Institutional Interest for Bitcoin Rises, Yet Challenges May Hamper Future Adoption

Institutional Hobby for Bitcoin Rises, But Challenges Would possibly perchance per chance Bog down Future Adoption

Institutional hobby for Bitcoin and other digital property has been obvious in outdated years. But industry consultants assume that investors are taking a newfound hobby in Bitcoin (BTC) following the approval of 11 US house Bitcoin commerce-traded funds (ETFs).

David Lawant, Head of Research at FalconX – an institutional crypto brokerage – told Cryptonews that growing institutional hobby for digital property has develop to be evident per fresh recordsdata.

“Since mid-final yr, when Blackrock filed for a house Bitcoin ETF and the approval began to appear enjoy a accurate probability, the dialog round institutional hobby started to shift,” acknowledged Lawant. “With the phenomenal performance of house Bitcoin ETFs, it has been further accelerated.”

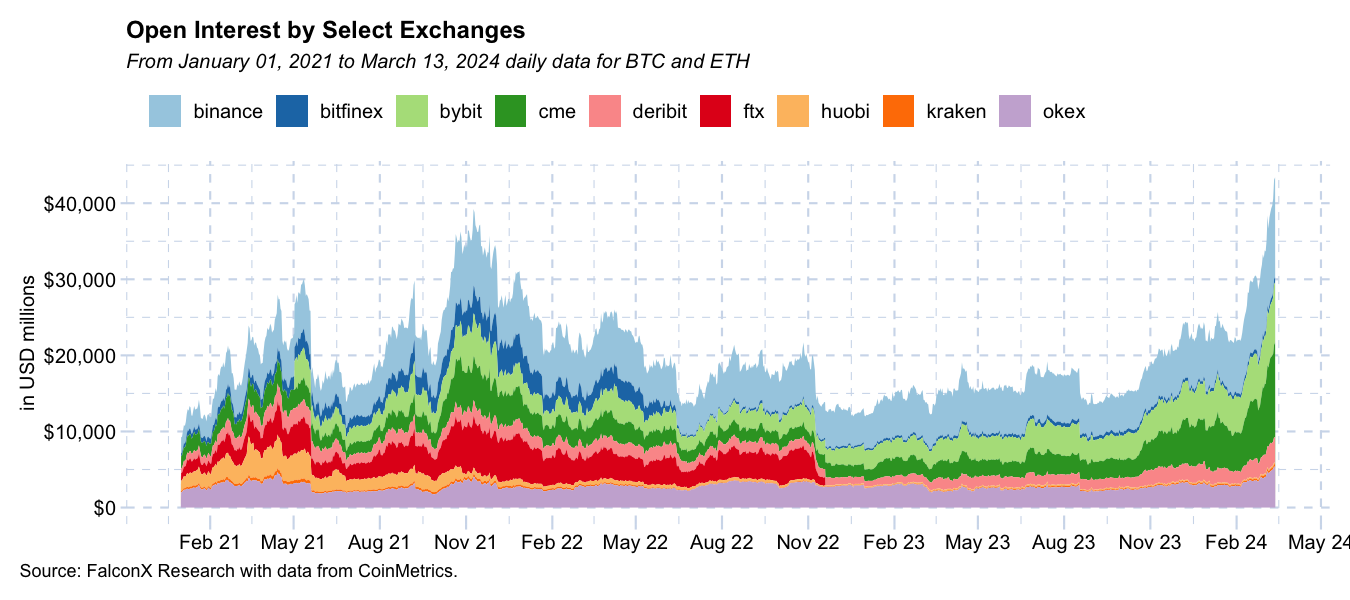

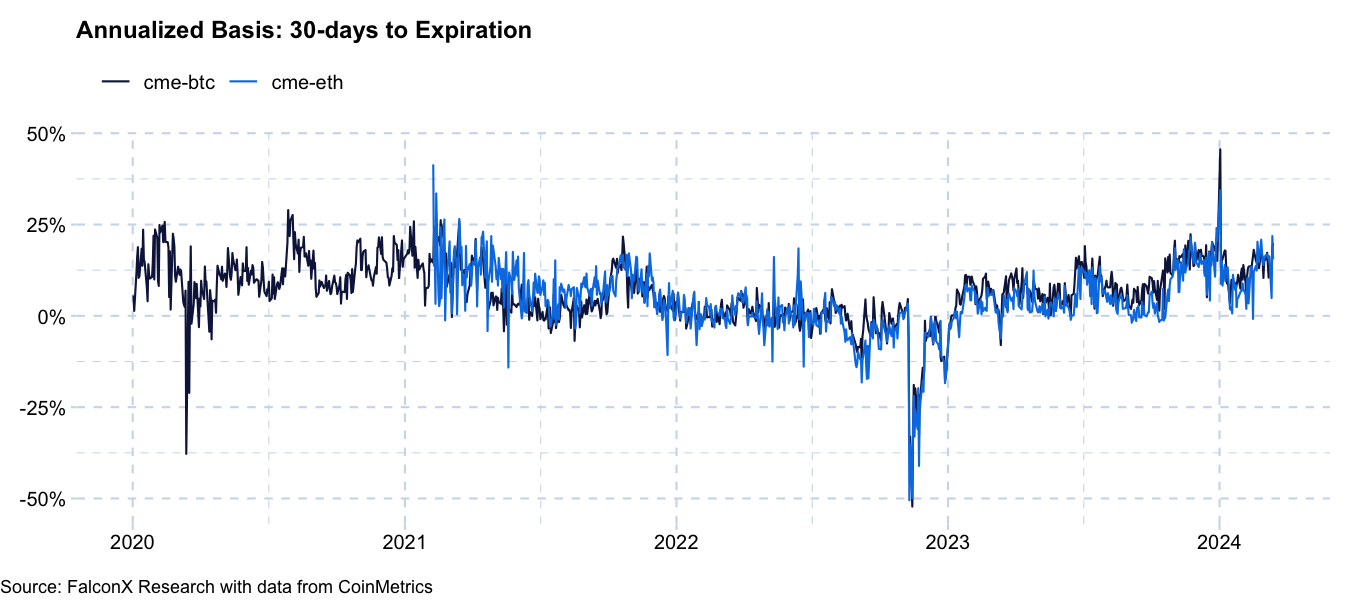

Consistent with Lawant, one of many ideal suggestions to gauge adoption of US-primarily based mostly mostly neat institutional investors is by evaluating the originate hobby with the root – which is the difference between futures and house costs – on the Chicago Mercantile Substitute (CME).

“As an illustration, the chart in an instant below exhibits futures originate hobby by exchanges,” acknowledged Lawant. “The second chart exhibits the CME foundation for both Bitcoin and Ethereum (ETH).”

Lawant identified that both charts establish unheard of hobby by establishments.

“The CME overtook the vital house in Bitcoin’s future originate hobby on the tip of ultimate yr, and it has been gaining further piece since then,” he acknowledged. “Also, the CME foundation stays elevated, especially for Bitcoin futures.”

Matthew Niemerg, Co-Founding father of the Layer-1 platform Aleph Zero, told Cryptonews that Microstrategy issuing over $800 million of low-hobby senior convertible notes to buy Bitcoin is one other instance of continued institutional adoption in digital property.

Institutional Hobby Drives Up Ticket of Bitcoin

Institutional hobby in Bitcoin could per chance even be the reason on the serve of BTC’s fresh file-breaking highs.

“Indeed, here is contributing to the upward thrust in the worth of Bitcoin, which is obvious from the inflows,” acknowledged Niemerg. “I count on that this style will proceed, mirroring the trajectory viewed with tokens – beginning with BTC, then ETH, and subsequently encompassing all other property.”

#Bitcoin’s establish hastily rose above its outdated all-time excessive, driven by inflows into US-listed house #Bitcoin ETFs. Past performance is now not indicative of future results

Be taught our stout analysis: https://t.co/LWJ8wO59mZ pic.twitter.com/3QoENLNGSj

— Grayscale (@Grayscale) March 14, 2024

Matt Ballensweig, Head of Jog Community – a digital asset settlement resolution from BitGo – told Cryptonews that the rising establish of Bitcoin could per chance even be attributed to Blackrock CEO Larry Fink’s fresh give a boost to.

“Fink has lately been a vocal champion of Bitcoin having a device interior institutional portfolios and in the same vogue, Constancy has now urged a enormous selection of quite about a portfolios across quite about a risk thresholds, every consisting of some share of digital property,” Ballensweig acknowledged. “These endorsements can now not be understated as it pertains to their impact on asset allocation from hedge funds, pensions, endowments and RIAs”

Institutional Progress Would possibly perchance per chance Gradual

But whereas it’s considerable that institutional hobby in digital property has been gaining traction, consultants warn that ongoing challenges interior the crypto industry could per chance also leisurely adoption.

As an illustration, Niemerg identified that the greatest hurdle for establishments buying digital property relates to security and compliance.

“Institutions require sturdy safeguards against theft thru dapper contract vulnerabilities,” he acknowledged.

Niemerg added that the dearth of security interior dapper contract platforms has already worth the decentralized finance (DeFi) sector billions as soon as a year.

Most lately, the DeFi protocol Unizen had a security breach that resulted in the loss of approximately $2.1 million in user funds. As Cryptonews beforehand reported, the hacker exploited an external call vulnerability interior the Ethereum-primarily based mostly mostly contract, changing the stolen USDT to DAI.

Niemerg believes that implementing failsafes, insurance protection, and non-mandatory privacy functions at a protocol level could per chance per chance mitigate these risks without compromising DeFi’s originate and permissionless nature. Such implementations could per chance also extinguish obvious continued hobby from establishments.

Niemerg identified that compliance is equally as severe.

“Institutions need assurance that they won’t unwittingly work in conjunction with sanctioned addresses or tumble afoul of guidelines,” he acknowledged.

Niemerg moreover renowned that implementing Know Your Buyer (KYC) and Anti-Money Laundering (AML) tests on the protocol level is severe.

“This will enable compliant buying and selling with verified counterparties,” he remarked.

Regulatory readability is moreover turning into increasingly more well-known as establishments dip their toes into Bitcoin. Even with the approval of house Bitcoin ETFs, there are other ongoing aspects concerning Bitcoin that can also maintain concerns in some unspecified time in the future.

As an illustration, US President Joe Biden launched his 2025 value range proposal on March 11. The proposal functions numerous provisions geared toward altering the cryptocurrency industry, including a wash sale rule for digital property.

Jonathan Bander, Head of Tax Contrivance at ExperityCPA, told Cryptonews that the proposed implementation of wash sale guidelines interior the crypto industry stands to originate a profound transformation for institutional investors.

“These guidelines would inevitably boost the burden of compliance, stressful meticulous attention to transaction monitoring and potentially main to better operational payments,” acknowledged Bander. “Furthermore, the barriers on claiming tax advantages could per chance per chance diminish the charm of decided buying and selling suggestions, compelling establishments to reassess their suggestions.”

Consistent with Bander, a wash sale rule for digital property could per chance per chance hinder market accessibility, decrease liquidity, and boost market uncertainty, posing challenges for both institutional and retail investors.

Scalability Considerations Would possibly perchance per chance Impact Institutional Crypto Adoption

Additionally, John Lilic, Govt Director of the Telos Foundation, acknowledged he believes scalability is the vital project for establishments coming into the crypto sphere.

“The ask from establishments necessitates attaining intensive scalability, excessive throughput, and greatly lowered transactional costs,” acknowledged Lilic.

Facts from Ycharts exhibits that Bitcoin transaction charges were $8.075 on March 12.

It’s moreover worth pointing out that Gas charges on the Ethereum mainnet live excessive, above 72 gwei in step with Ycharts. To construct this in perspective, a median swap would worth users $86.15 in gas charges, in step with Etherscan recordsdata.

Institutions To Adopt Bitcoin Due To Global Progress

Challenges apart, Ballensweig remarked that Bitcoin adoption will possible proceed for establishments, especially given regulatory readability taking device in regions outside of the US.

“There appears to be to be a softening in the direction of guidelines of digital property globally,” he acknowledged. “This has develop to be obvious with the UK allowing Bitcoin-linked securities to be listed on the stock market and South Korea weighing alternate ideas to take the ban on house Bitcoin ETFs, so we’re making steps in the vivid direction.”

Echoing this, Lilic added that Hong Kong is popping into increasingly more well-known for institutional adoption of digital property too.

“Lately, I had the opportunity to issue about with and exercise time with my longtime Ethereum buddy, Lawrence Chu,” acknowledged Lilic. “His group is main efforts to pre-empt the United States in adopting an ETH ETF in Hong Kong. I am assured in their success, and the growing momentum underscores institutional hobby in digital property.”

This could per chance also very smartly be the case, as Hong Kong-primarily based mostly mostly establishments are actively making ready to open house ETFs for Ethereum.

Furthermore, Niemerg remarked that the mandatory infrastructure is in the extinguish in device for establishments to pass forward with digital asset adoption.

To illustrate, he identified that establishments having qualified custodians has been implemented.

“This has allowed establishments to further buy digital property,” he acknowledged. “With the vivid technical and regulatory groundwork, establishments can confidently plot shut half in DeFi markets, unlocking increased liquidity and adoption.”

Source : cryptonews.com