Ethereum’s Growth Could Spike With Increased Institutional Investments In First Half of 2024: Coinbase

Ethereum’s Boost Might perchance perchance Spike With Increased Institutional Investments In First Half of of 2024: Coinbase

With a novel evaluation released on February 8, Coinbase’s compare division clarify the predicted development in Ethereum’s trading dynamics right thru the preliminary six months of 2024.

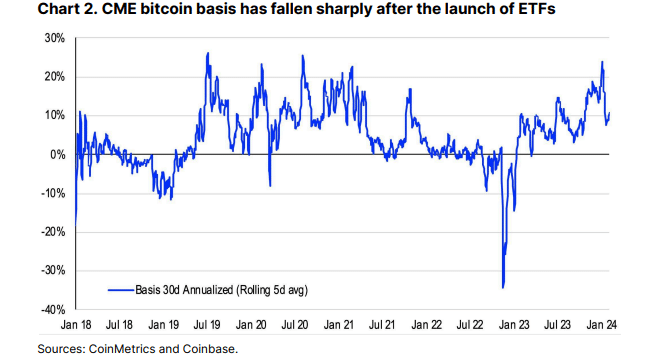

Coinbase analysts highlighted development functions after the approval of region Bitcoin (BTC) ETFs in decentralized finance (DeFi) and the wider crypto market.

Per the file, Ethereum has moved slowly in latest months as Bitcoin continues to entice extra institutional investments.

Field Ethereum ETFs Expected to Gasoline Boost

No topic Ethereum’s sluggish development compared to others, analysts project institutional investments within the first half of the year delight in the functionality to commerce the story.

“…we imagine there’s room for ETH to play obtain up to its peers in 1H24. Even supposing there used to be some rotation into ETH after the open of region bitcoin ETFs, the momentum used to be arrested by liquidations from a mammoth defunct crypto lender alongside stress from the sale of ETH alternatives.”

The anticipation of development largely banks on the functionality approval of region Ethereum ETFs, mirroring the market acceptance Bitcoin has loved. The kind of pass could perchance additionally open up recent dwelling windows of different for Ethereum.

ETH won over 80% in 2023 and recorded rising DeFi numbers and institutional fund funding in spite of playing 2nd fiddle to Bitcoin’s soaring ETF narratives.

Bitcoin led the pack with over 158% positive aspects in 2023 as institutional funds trickled in from BlackRock’s ETF application wiping out losses from the unpleasant crypto iciness in 2022.

Solana’s Boost Eclipses Ethereum

Ethereum’s development on the institutional front used to be additionally overshadowed by Solana (SOL) which recorded a string of inflows into funding funds incomes the outline as an institutional investor well-liked.

This year, the approval of region Bitcoin ETFs has viewed flows into the market leader and altcoins however the momentum of Ethereum is aloof beneath the model projected by most analysts.

Final year, a community of wealth managers projected Ether as having the wonderful development potential amongst high crypto resources in spite of figures on the time.

The corporations checked out the activities round decentralized applications (dApps) on the Ethereum Community and their performance right thru a bull trail to web their predictions.

Additionally, the staking mechanism on the blockchain after it transitioned to a Proof-of-Stake (POS) model can entice recent users who desire to assemble staking rewards.

Equally, a e-newsletter by Grayscale famed the underperformance of Ethereum in 2023 as its trim contract development used to be comparatively higher than other networks along with other metrics.

“Ether produced genuine returns in 2023 however underperformed Bitcoin apart from sure other trim contract blockchain tokens. We expect this shows Bitcoin-explicit positives this year and a slower recovery in Ethereum’s on-chain job.”

Source : cryptonews.com