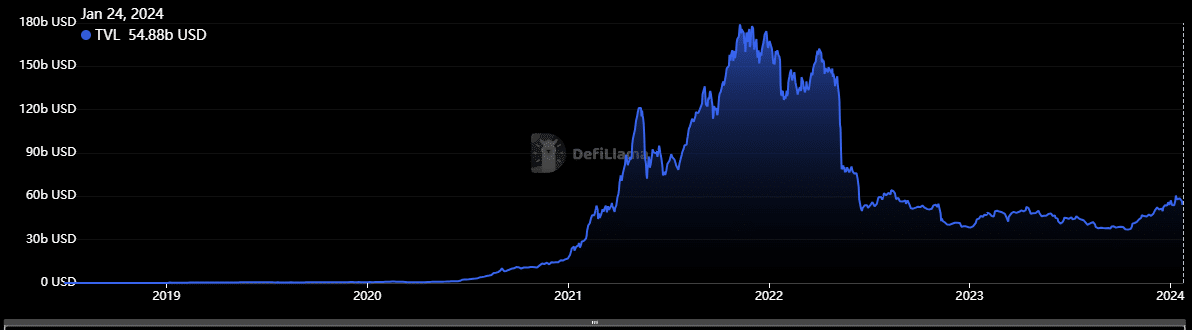

Issues gain seriously changed for DeFi between 2022 and 2024. And the shift goes beyond crypto market costs.

The endure market of 2022 brought various challenges to many DeFi tasks, Stadelmann said. This involves vulnerabilities, orderly contract exploits, and regulatory uncertainties.

And these stay indispensable issues in 2024.

Additionally throughout 2022, DeFi’s total charge locked (TVL) went from bigger than $150 billion to less than $40 billion. However, as of January 2024, TVL has rebounded to $55 billion on the time of writing.

The CTO opined,

“The region appears to be like poised to develop once extra.”

One more indispensable shift since 2022 has been the maturation of Layer 2 (L2) blockchain networks, which has elevated scalability and reduced transaction charges. DeFi purposes on these networks are in reality usable from a charge perspective, said the knowledgeable.

Additionally, inappropriate-chain interoperability trends gain contributed to a extra united DeFi ecosystem.

Most predominant Subject matters for 2024

We’ve already popular the functionality future actions in crypto costs, investment sentiment, and DeFi markets.

However 2024 has indispensable extra to provide. Stadelmann listed the year’s indispensable themes. He said these will assign extra importance even beyond 2024 because the crypto region matures.

Initially, he said, is the interoperability amongst varied blockchain networks.

“As the blockchain region diversifies, the need for users to alternate throughout blockchains will completely continue to enlarge.”

Within the CTO’s thought, extra users will turn to tell-to-scrutinize (P2P) bridge choices, cherish the one provided by Komodo Pockets.

Subsequent: L2s will continue to develop and behold accelerated adoption. Extra users are going in the DeFi region and are the employ of decentralized apps (dapps) extra regularly. Therefore, it’s miles serious to alleviate Layer 1 congestion and chop transaction charges by processing a important share of transactions off-chain.

Stadelmann said that,

“The continuing pattern and adoption of L2 choices signify a in actuality crucial step in opposition to achieving mainstream scalability for blockchain technology.”

Gary Gensler is No longer Attracted to Crypto Industry’s Belief

The central theme for 2024, Stadelmann said, is the pursuit of regulatory clarity. And greater straightforward job will, with any luck, gain a catalyst for accelerated market growth.

Governments and regulatory our bodies globally are an increasing number of horny with the crypto enterprise.

Talking of which, Stadelmann no longer too lengthy previously wrote an originate letter to SEC Chair Gary Gensler. Asked if Gensler is attracted to listening to the crypto enterprise’s opinions, Stadelmann responded that he doesn’t tell so.

One certain paddle from Gensler’s administration used to be the approval of fresh ETFs. And yet,

“After years of delays, the predominant aspect for approval used to be seemingly political stress from capital-prosperous institutions.”

Within the intervening time, we gain considered very dinky motion to give protection to merchants or develop crypto extra accessible to merchants, he said.

Furthermore, SEC enforcement actions in opposition to Ripple, Binance, Coinbase, and Kraken gain stunted the functionality growth of the crypto enterprise. And while the agency has clear evidence in opposition to FTX and “other enterprise avid gamers which gain blatantly hurt merchants,” argued Stadelmann, Gensler determined no longer to level of curiosity on these points.

3⃣Fraudsters continue to exploit the rising recognition of crypto sources to lure retail merchants into scams. These investments continue to be replete w/ fraud- bogus coin choices, Ponzi & pyramid schemes, & outright theft the attach a venture promoter disappears w/ merchants’ money.

— Gary Gensler (@GaryGensler) January 8, 2024

NFT Employ Cases Wil Result in Extra Pastime

At closing, non-fungible tokens (NFTs), despite discussions of their decline, are right here to pause.

Stadelmann said,

“I am optimistic about their future in 2024 and beyond. The NFT market has undergone a important shift in level of curiosity, increasing beyond digital art to incorporate gaming, virtual right estate, and metaverse-connected sources.”

Industries will continue to adopt NFT technology. Which potential that of this truth, employ circumstances will diversify and outcome in renewed passion.

“I predict we’ll tell NFT was extra integrated with right-world sources, that will provide extraordinary experiences that transcend straightforward digital ownership,” the CTO opined.

#BitcoinOrdinals Debate: : Innovation or Disruption?🤔 Bitcoin Ordinals Accept as true with Confirmed So Controversial It Could well Jog the Bitcoin Industry in Two, writes @KomodoPlatform CTO Kadan Stadelmann. Get no longer pass over this! #Bitcoin #BitcoinNFTs #NFTs https://t.co/mhEvCDxnPR

— AlexaBlockchain (@AlexaBlockchain) December 30, 2023

Why Don’t We Accept as true with DeFi Simplicity But?

It’s been said for years that simplicity and ease of employ are the answer to DeFi’s adoption points. Stadelmann argues that achieving this operate has proven to be a difficult job.

The greatest obstacle is the inherent complexity of DeFi processes interesting orderly contracts, liquidity pools, and yield farming.

“Balancing user-pleasant interfaces with the intricacies of blockchain technology gifts a non-stop grief.”

There are some seemingly choices:

- toughen user education via comprehensive tutorials; e.g. users taking the time to study about the fundamentals of blockchain technology and uncomplicated methods to employ particular DeFi platforms;

- simplify the DeFi onboarding course of for crypto newbies.

Komodo Pockets, for instance, no longer too lengthy previously added a fiat on-ramp, decreasing the barrier to DeFi market participation. Customers can at once buy crypto with fiat rather than signing up for a centralized exchange myth and studying easy methods to transfer sources on-chain.

300 and sixty five days of the Dragon Brings Recent Roadmap

Stadelmann couldn’t portion any particular Komodo’s plans for 2024, but said that this would possibly maybe level of curiosity on making improvements to blockchain interoperability to unify the DeFi region.

“We belief to release our 2024 roadmap on Chinese language Recent 300 and sixty five days, which falls on February 10, 2024, as it marks the origin of the 300 and sixty five days of the Dragon.”

Within the intervening time, in December, the platform added the above-mentioned fiat on-ramp to Komodo Pockets (web) that supports companies Ramp and Banxa, which red meat up monetary institution transfers, Apple Pay, Visa/Mastercard cards, and so forth.

🎨🖼️ NFT pockets red meat up is dwell on Komodo Pockets!

We now gain got integrated ERC721 and ERC1155 token requirements.

Supported chains encompass @ethereum, @BNBCHAIN, @0xPolygonLabs, @avax, and @FantomFDN.#crypto #cryptonews #DeFi #Web3 #NFT $KMD

👉 https://t.co/Xp0MJuQDd6 pic.twitter.com/mKvwHfjYsU

— 🦎 Komodo (@KomodoPlatform) December 26, 2023

It also applied the KMD burn program, and it launched an NFT characteristic on Komodo Pockets, which lets in web app users to ship, gain, and gape the transaction historical previous for his or her NFTs on Ethereum, Polygon, BNB Chain, Avalanche, and Fantom.

Verify out an earlier insightful chat with Stadelmann on the Cryptonews Podcast:

Source : cryptonews.com