Franklin Templeton Lists Ethereum ETF Under Ticker 'EZET' on DTCC

Franklin Templeton Lists Ethereum ETF Under Ticker ‘EZET’ on DTCC

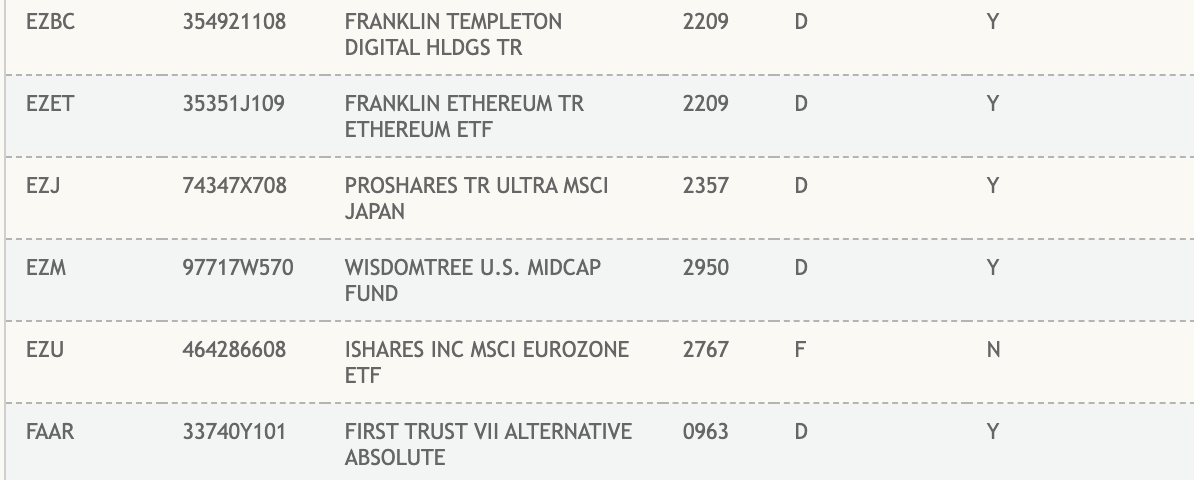

Asset management firm Franklin Templeton has listed its Ethereum switch-traded fund (ETF) below the ticker EZET on the Depository Belief and Clearing Corporation (DTCC) web space.

The “Franklin Templeton Ethereum TR Ethereum ETF” is listed in the create or redeem column on the DTCC web space. The product has yet to be favorite by the U.S. Securities and Alternate Commission (SEC).

Franklin Templeton Awaits Approval

On February 12, Franklin Templeton became once the most recent asset manager to file a attach of dwelling Ethereum ETF application with the SEC — joining a long checklist of asset managers equivalent to BlackRock, Fidelity, Grayscale, VanEck, Invesco and Galaxy, apart from Cathy Wood’s Ark Invests and 21Shares, all of which personal submitted purposes for a attach of dwelling Ethereum ETF.

SEC Delays Decision on ETH ETFs

Closing week, the SEC presented a prolong in its decision relating to Franklin Templeton’s proposed attach of dwelling Ethereum ETF, extending the gash again-off date to June 11. This news comes from a submitting made public, leaving the methodology forward for this financial product unsafe in the in the intervening time.

The proposed ETF seeks to observe the price of ether and would create basically the most of Coinbase Custody Belief Firm and the Bank of Modern York Mellon as custodians.

SEC Anticipated to Philosophize Situation ETH ETF Apps Would possibly maybe 23-24

In March, the SEC delayed a decision to approve the BlackRock attach of dwelling Ethereum ETF. The SEC now has until Would possibly maybe 23 to approve or reject VanEck’s ETF application for an Ethereum ETF tracking the sector’s 2nd-largest cryptocurrency.

Bloomberg Intelligence analyst James Seyffart has expressed scepticism, suggesting the contemporary spherical of Ether ETF purposes could in the extinguish be denied.

Earlier this day, Tron CEO and founder Justin Sun acknowledged it’s no longer always going an Ethereum ETF can be favorite in Would possibly maybe with the cryptocurrency wanting “long-term training with regulators.”

Will the SEC Place ETH a Security?

The predicament of Ethereum is in limbo – for the time being, ETH is no longer belief a few security by the U.S. Securities and Alternate Commission (SEC) — nonetheless this could all switch very fleet. It has been widely reported that plenty of U.S.-basically basically based fully companies personal acquired subpoenas attempting to mark ETH as a security.

Ethereum is considered as a decentralized cryptocurrency, in preference to a security. On the opposite hand, regulatory companies like the SEC continue to show screen the cryptocurrency space and will present extra guidance and surprising adjustments or contemporary rulings in due course. It’s mandatory to set up as a lot as now on regulatory developments.

Consensys Info Lawsuit Against SEC Over Ethereum

On Thursday, it emerged, that Ethereum developer firm Consensys, managed by Joe Lubin, filed a lawsuit on April 25 in opposition to the SEC over its “overzealous law” around the Ethereum blockchain.

In an announcement on social media platform X, Lubin acknowledged Consensys has taken a extraordinarily crucial step in direction of “maintaining get admission to to ether and, by extension, the Ethereum blockchain in the U.S. We are suing the SEC and fighting assist in opposition to its overzealous regulatory overreach.”

In a weblog put up, Consensys acknowledged the SEC’s reckless capability is causing chaos to builders, market contributors, institutions, and countries that are building or already managing major programs running on Ethereum, the sector’s largest platform for decentralized purposes.

Source : cryptonews.com