Ether Draws Institutional Bullishness, Bitcoin Remains Retail Favorite: Bybit

Ether Attracts Institutional Bullishness, Bitcoin Remains Retail Accepted: Bybit

Learn from Bybit highlights a rising institutional bullishness on Ether, pushed by the expected certain affect of the Dencun assist on the Ethereum blockchain.

Dencun, slated for March 13, will introduce numerous Ethereum Development Proposals (EIPs) including proto-danksharding aimed toward cutting back Layer-2 transaction costs, per builders.

“Whereas the upcoming assist will no longer likely result within the same affect because the Merge, the functionality successful implementation will likely allege a tailwind to ETH and other Layer 2 tokens,” the story acknowledged.

The final most principal assist to Ethereum, identified as Shapella, took net site in April 2023. It marked a milestone as it allowed customers and validators to withdraw their staked ether from the network.

Institutional Shift from Bitcoin to Ether

In line with Bybit, optimism in direction of Ether began in Sept. 2023 and picked up momentum in Jan. 2024, reaching about 40% of institutional portfolios. The workers also effectively-known that expectations for the SEC’s approval of a Station Ether ETF by the pause of 2024 are adding to the certain sentiment surrounding Ether.

Bybit acknowledged that institutions started cutting back their Bitcoin holdings in early Dec. 2023, at a time the asset examined a prime resistance stage of $40k. Thereafter, their Bitcoin holdings continued to issue no. It remains unclear whether or no longer this shift from Bitcoin to Ether represents a snappy-time length tactical adjustment or a medium-time length strategic reallocation.

With the Bitcoin halving constructing in April 2024, it’s dangerous to be detrimental in regards to the crypto asset since the halving is steadily viewed as an correct convey, Bybit indicated.

Retail vs. Institutional Investment Styles

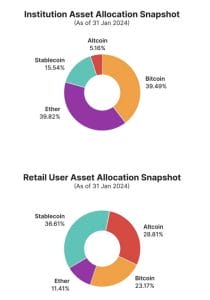

The story also equipped a breakdown of asset allocations. It confirmed that institutions allocated about 40% to Bitcoin, 40% to Ether, 15% to stablecoins, and 5% to altcoins from July 2023 to Jan. 2024.

In line with Bybit, institutions bear raised their portfolio focal level on Bitcoin and Ether from 50% to 80%. In incompatibility, retail customers bear a decrease concentration in Bitcoin and Ether, with these two property making up about 35% of their whole portfolios.

“Retail customers bear a extremely particular funding model, relative to institutions, with a better tilt into altcoins and with extra cash (e.g., better stablecoin percentage),” the story acknowledged.

Retail Users Indicate Elevated Self assurance in Bitcoin vs. Ether

In yet every other well-known inequity, retail customers had been chanced on to bear reasonably stronger optimism toward Bitcoin when when in contrast with Ether. Bybit acknowledged they did no longer make investments in Ether to the same extent as institutions for the length of the learn length.

Furthermore, retail customers bear no longer diminished their positions in Bitcoin for the reason that length between Dec. 2022 and Sept. 2023.

“The distinctive funding form of retail customers could well well presumably also must whole with their better leverage, which requires a better stage of portfolio property as collateral (INS leverage at ~12; Retail customers’ leverage stage at ~20),” Bybit acknowledged.

Retail Investors Take care of Better Altcoin Exposure

The story printed that retail customers gentle assist better positions in altcoins when when in contrast with Bitcoin and Ether. Then all as soon as more, there could be a prevailing cautious sentiment in direction of altcoins amongst most customers.

Institutions tremendously diminished their overall positions in altcoins by half in percentage phrases. They had been seen to bear virtually exited all positions in highly volatile token categories, comparable to meme, AI, and BRC-20 tokens, aside from for L1, DeFi, and metaverse tokens.

“Despite jaw-shedding returns in 2023, institutions bear no longer been fans of those excessive-risk excessive return bets in 2023. We simplest explore a clear prolong within the holding for meme tokens from the foundation of Sept except October,” Bybit acknowledged.

Furthermore, Bybit chanced on that even though Solana has outperformed, both institutions and retail customers had been no longer holding SOL for prolonged intervals.

Within the third quarter of 2023, Solana held a most principal net site within the portfolios of both institutions and retail customers. Then all as soon as more, as Solana rebounded and reached $40, institutions and retail customers opted for profit-taking.

Source : cryptonews.com