Bitcoin Price Surprisingly Strong As Hot US Inflation Data Throws Fed Rate Cut Story Into Doubt – Where Next for BTC?

Bitcoin Sign Surprisingly Bag As Scorching US Inflation Data Throws Fed Price Cut Account Into Doubt – The effect Subsequent for BTC?

Regardless of hotter-than-expected inflation files, the Bitcoin designate defied expectations and surged on Wednesday, even as the US Federal Reserve’s rate decrease myth used to be thrown into doubt.

The US Shopper Sign Index (CPI) reported a 0.4% carry in March, exceeding the expected 0.3% rise. Core CPI metrics moreover surpassed forecasts.

This news sent US bond yields and the US greenback hovering, as traders reconsidered their bets on the US Federal Reserve’s rate decrease.

The US 10-one year yield reached its most practical seemingly level since November, rock climbing almost about 20 bps. Meanwhile, The US Buck Index (DXY) surged 1% to over 105, moreover hitting its peak since November 2023.

These immense strikes weighed heavily on US stock prices, with the S&P 500 final down around 1% on the day. The benchmark US equity index hit its lowest level in almost about four weeks earlier within the session.

Decrease stock prices coupled with power in yields and the US greenback on the total spell weakness for crypto prices. That’s because crypto prices tend to absorb a solid sure correlation to shares, and a negative correlation to yields and the USD.

The Bitcoin designate’s soar aid to the $69,000s may perchance absorb caught some traders off guard, suggesting that the cryptocurrency market is rarely any longer as carefully aligned with extinct financial markets as once thought.

Merchants Pare Help on Fed Easing Bets

Expectations for relieving from the US Federal Reserve has been a foremost driver of Bitcoin’s designate appreciation this one year.

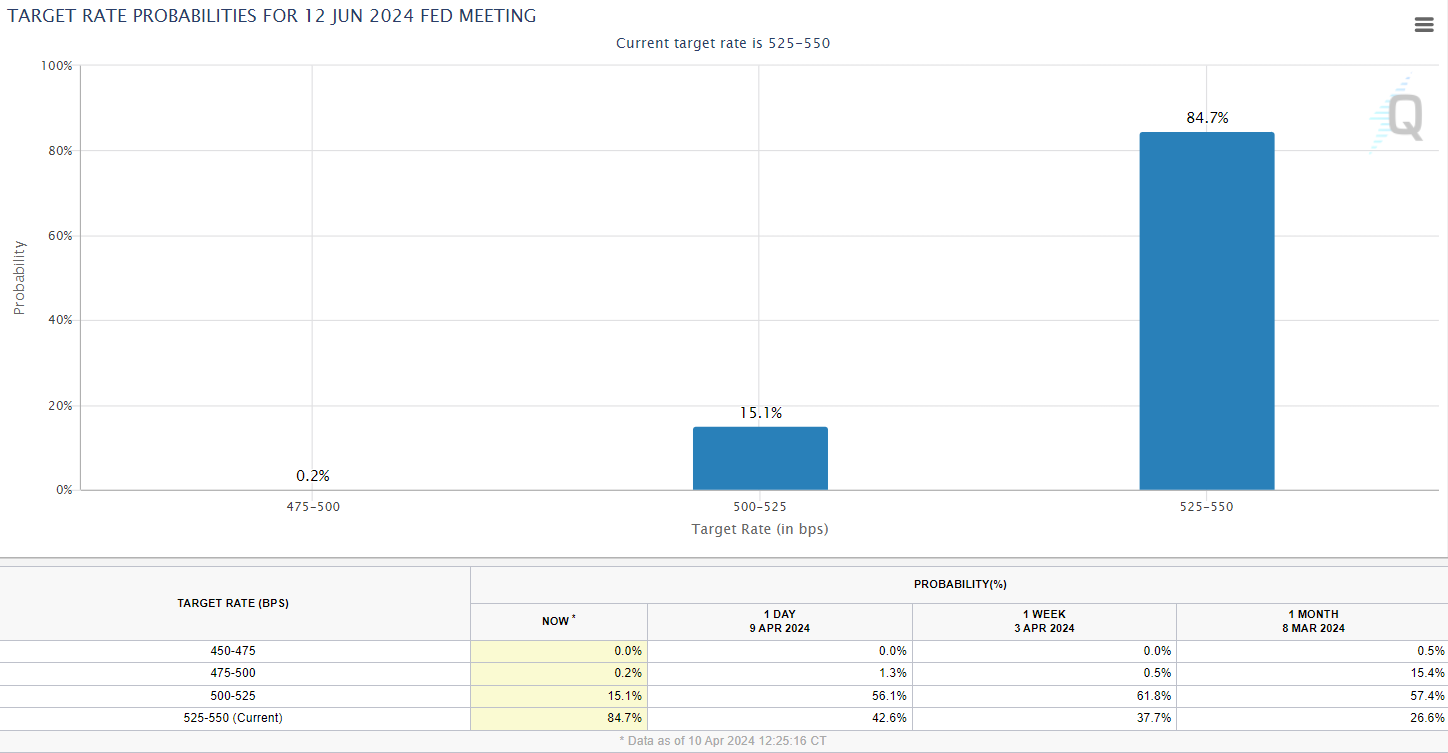

As primary, that myth took a blow following the newest files. US hobby rate futures markets at express are now handiest pricing a 15% likelihood that the Fed cuts hobby charges by 25 bps to 5.0-5.25% in June, as per the CME’s Fed Study about Design.

One month ago, US money markets were pricing a 57% likelihood of a rate decrease in June.

That paring aid of Fed rate decrease bets comes following a string of stronger-than-expected US financial files releases. Wednesday’s sizzling CPI suppose follows solid ISM Manufacturing and jobs files final week.

And with the US financial system aloof humming alongside successfully and inflation caught successfully above the Fed’s 2.0% target, policymakers had been reluctant to notify pork up for near-timeframe rate cuts.

The effect Subsequent for the Bitcoin (BTC) Sign?

Plenty of issues may perchance absorb contributed to Bitcoin’s resilience on Wednesday, no topic the warmer-than-expected inflation files and the following promote-off in extinct financial markets.

One seemingly rationalization is the growing belief that the mammoth-scale promoting of Grayscale Bitcoin Believe (GBTC) shares by bankrupt crypto estates is nearing an discontinuance.

Grayscale CEO Michael Sonnenshein informed Reuters on Wednesday that outflows from the ETF can be reaching equilibrium, suggesting that this headwind for Bitcoin is diminishing.

Any other seemingly rationalization is the upcoming Bitcoin halving, which is scheduled to hold effect subsequent Saturday.

The halving will within the cleave worth of the issuance rate of most recent Bitcoins by 50%, from 6.25 BTC per block to a couple.125 BTC. Here’s expected to within the cleave worth of lengthy-timeframe promote stress from miners and is also a bullish part for the worth of Bitcoin.

Alternatively, reward that the halving’s non permanent market affect is unsure. Within the previous, the market has in most cases corrected sharply decrease around the time of the halving. Therefore, some traders can be hesitant to carry out immense bets sooner than this match.

Regardless of the uncertainty surrounding the halving, the lengthy-timeframe outlook for Bitcoin stays sure. The rising US deficit, the upcoming halving, and the doable for a Bitcoin ETF approval are all components that can perchance pork up the worth of Bitcoin within the very lengthy timeframe.

I construct no longer deem this ride fading the elevated-than-expected CPI. Whether the Fed decrease charges 25bps in June or no longer is rarely any longer the lengthy-timeframe driver of bitcoin prices upright now. Or no longer it is a marginal part.

ETF flows + rising deficits topic more, and they’re lining up very successfully for bitcoin.

— Matt Hougan (@Matt_Hougan) April 10, 2024

Moreover, Bitcoin’s resilience to the market’s paring aid on Fed tightening bets suggests that once Fed rate cuts at final attain arrive, the Bitcoin designate is successfully-positioned to ride elevated.

Overall, whereas it is disturbing to predict the effect the Bitcoin designate will rush within the brief timeframe, the lengthy-timeframe outlook stays bullish. Bitcoin may perchance with out problems aloof hit $100,000 this one year, but first, this would perchance must damage out of its most recent consolidation pattern.

Disclaimer: Crypto is a high-difficulty asset class. This text is geared up for informational capabilities and does no longer constitute funding advice. You may perchance lose your complete capital.

Source : cryptonews.com