Crypto VC Deals in 2023 Plunged 70% on Funding Constraints

Crypto VC Offers in 2023 Plunged 70% on Funding Constraints

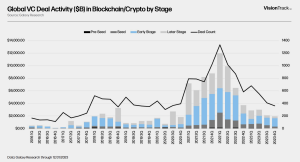

Crypto endeavor capital (VC) funding dropped 70% in 2023, securing splendid about $10b in deal worth.

That’s a tumble from nearly $32b in 2022, which had nearly 90% extra deals.

Galaxy Digital published a yarn Wednesday displaying endeavor deal reveal in the crypto sector closing 365 days.

It published lackluster reveal via the fourth quarter, with 359 deals totaling nearly $2b in deal worth. VC deal depend hit its lowest point in 4Q since 2Q 2020’s 301 deals.

“As capital in the sector is continually constrained, funds are reaching capability on deployment and later-stage winners are capturing remaining fund worth,” Bailey York, data lead at VisionTrack, wrote in the yarn.

Most VC deals in 2023 were with early-stage companies, a trend that intensified at some point soon of the 365 days.

Very absolute most life like lower than 20% of deals in 3Q and 4Q 2020 enthusiastic later-stage firms.

Within the fourth quarter of 2023, slack-stage endeavor deals — which happen after early-stage financing — made up wonderful over 14% of total deal counts.

This changed into the splendid share of slack-stage deals viewed in quarterly data labeled by stage, the yarn learned.

Offers in the pre-seed stage accounted for roughly 9%, marking the bottom stage since 1Q 2016.

The yarn further pointed out that VCs leveraged later-stage deal valuations and equipped give a enhance to to “prized” portfolio companies.

Having a gape at the high deals of 2023, splendid eight surpassed the $100m stamp in deal worth.

A couple of of the standout deals in the 365 days were Wormhole with $225m, Line Subsequent with $140m, Blockstream with $125m, LayerZero with $120m, and Worldcoin securing $115m. These were predominantly later-stage deals.

Crypto VC fundraising cools as market valuations normalize

In 2023, global VC funding in crypto and blockchain raised $5.75b. This changed into a substantial tumble from 2022’s yarn of $37.7b, which changed into unfold all the draw via 262 funds.

“As the market spent essential of 2023 centered on passive/beta single-asset and multi-asset index offerings, crypto endeavor capital will probably return might maybe perhaps maybe maybe also peaceable crypto-native allocators purpose to rotate to endeavor fund products later in 2024,” York acknowledged.

He emphasised the position of endeavor funds in supporting the blockchain/crypto ecosystem, by serving as the first supply of capital for recent companies.

The yarn didn’t predict 2024’s crypto fundraising landscape. Nonetheless, it highlighted that Bitcoin’s uncommon worth proposition is underscored by geopolitical uncertainty and banking device turmoil.

Source : cryptonews.com