HTX Exchange Surpasses Coinbase In Spot Trading Volumes

HTX Alternate Surpasses Coinbase In Keep Trading Volumes

HTX (beforehand Huobi) accomplished a significant milestone on Can also 27 by rapid surpassing US-basically based entirely Coinbase in day to day predicament buying and selling volumes for the foremost time.

Justin Solar, the influential figure in the succor of the TRON blockchain and one in all the merchants at HTX, shared the milestone on X. He acknowledged HTX traded $1.81 billion price of cryptocurrencies in 24 hours, beating Coinbase’s $1.58 billion.

HTX Alternate Recorded $1.81B Keep Trading Volume

For the foremost time, @HTX_Global has more predicament buying and selling volume than @coinbase. Here is candy the starting up establish, and we’re good getting started. 🫡 pic.twitter.com/VeYHFCviHy

— H.E. Justin Solar 孙宇晨 (@justinsuntron) Can also 27, 2024

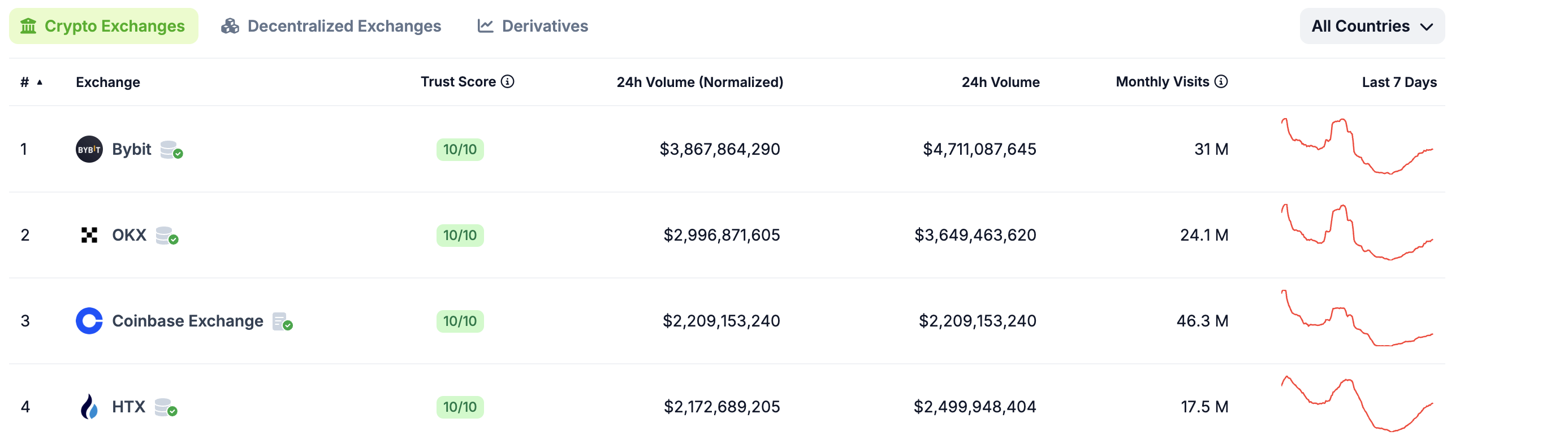

Consistent with most original CoinGecko records, Coinbase has taken succor the tip predicament. Within the previous 24 hours, Coinbase processed a $2.2 billion buying and selling volume, making it the third-largest crypto exchange globally, in the succor of easiest Bybit and OKX. HTX traded round $2.1 billion, pushing the platform in the succor of Coinbase.

It might possibly presumably well very smartly be recalled that the HTX exchange, one in all the enviornment’s largest and oldest cryptocurrency exchanges, infamous its 10-one year anniversary in September 2023. To note the milestone, the exchange rebranded from Huobi to HTX.

The rebranding became controversial, with many in the crypto neighborhood drawing parallels between HTX and the collapsed exchange FTX. Here is with admire to the recent name, “H”, which stands for Huobi; “T” represents Solar’s blockchain project Tron; and “X” signifies the exchange.

HTX Alternate Most up-to-date Milestone Linked to Coinbase Apt Challenges

The non eternal decline in Coinbase predicament buying and selling volume came amid the exchange’s apt war in the USA.

The USA Securities and Alternate Commission (SEC) filed a lawsuit towards Coinbase, accusing the exchange of offering unregistered securities. The SEC’s lawsuit claims that Coinbase did no longer register as a broker, national securities exchange, or clearing company, thereby circumventing the regulatory disclosure requirements designed to provide protection to securities markets.

On the present time we charged Coinbase, Inc. with working its crypto asset buying and selling platform as an unregistered national securities exchange, broker, and clearing company and for failing to register the supply and sale of its crypto asset staking-as-a-carrier program.https://t.co/XPG2gDkxtV pic.twitter.com/hCdVMw8B2v

— U.S. Securities and Alternate Commission (@SECGov) June 6, 2023

Coinbase has since been defending its enterprise practices in court. However, the apt war reached a severe juncture in March 2024 when a U.S. court denied Coinbase’s motion to push apart the SEC’s case. The ruling accredited the SEC to proceed pursuing its allegations that Coinbase operates an unregistered exchange, broker, and clearing company.

Coinbase took a strategic apt step by submitting a memorandum in wait on of its interlocutory allure in Can also 2024, nonetheless. The allure seeks to overturn the court’s earlier dedication and doubtlessly mitigate among the firm’s apt pressures.

Earlier in the month, the exchange’s apt woes additional deepened as Coinbase customers filed a lawsuit towards two of the firm’s subsidiaries for over and over breaking securities legislation for the reason that inception of Coinbase.

Source : cryptonews.com