Bithumb IPO Plans ‘Accelerate’ as South Korean Crypto Exchange Eyes Public Listing

Bithumb IPO Plans ‘Bustle’ as South Korean Crypto Alternate Eyes Public Listing

The South Korean alternate Bithumb is calling to step up its IPO plans – and will detect to open a immediate-tracked initial public providing as the crypto bull market continues.

Per Hanguk Kyungjae, Bithumb is calling to “hasten up” its proposed KOSPI itemizing.

Bithumb IPO: Alternate Takes Decisive Steps

The media outlet reported that Bithumb launched that the alternate will bound off its holdings operations real into a separate firm. It is far tentatively naming this agency Bithumb Funding.

The agency published a regulatory submitting file on March 22 detailing its plans.

The contemporary agency will take support watch over of Bithumb’s holdings, investments, and true estate operations.

Meanwhile, the entity for the time being identified as Bithumb Korea will focal point on working the crypto trading platform.

The firm plans to divide shares in Bithumb the exercise of a 6:4 ratio. This would possibly build the conception sooner than a meeting of shareholders on Might perhaps perhaps 10.

If the shareholders approve, Bithumb Funding will officially open on June 13, the media outlet reported.

Shareholders will reportedly be urged they’ll “in discovering contemporary shares in the contemporary company in share to their new shares.”

The agency made no point out of ongoing court instances, including a probe into alleged market manipulation supposedly performed by the mysterious “true” proprietor of Bithumb.

As a substitute, it seems the agency desires to distance itself from such matters. It seems to want the IPO’s success or in every other case to stem from its core alternate commercial.

Overseas merchants contain prolonged their buying budge, buying a catch buy of 14.401 trillion received in #KOSPI #stocks to this point this year, in line with the #Korea Alternate. This figure far exceeds closing year’s total catch purchases of 11.424 trillion received.https://t.co/LiPQxxVfCW

— The Chosun Day-to-day (@EnglishChosun) March 24, 2024

Might perhaps perhaps Bithumb Bring Forward its Listing Plans?

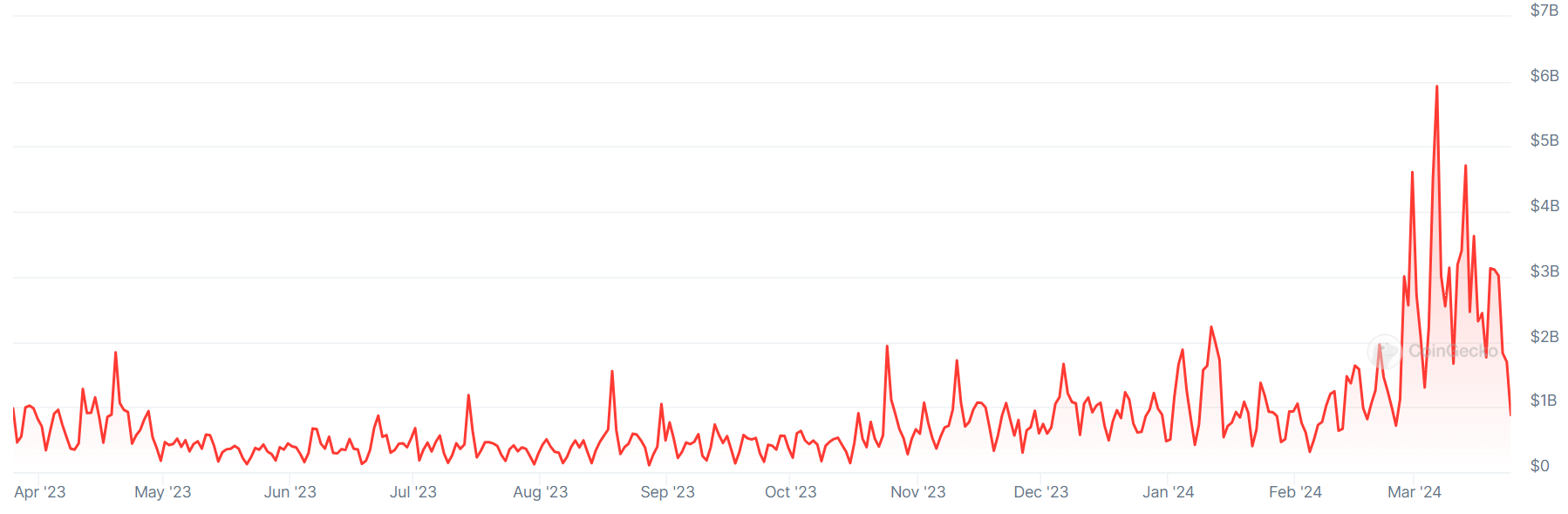

Bithumb-related commercial has boomed in latest months. The agency became as soon as, except currently, providing commission-free trading in a elaborate to claw aid market fragment from its very most appealing rival Upbit.

A retail Bitcoin (BTC) trading renaissance has furthermore viewed trading volumes rise in South Korea. The nation is famously crypto-eager. On the opposite hand it has a exiguous pool of platforms that contain fiat-crypto trading licenses.

The alternate hopes that the spinoff will “extra invent bigger the chance of IPO open” by creating an entity that’s “centered on the alternate commercial,” the media outlet current. It added:

“Novel companies outside core alternate operations shall be pursued with hasten thru contemporary companies – with out being restricted by the Bithumb IPO elaborate.”

A Bithumb spokesperson acknowledged the hasten would “promote efficiency.” The first price added that it can per chance furthermore “increase the increase” of “alternate operations” with “separate possession” gadgets.

Bithumb has previously acknowledged it’s miles eyeing a 2025 KOSPI debut. The contemporary hasten would possibly per chance potentially sight the alternate hasty-discover its itemizing.

Despite the timing, alternatively, the alternate is prone to salvage its elaborate to turn out to be doubtlessly the major South Korean trading platform to hasten public.

🇰🇷 South Korea’s Crypto-eager Good passable Bank Aims for IPO Amid BTC Boost

Good passable Bank, a South Korean neobank that has viewed hasty increase thanks largely to its crypto operations, is made up our minds to invent an initial public providing (IPO) elaborate.#CryptoNews #newshttps://t.co/C0HqMWCHSL

— Cryptonews.com (@cryptonews) March 11, 2024

Upbit’s operator Dunamu is believed to be “too trim” to debut on the KOSPI. Discuss of a Coinbase-inspired NYSE Dunamu itemizing went frigid throughout the 2022 undergo market.

On the opposite hand, one other Upbit-related agency is furthermore seeking to open its salvage IPO elaborate, specifically the neobank Good passable Bank.

Good passable Bank offers fiat on/off ramp-vogue banking services to Upbit potentialities. The partnership has viewed Good passable the Bank user inappropriate grow exponentially over the past few years, and will furthermore sight the bank open on the KOSPI in the arrive future.

Source : cryptonews.com