ECB’s Disparaging Comments on Bitcoin Draw the Ire of Crypto Community

ECB’s Disparaging Feedback on Bitcoin Draw the Ire of Crypto Community

On February 22, the European Central Monetary institution (ECB) described Bitcoin as a ‘needless cat’ and criticized its spend in felony activities on the darknet. These remarks delight in ignited a backlash from the crypto crew, questioning the ECB’s stance and credibility.

Bitcoin Failed In Its Normal Promise

In Ulrich Bindseil’s and Jürgen Schaaf’s blog put up, the European Apex financial institution criticized Bitcoin for failing to satisfy its unique promise as a world decentralized digital currency. The ECB argued that Bitcoin has no longer won mainstream adoption and enjoys restricted legitimate spend circumstances.

Bitcoin has failed to severely change a world decentralised digital currency, as a replacement falling sufferer to fraud and manipulation.

The recent approval of an ETF doesn’t change the indisputable reality that Bitcoin is dear, stupid and inconvenient, argues #TheECBBloghttps://t.co/e9Ek01Dism pic.twitter.com/ddBFsv4g0w

— European Central Monetary institution (@ecb) February 22, 2024

The European institution also touched on Bitcoin mining. It noted that transaction validation on the network contributes to environmental atomize due to the its reliance on the proof-of-work (PoW) consensus mechanism.

The ECB said that the vitality demands of the PoW network are on the same scale as some puny countries. Elevated Bitcoin prices imply higher vitality consumption as miners lag to resolve the inherent cryptographic puzzles.

Furthermore, the financial agency noted that Bitcoin is now not any longer a correct investment automobile because it would now not provide ready money drift for easy liquidity get hold of admission to. It implied that the Bitcoin imprint is basically pushed by dismay of missing out (FOMO) initiated by less an authority retail patrons who in most cases soar on the crypto bandwagon.

The ECB added that these compelling causes made it interrogate the validity of the US Securities and Alternate Commission’s (SEC) resolution to approve a local Bitcoin change-traded fund (ETF). To them, an ETF approval would now not rob away the indisputable reality that the dazzling rate of Bitcoin is mute zero.

X’s Community Show Debunk the ECB’s Claims

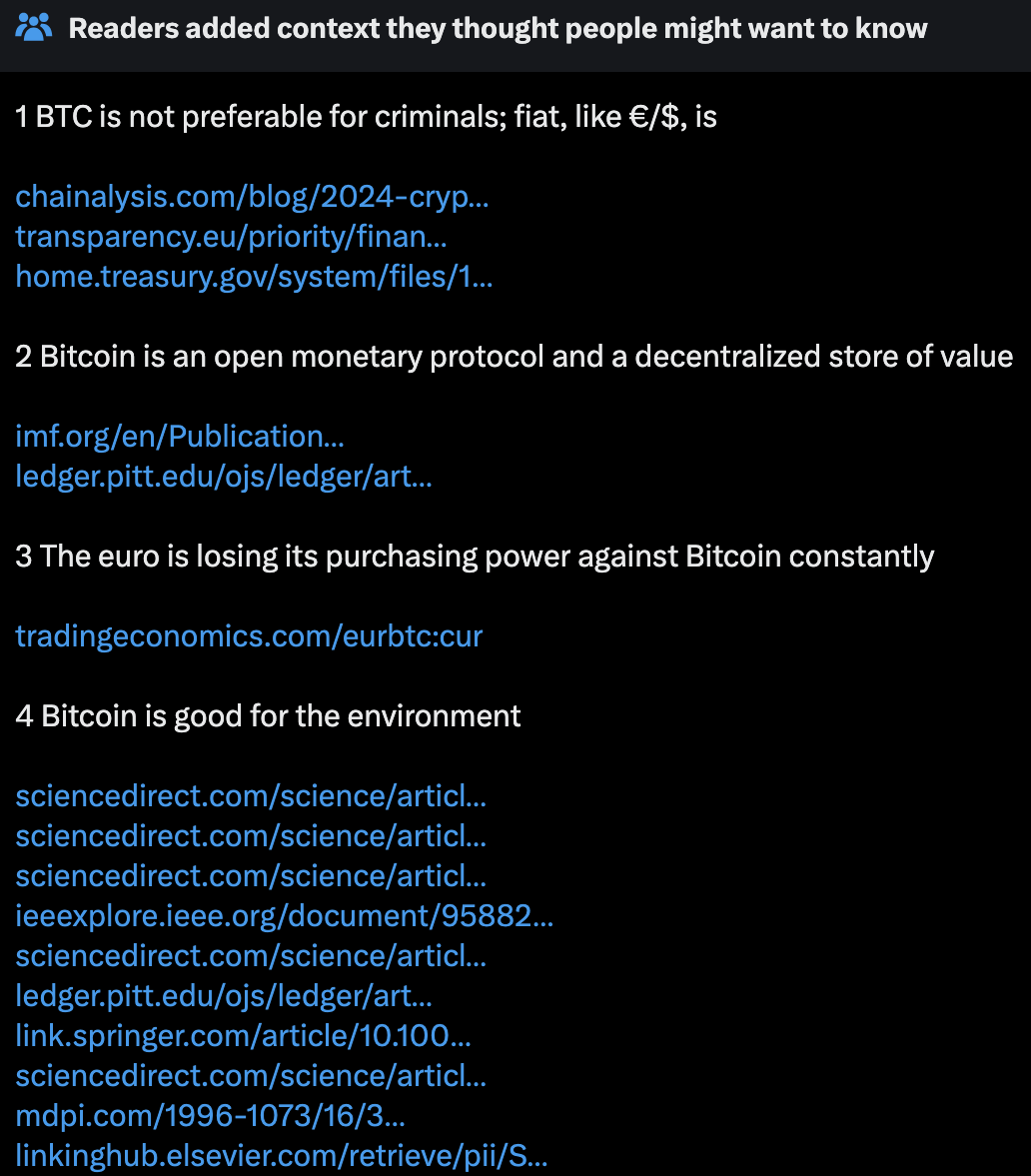

The ECB’s put up on X (previously Twitter) ignited a backlash. One principal response used to be X’s Community Show characteristic, which debunked among the European agency’s claims regarding the crypto bellwether.

The “X Community Show” characteristic is a tool or characteristic throughout the X platform that permits users as a device to add comments or annotations to posts, providing extra context or data.

In an instantaneous response to the ECB’s put up, the Community Show said that 0.34% of full crypto transactions had been attributable to felony activities. Bitcoin’s involvement on this used to be lower than 25% when put next with 110 billion euros extinct in felony enterprises in 2010.

It also doubled down on the broader crypto market’s belief that the Bitcoin network is an delivery financial protocol and a viable retailer of rate. It cited experiences exhibiting that the Euro currency used to be losing its shopping vitality and that Bitcoin is a catalyst for pivoting the realm to renewable vitality sources.

To boot to the Community Show, the crypto crew did no longer react positively to the ECB’s claims. One such instance is crypto evangelist and Messari co-founder and CEO Ryan Selkis, who quoted the ECB’s put up with the caption:

“The Euro would possibly possibly be needless in 4-5 years. Bitcoin would possibly possibly be alive and well so long as nodes exist that bustle the Bitcoin core client.”

The Euro would possibly possibly be needless in 4-5 years.

Bitcoin would possibly possibly be alive and well so long as nodes exist that bustle the bitcoin core client. https://t.co/7nxCVsAMY0

— Ryan Selkis (d/acc) 🇺🇸 (@twobitidiot) February 22, 2024

One other person noted that the Euro has misplaced 99.5% of its rate relative to Bitcoin within the last ten years.

The Euro has misplaced 99.5% of its rate vs. #Bitcoin in lower than 10 years.

Within the meantime, 97% of all trading days are in profit for Bitcoin.

That technique anybody who has euro-rate-averaged into Bitcoin in preference to conserving onto the ECBs flaming rubbish is massively in profit simply now.… pic.twitter.com/G74UT8bcPR

— Stack Hodler (@stackhodler) February 22, 2024

In response to the person, 97% of all trading days are in profit for Bitcoin. This implies patrons who delight in held the crypto asset within the last decade delight in made stronger returns than the spend of a Euro-backed investment automobile.

Source : cryptonews.com