Data Indicates Stablecoins Are Becoming A Global Asset Class

Files Indicates Stablecoins Are Changing into A World Asset Class

Stablecoin adoption is rising impulsively. Files from research agency rwa.xyz reveals the model of addresses holding both dollar and crypto-pegged stablecoins has increased by 15% in 2024, which is the supreme up to now.

New research from blockchain diagnosis agency Chainalysis further stumbled on the rising prominence of stablecoins in overall on-chain transaction relate. Chainalysis’ “Crypto Spring File” illustrious that stablecoins are changing valid into a upright, global asset.

4/ Stablecoins offer any individual with an web connection a gateway to the USD, unlocking recent pathways of monetary inclusion. The US leads in purchases, nevertheless global attach a matter to is excessive, with $40B+ bought in March by myself one day of diverse nations and areas. pic.twitter.com/AyOxVypS9j

— Chainalysis (@chainalysis) April 25, 2024

Stablecoins Are Changing into Extra Critical

Kim Grauer, Director of Research at Chainalysis, instructed Cryptonews that by comparing fiat purchases of stablecoins between international locations, it’s particular that stablecoins are rising in importance.

“With a diverse representation of countries and areas–most notably the EU, Turkey, and Thailand–contributing to over $30 billion in purchases in January 2024 by myself, and the excessive share of all transaction quantity on-chain, it’s laborious to push apart stablecoins’ prominence,” stated Grauer.

In keeping with Grauer, stablecoins—cryptocurrencies with values pegged to an exterior reference, be pleased the U.S. dollar—bring collectively not too long ago represented over half of of all on-chain transaction quantity.

“This used to be easy by way of the on-chain information that Chainalysis ingests,” added Grauer.

Andrew O’Neill, Managing Director and Co-Chair of S&P World’s Digital Property Research Lab, instructed Cryptonews that he also believes stablecoins are rising in importance.

“Money doesn’t pass on the identical velocity as information does,” stated O’Neil. “On-chain capabilities can aid solve this area, and splendid now, stablecoins bring collectively emerged in the absence of more than a couple of instruments be pleased central monetary institution digital currencies.”

Stablecoin Expend Circumstances Push Adoption Forward

O’Neil added that most modern findings from credit standing agency S&P World impress stablecoins can even turn out to be a key pillar of monetary markets’ blockchain adoption by serving as a digital forex for absolutely on-chain funds.

“Funding community Blackrock’s BUIDL fund offers a recent utilize case,” he pointed out. “The tokenized fund, which makes utilize of the Ethereum blockchain and invests in U.S. treasuries, has a liquidity pool denominated in the USDC stablecoin, for which merchants can redeem share tokens by way of a orderly contract, instantaneously.”

Stablecoins are certainly proving to be a famous bridge between outmoded finance and cryptocurrency. Files reveals that the stablecoin market is for the time being valued at about $150 billion, which is anticipated to exceed $2.8 trillion by 2028.

I'm delulu for a bull case

If all of us take into story it laborious ample, perchance we can manifest it

Naur… let the numbers impress you

1. Stablecoins are at an ATH since the possess of June 2022 👶

Yes, they're not at an ATH in regular. Don't approach for me.However here’s a wholesome indicator… pic.twitter.com/gMI8OwvMfy

— Beba🪄 (@Web3Wand) April 26, 2024

The stablecoin market has also grown more competitive. To illustrate, XRP issuer Ripple not too long ago announced plans to begin a United States dollar-backed stablecoin.

A Ripple spokesperson instructed Cryptonews that bringing a relied on USD-backed stablecoin to the XRP Ledger will generate more utilize instances, liquidity, and opportunities for builders.

“Ripple will leverage the stablecoin in its have funds solution to offer customers with basically the most helpful fee journey, taking into story the placement, time constraints, and connected prices,” the spokesperson stated.

The spokesperson added that pairing the recent stablecoin with XRP will enable more crypto liquidity to carrier extra depraved-border funds attach a matter to.

“This could well enable famous on/off ramps and reinforce global scale,” the spokesperson stated. “Ripple’s fee solution has already processed more than $50 billion in lifetime quantity and has payout capabilities in 80 markets, which represents more than 90% of the day after day FX market.”

Stablecoins Present Salvage entry to to U.S. Greenbacks

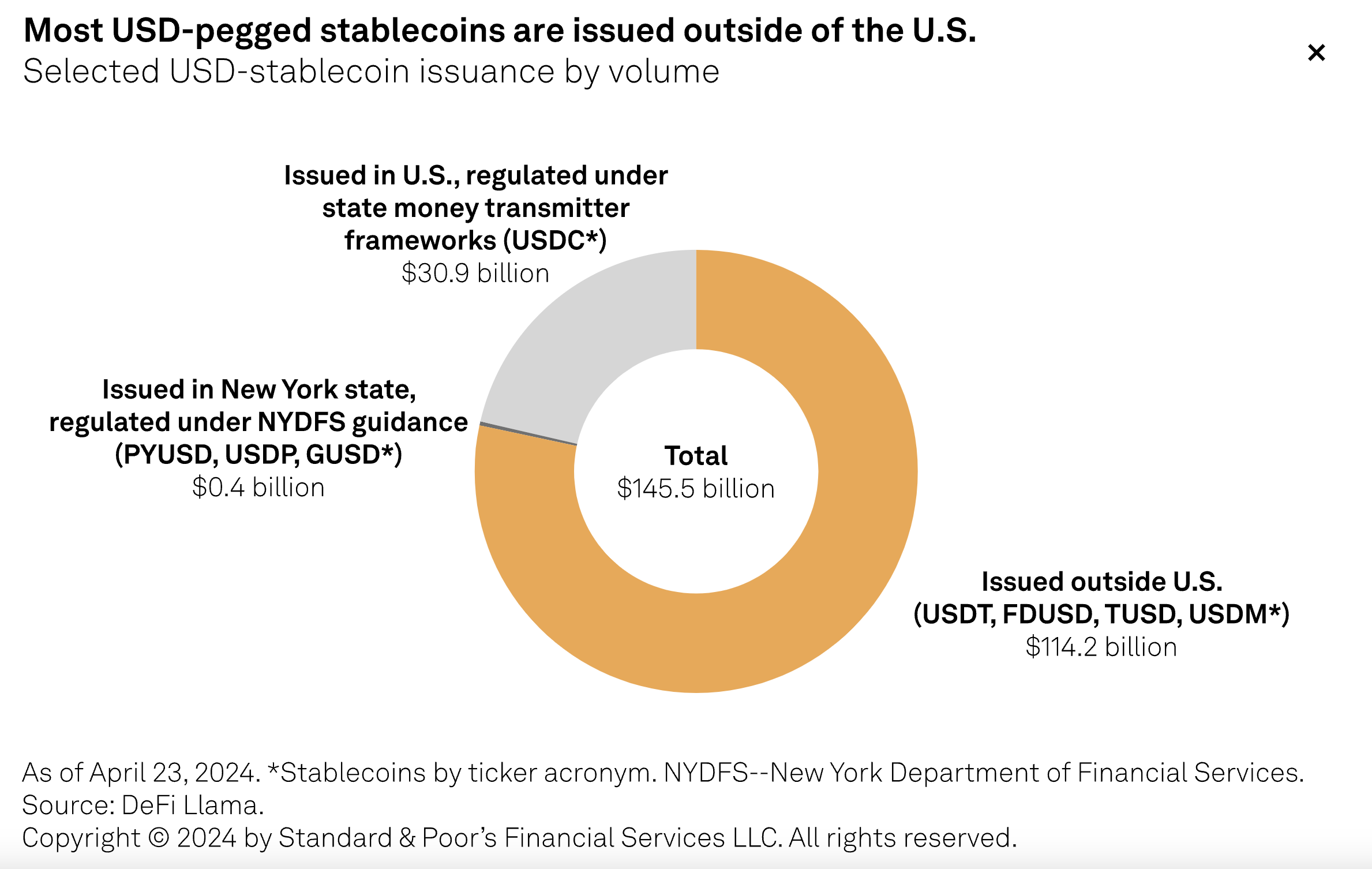

Right here is legendary, as stablecoin utilize instances equivalent to this also promote dollar dominance since they delay fetch admission to. Research from S&P World reveals that almost all USD-pegged stablecoins are genuinely issued outside of the U.S.

“Extra stablecoin utilize instances are connected to depraved-border funds and on/off ramping relative to crypto,” stated O’Neil.

To attach this in point of view, O’Neil mentioned that PayPal’s stablecoin, PYUSD, is recurrently used to facilitate funds and depraved-border transactions in Latin America and the Caribbean.

“The more than a couple of component for stablecoins is remittances,” O’Neil added. “Tether is used heavily to send U.S. greenbacks to family and company in emerging markets.”

It’s also worth pointing out that information from CoinGecko stumbled on that U.S. Buck-backed stablecoins negate a 98.9% share of the stablecoin market.

David Pope, Commissioner of The Wyoming Precise Token Fee, instructed Cryptonews that the global attach a matter to for greenbacks is sturdy, and stablecoins simplify and velocity the transfer of ownership of those greenbacks.

“Right here is why stablecoins are changing valid into a upright, global asset class,” Pope stated.

Growing Level of interest For Stablecoin Legislation

The rising attach a matter to for stablecoins has also precipitated lawmakers to focus on stablecoin regulations.

In an April 17 announcement, United States Senators Kirsten Gillibrand and Cynthia Lummis presented regulations setting up a regulatory framework for fee stablecoins.

“Passing a regulatory framework for stablecoins is genuinely famous to asserting the U.S. dollar’s dominance, selling responsible innovation, holding consumers and cracking down on money laundering and illicit finance,” Senator Gillibrand illustrious.

The Lummis-Gillibrand Fee Stablecoin Act also notes it would “protect consumers by requiring stablecoin issuers to withhold one-to-one reserves and prohibiting unbacked, algorithmic stablecoins.”

S&P World Says US Stablecoin Adoption Would possibly Fly Following New Rules

S&P World highlighted how the Lummis-Gillibrand Fee Stablecoin Act can even result in a surge in U.S. stablecoin adoption in consequence of the regulatory framework boosting self belief. The act targets to offer a… pic.twitter.com/LAynaDNfCt

— Maira.Cruz.Gomes (@Mairetinha) April 25, 2024

Moreover to The Lummis-Gillibrand Fee Stablecoin Act, United States Home Monetary Services and products Committee ranking member Representative Maxine Waters urged in an April 24 interview with Bloomberg that lawmakers had been progressing toward passing stablecoin regulations.

During the interview, she illustrious that she had been working “very nicely collectively” with committee chair Patrick McHenry on regulations on stablecoins and clawbacks for banks.

Stablecoin Legislation Would possibly Force Adoption

While such regulations would likely restrict algorithmic stablecoins be pleased TerraUSD (UST) – which depegged from the U.S. dollar in 2022, O’Neil believes that approving a stablecoin bill in the U.S. would velocity up institutional blockchain innovation.

“A particular federal framework would offer more consolation for institutions the usage of stablecoins,” he stated. “This can even just also give banks consolation to command of affairs stablecoins themselves, which in turn can even just raise banks into the stablecoin market.”

Ripple’s spokesperson also believes that now would possibly perchance well perchance be the time for particular and definitive guidelines on stablecoins.

“The U.S. wants to advise its management to offer companies and banks with the working out required to proceed,” the spokesperson stated. “With out this, the U.S. dangers transferring technological innovation and client benefits in a foreign country.”

They added that Ripple is tranquil in the capacity of reviewing how this regulations can even just impact its trade. Yet, they illustrious, “It’s particular that a stablecoin bill represents a famous step.”

While this is in a position to well be the case, Chainalysis Head of North America Coverage Jason Somensatto instructed Cryptonews that Chainalysis believes the passage of such regulations will bring collectively itsy-bitsy impact on stablecoin adoption in the U.S.

Somensatto added that stablecoin adoption is thriving globally no topic the dearth of an unprejudiced stablecoin-particular regulatory regime in the U.S.

“Right here is likely in consequence of the utilize case of stablecoins,” he stated. “By giving any individual in the realm with an web connection fetch admission to to the soundness of the U.S. dollar, stablecoins are a extraordinarily most famous solution for residents of countries dealing with forex volatility, both for keeping financial savings and even facilitating commerce.”

Given this, Somensatto believes stablecoins will tranquil upward push as a world asset no topic guidelines.

“While valuable cryptocurrencies be pleased Bitcoin and Ether are inclined to dominate the headlines and offer gains that stablecoins lack, stablecoins bring collectively surpassed all varied kinds of cryptocurrencies in usage, representing over half of of all transaction quantity in most modern months,” Somensatto illustrious.

Source : cryptonews.com