Crypto Exchange Trading Volume Declines in April as Bitcoin Retreats from Record High

Crypto Alternate Trading Quantity Declines in April as Bitcoin Retreats from File High

Trading quantity on predominant cryptocurrency exchanges has skilled a most well-known decline in April, coinciding with Bitcoin’s retreat from its all-time high.

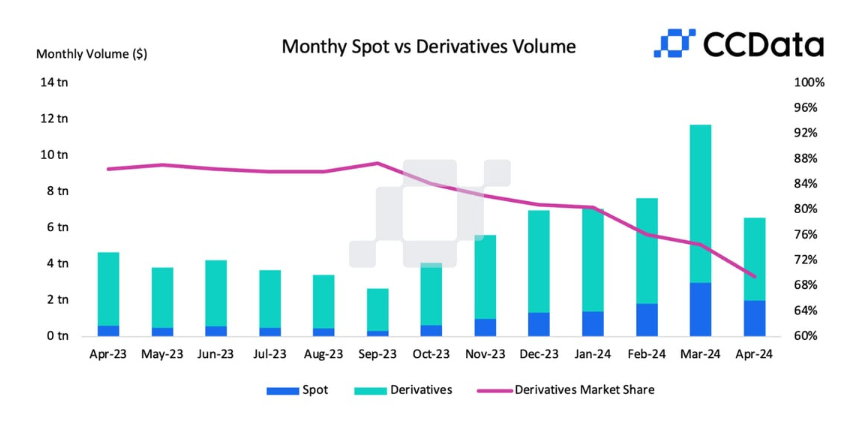

Location trading quantity on centralized exchanges esteem Coinbase Global, Binance, and Kraken dropped by 32.6% to $2 trillion closing month, as reported by study firm CCData.

Additionally, derivatives trading quantity saw its first decrease in seven months, falling by 26.1% to $4.57 trillion.

Trading Quantity Declines Due to Tightening Monetary Conditions

The surge in trading quantity witnessed earlier in the year, following the introduction of US alternate-traded funds investing in Bitcoin, waned as a result of tightening of monetary stipulations in the United States.

The Federal Reserve’s efforts to take care of power inflation challenges contributed to this shift.

Prior to the April 19 Bitcoin halving tournament, which diminished the provision of original money by half, there used to be anticipation and excitement for the length of the market.

Jacob Joseph, a study analyst at CCData, instantaneous Bloomberg that the decline in trading exercise on centralized exchanges after the Bitcoin halving tournament aligns with patterns noticed in outdated cycles.

He extra explained that the commence of increased-than-anticipated Client Worth Index (CPI) inflation recordsdata and escalating geopolitical tensions in the Center East injected uncertainty and distress into the market.

These factors and detrimental bag flows from intention Bitcoin ETFs led to predominant crypto sources reaching their vary lows.

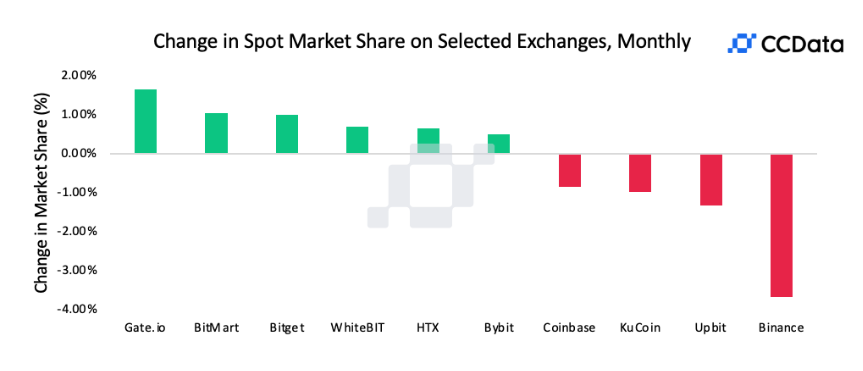

The decline in trading volumes also affected the intention market fragment of Binance, the world’s largest crypto alternate.

For the principle time since September 2023, Binance’s intention market fragment dropped by practically 4% to 33.8%, reaching its lowest level since January, constant with CCData.

The CME Community, a eminent derivatives market, also skilled a decline in crypto trading quantity for the principle time in seven months.

In April, its derivatives trading quantity diminished by close to twenty% to $124 billion, as reported by CCData.

In spite of the decline, Jacob Joseph talked about that trading exercise on centralized exchanges, while slower when compared to its peak in March, remains at an elevated level when compared to outdated months.

CEX Trading Quantity Triples in 2024

Centralized cryptocurrency exchanges (CEXs) esteem Binance skilled a extensive surge in trading volumes between October 2023 and March 2024, constant with Bybit’s 2024 Institutional Industry File released on April 18.

Particularly, OKX saw a 278% develop in 30-day volumes since October, followed closely by Binance, which saw a 239% surge.

Bybit alternate also demonstrated spectacular enhance, at the side of 264% to its trading volumes for the length of the identical length.

As confirmed by a spokesperson for Bybit, these exchanges agree with outpaced the enterprise’s moderate enhance charge of 255%.

The U.S.-essentially based alternate Coinbase also witnessed enhance, albeit relatively of trailing slack with a 193% develop in trading quantity.

The CEX enhance hasn’t surpassed the even extra hasty expansion of decentralized exchanges (DEXs), nonetheless.

Leading DEX Uniswap v3, as an illustration, saw a 320% develop in volumes for the length of the identical length, as highlighted in Bybit’s recordsdata.

Uniswap has surpassed $2 trillion in lifetime trading quantity.

Source : cryptonews.com