Ethereum Leads Weekly Altcoin Losses as Wider Market Sell-Off Continues

Ethereum Leads Weekly Altcoin Losses as Wider Market Promote-Off Continues

The crypto market remains in the red zone with altcoins and pack chief Ethereum (ETH) posting losses two weeks after the approval of field Bitcoin (BTC) ETF by the United States Securities and Exchange Price (SEC).

On-chain data exhibits the designate of several crypto sources trading at monthly lows. This comes not like the uptick in costs in direction of the conclude of closing 365 days.

The hot sell-off also can moreover be seen at some stage in Bitcoin and a slew of altcoins as day after day trading volumes of cryptocurrency tumble.

In the closing 24 hours, day after day trading volumes stood at $46.27 billion, a 6.61% decline from the day gone by. This brings the entire crypto market capitalization to $1.56 trillion.

With asset costs down, decentralized finance (DeFi) volumes respect moreover plummeted and stay at $3.6 billion. At 7% of the entire crypto market, this exhibits diminished activity and sell-offs.

Ethereum Leads The Pack

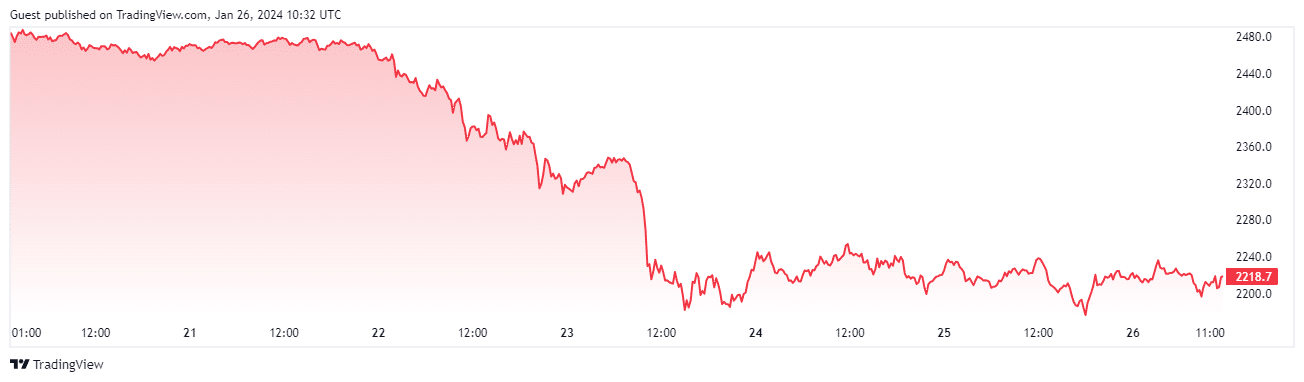

Ethereum has recorded the top doubtless loss among altcoins in the high 20 ranked sources at some stage in the closing seven days with its decline entering double figures.

ETH is down by 10.7% in a week on the time of writing and exchanges hands at $2,212, a 0.4% small hurry up to now 24 hours.

Fancy most sources, Ethereum received momentum in Q4 2023 after a slack open to the 365 days coming off the 2022 endure market. The altcoin large recorded 90% profits all 365 days prolonged notching institutional inflows and ambitious DeFi numbers.

On the replacement hand, beneficial properties posted in December were wiped off amid the recent market correction. Bears are at this time predicting a a miniature decrease designate in the upcoming weeks. Solana (SOL) and Ripple (XRP) had 6.69% and 6.4% losses up to now week to interchange at $87.83 and $0.51 respectively.

Fancy ETH, huge December beneficial properties recorded by SOL were wiped out because the asset posts a monthly decline of 23.22%. XRP’s monthly losses are at 17.63%. Cardano (ADA) and Avalanche (AVAX) respect plunged 5.54% and 7.5% respectively up to now week with the next 22% and 15.29% in the closing 30 days.

Bitcoin Is Tranquil in The Promote-off Combine

As the altcoin market remains in the red zone, Bitcoin’s correction after the approval of field ETFs has drawn opinions from several commentators with some bringing up that this was merely a sell-the-data tournament.

The months main as a lot as the approval were marked with an improved institutional investor urge for food because the asset’s designate surged to ranges no longer seen in months.

This was adopted by predictions from analysts of a huge designate manufacture after the approval because it changed into a brand new window for investors to amplify their publicity to the high sources.

Matrixport projected a $50,000 designate for the asset in December and with the recent designate correction, a brand new document has been launched on a potential designate decline to $36,739 earlier than a rebound.

Source : cryptonews.com