Bitcoin Whale Addresses Surge Following Spot ETF Approval: CryptoQuant

Bitcoin Whale Addresses Surge Following Position ETF Approval: CryptoQuant

Bitcoin (BTC) has recorded big verbalize in worth amid institutional inflows this 365 days following area ETF approval by the United States Securities and Alternate Payment (SEC).

Unique data by on-chain analytics firm CryptoQuant presentations bullish sentiment in direction of the market leader in fresh weeks resulting in a cost uptick.

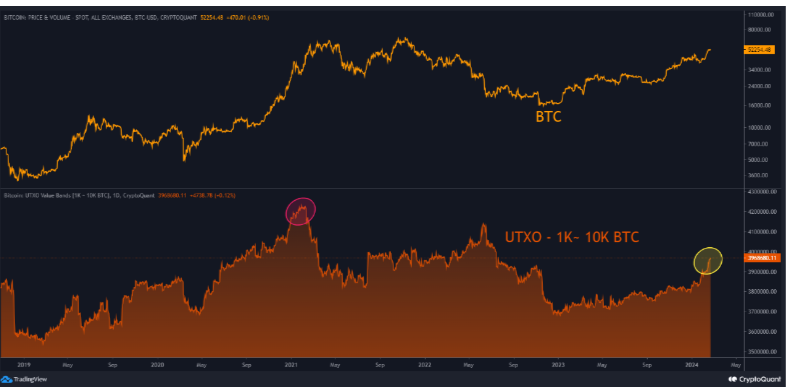

Per the data, there is an rising amount of Bitcoin Unspent Transaction Output (UXTO) in the market ranging from 1000 to 10,000 BTC.

These figures bear increased progressively from Q4 2023 on the heels of institutional inflows into Bitcoin as the market hoped for drawing shut approval by the SEC.

The inflows led to a cost rally wiping out 2022 losses and ushering in a brand unique bullish outlook in the marketplace. In December 2023, the associated rate of the asset hit $42,000 with loads of analysts pointing to a $50,000 worth post-approval.

On the institutional front, inflows hitting millions were recorded in many products boosting Bitcoin’s Sources Below Management (AUM) to over $36 billion.

Bitcoin Whales Change into Active

Even supposing the approval of area Bitcoin ETFs affects every institutional and retail investors, the actions of whales bear spiked in the final 30 days.

“These quantities most regularly tend to be linked by whales or institutional investors in desire to folks, and in particular since the unique approval of Bitcoin area ETFs, they’ve been rising sharply.”

Analysts at CryptoQuant pointed out that these inflows are now not as fundamental as the highs of 2021 nevertheless it surely presentations noteworthy institutional exercise.

“In total, in bull markets, after a fundamental inflow of institutional investors, unique particular person investors enter the market, marking the discontinuance of the bull speed,” they added.

Days after the approval, miners despatched $1 billion worth of BTC reserves to exchanges with analysts pointing to the upcoming halving and the must hedge in direction of better facilities.

Therefore, data from CryptoQuant presentations nearly $1 billion exiting Coinbase to other custodians, described as a holding switch. Here is on account of outflows from centralized exchanges impart a bullish sentiment.

Bitcoin Sees a Unique Abilities Publish ETF Approval

The SEC current the long-awaited area Bitcoin ETF on January 10 opening up a brand unique funding window for transitional investors.

This has sparked a brand unique surge in the market pushing up asset costs and an inflow of unique investors. To this level, Bitcoin ETFs bear attracted $5.2 billion in find inflows as over $1 billion was once recorded in the final seven days.

Bitcoin AUM has additionally hit $Forty eight billion attributable to an amplify in the asset worth and unique inflows to the market. At press time, Bitcoin trades at $51,086, a 26% surge in the final 30 days as the broader market hits a $1.94 trillion market capitalization.

The success of area Bitcoin ETFs has led to institutional avid gamers turning to Ethereum (ETH) ETFs in the United States. Some commentators challenge unique inflows to ETH following ETF expectations.

Source : cryptonews.com