Cryptocurrency Prices Dump As Middle Eastern Tensions Trigger Risk-off Panic – Here’s The Latest

Cryptocurrency Prices Dump As Heart Eastern Tensions Draw off Possibility-off Dismay – Right here’s The Most modern

Cryptocurrency costs dumped on Friday as rising Heart Eastern tensions introduced about risk-off scare selling all the diagram in which thru monetary markets, with Bitcoin (BTC) losing 5% within the previous 24 hours to fall below $67,000, and Ether (ETH) dropping 9% to the $3,200 state.

Israel is braced from a counterattack from Iran after they currently took out IRGC defense force leaders in Syria. Reports emerged on Friday that the US is though-provoking warships to ready itself to shield Israel.

🚨🇺🇸🇮🇱 JUST IN: The United States has pledged to DEFEND ISRAEL if Iran attacks. Iran has acknowledged it will make the US a target of Iran. pic.twitter.com/Esn0bPXWFX

— Jackson Hinkle 🇺🇸 (@jacksonhinklle) April 12, 2024

Tensions were excessive within the Heart East since the October 7th Hamas attack against Israel, and Israel’s devastating counterattack into Gaza.

Rising fears that the US and Iran could additionally uncover themselves engaged in a sizzling battle roiled sentiment on Friday.

The S&P 500 hit its lows level in virtually a month ultimate above 5,100, dropping 1.4% on the day.

Safe havens fancy the US buck and Gold every soar. The DXY rallied above 106 for the first time ultimate November, whereas gold hasty hit document highs above $2,400.

It’s no shock then that cryptocurrency costs came below rigidity – many investors think cryptocurrencies as a excessive beta risk sources.

Altcoins Undergo the Brunt as Cryptocurrency Prices Dump

The Friday sell-off in Bitcoin became once decidedly gentle when put next with that of many valuable altcoins.

As per CoinMarketCap, the likes of Solana, XRP, Dogecoin, Toncoin, Cardano and Avalanche all dropped between 10-16% in 24 hours.

Dogwifhat, Bonk and Arbitrum had been amongst the worst-performing names within the stop 100 by market capitalization.

Friday’s carnage noticed launch passion in altcoin cryptocurrencies slashed by 30%.

Altcoins misplaced ~$6 billion in launch passion.

30% drop in total launch passion.

Massacre.

🩸

— Zaheer (@SplitCapital) April 12, 2024

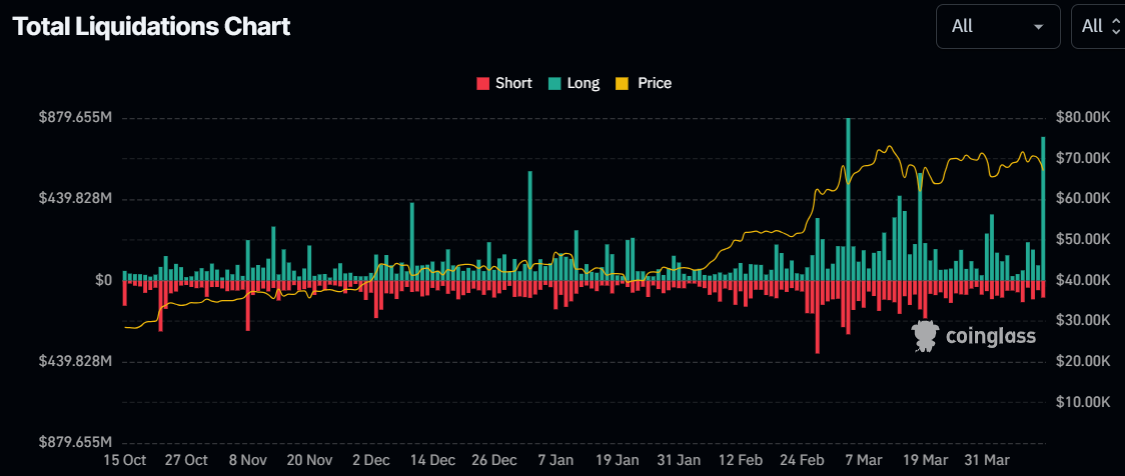

That comes after $770 million in leveraged long crypto futures positions had been wiped out on Friday, as per coinglass.com recordsdata.

Most of the aforementioned altcoins are at the least 25% down from fresh highs.

Some, fancy Arbitrum and Bonk, are down over 50% from yearly highs.

Certainly, it had already been an grotesque few weeks for a range of replacement cryptocurrency costs, even prior to Friday’s moving.

After a solid attain to 2023/initiate to 2024 that noticed many valuable altcoins posting 2-3x or extra beneficial properties, besides to Bitcoin recovering to unique document highs, momentum has stalled, and profit-taking has taken over.

Jitters about a Bitcoin halving linked turbulence, fading Fed price lower bets and geopolitics have added unique causes to derisk.

The save Next For Cryptocurrency Prices?

It stays a ways too early to pronounce definitively that the most fresh drop in cryptocurrency costs is over.

At the least, there stays masses of room left for escalation between Iran and Israel.

The altcoin pullback gifts a gargantuan replacement for investors to rep in at good aquire costs versus a couple of weeks ago.

But anyone leaping into the market now ought to composed be ready for significant two-formulation volatility.

Or, if they love procuring a crypto that carries a a lot lower risk of end to-time length 15% intra-day strikes, there’s Bitcoin.

Sure, Bitcoin has dropped 5% in 24 hours on risk off flows. But trading within the $67,000s, BTC is handiest down 8% from the document highs it hit end to $74,000 ultimate month.

Furthermore, it stays locked wisely inner fresh ranges.

That could additionally replicate the reality that many eye Bitcoin to in actuality be a stable haven asset, a lot fancy gold.

And its standard resilience in fresh weeks could additionally replicate a reluctance to sell forward of the halving/amid ETF optimism.

Whereas a post-halving “sell-the-truth” response could additionally seek Bitcoin dip back in direction of the $60,000s, its outlook stays solid.

Prior halvings have in total been adopted by a lot save flee-usato unique document phases inner a couple of months.

Good US deficit spending and world central bank easing suggests that macro will stay a tailwind. That’s even though the Fed is comparatively slack to initiate lowering charges, amid sturdy US recordsdata.

And within the waste, institutional request of for state Bitcoin ETFs has added a unique, long-time length source of aquire rigidity to the market.

$100,000 Bitcoin for later this 365 days stays very a lot on the cards.

And that implies that, whereas the end to-time length altcoin outlook is bumpy, traders ought to composed brace for solid comebacks later this 365 days.

Disclaimer: Crypto is a excessive-risk asset class. This article is equipped for informational choices and doesn’t constitute funding advice. That you just may well presumably additionally lose your entire capital.

Source : cryptonews.com