Bitcoin Price Pushes Towards $42,000 as US Core PCE Inflation Data Eases – How High Can BTC Go?

Bitcoin Impress Pushes Against $42,000 as US Core PCE Inflation Info Eases – How Excessive Can BTC Tear?

The Bitcoin (BTC) ticket is playing an kill-of-week reduction rally in wake of business info that confirmed inflationary pressures in the US persevered to subside to more acceptable ranges in December 2023.

US Core PCE Impress Index figures confirmed YoY inflation falling to 2.9%, below the expected rate of 3.0%.

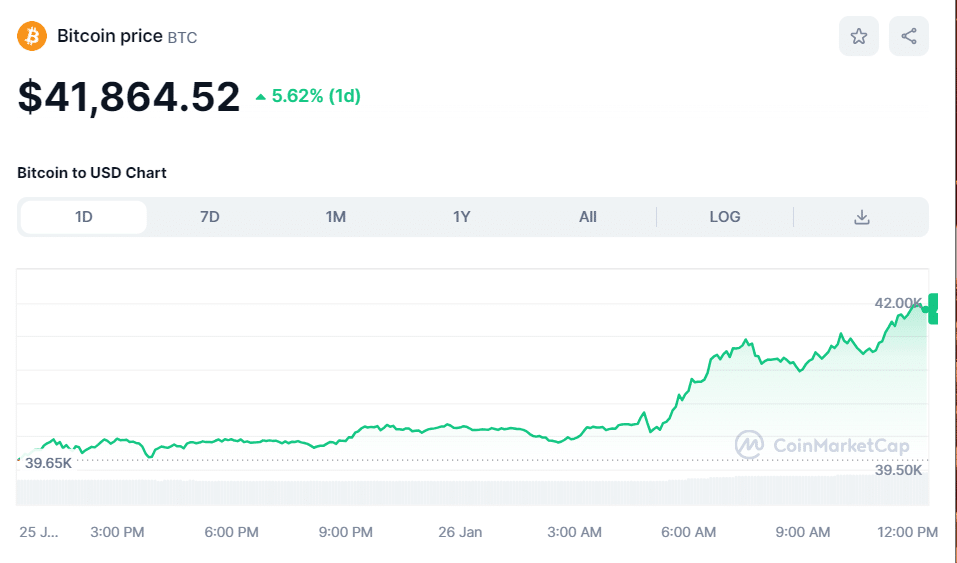

The Bitcoin ticket was closing probing $42,000, up over 5% previously 24 hours as per CoinMarketCap.

The Core PCE Impress Index is the US Federal Reserve’s favored measure of underlying ticket pressures in the united states.

With inflation in the US trending decrease, this opens the door for rate cuts from the Fed this year.

Decrease hobby rates invent a more favorable liquidity atmosphere that can motivate crypto costs.

That can per chance per chance well spin some blueprint in explaining why the Bitcoin ticket has pushed bigger since Friday’s US market originate.

US Equity Market Rally, ETF Flows Pushing Bitcoin Impress Bigger?

As per the CME’s Fed Witness instrument, US hobby rate future market pricing implies a likelihood of honest below 50% that the Fed begins cutting hobby rates as quickly as March, unchanged from one week ago.

That means that, in wake of potentially the most recent US inflation figures, macro traders aren’t considerably upping Fed rate decrease bets.

That gaze is further substantiated by having a gape all over archaic asset markets.

The US Dollar Index (DXY) is flat and rather unchanged on the week in the mid-103s.

The US 10-year yield is flat and rather unchanged on the week spherical 4.14%.

If the anecdote in archaic asset markets was a win-up of Fed rate decrease expectations, one would ask each and every to be falling.

The Bitcoin ticket would possibly per chance well be playing tailwinds from US stock costs.

The S&P 500 continues to press to recent file ranges and is now above 4,900.

Sure equity market possibility appetite would possibly per chance well be spilling over to crypto markets.

Grayscale sales of BTC from its GBTC ETF also appear to possess slowed.

The previous couple of days possess seen Grayscale spin 10,000 BTC per day to be offered on exchanges.

Meanwhile, newly launched ETFs from the likes of BlackRock and varied asset managers continue to appeal to wide flows.

Certainly, BlackRock’s iShares Bitcoin Trust (IBIT) surpassed $2 billion in sources below administration on Friday.

JP Morgan argued earlier in the week that promote strain from Grayscale’s GBTC is “largely on the back of us” – traders had been buying GBTC all by 2023 at a good deal to get asset payment (NAV) on the realization that it is also converted to a space ETF, and that GBTC shares would then be straight redeemable for Bitcoin at get asset payment.

Merchants had been taking profit on this successful substitute on masse in wake of GBTC’s conversion to a space Bitcoin ETF earlier this month.

But JP Morgan thinks focal level now switches to newly launched ETFs love BlackRock’s IBIT.

Assuming flows into such funds remain steady, this would possibly occasionally probably per chance per chance well underpin the Bitcoin ticket going ahead.

How Excessive Can the BTC Tear?

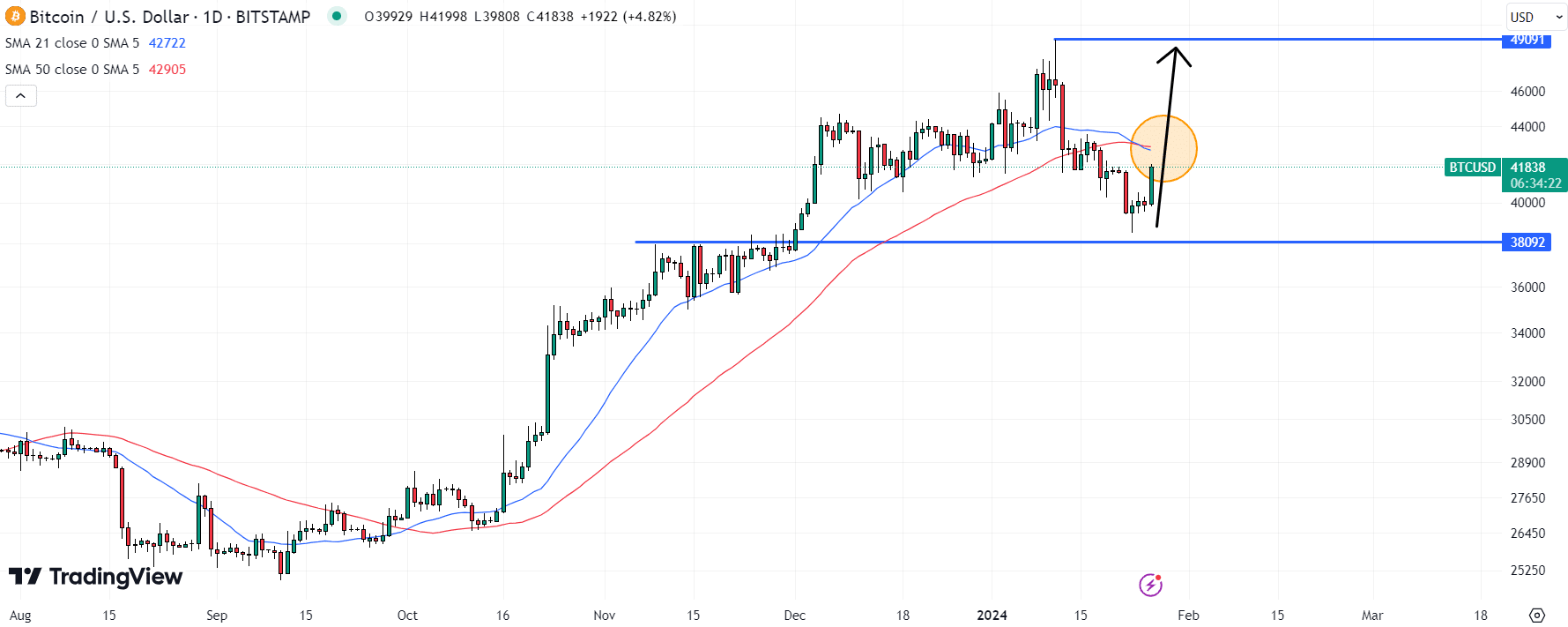

Despite potentially the most recent rebound, the Bitcoin ticket stays spherical 15% down from its newest highs above $49,000.

Essentially the most recent leap suggests the 100DMA and November highs spherical $38,000 each and every acted as steady motivate.

However the Bitcoin ticket would possibly per chance well moreover possess problems breaking back above its 21 and 50DMAs shut to $43,000.

Fully as soon as Bitcoin is in a space to interrupt back above its 21 and 50DMAs on a sustained foundation would possibly per chance well we repeat that market momentum has swung decisively bullish as soon as over again.

On this case, a retest of yearly highs spherical $49,000 can be on the cards.

In the months ahead, focal level will an increasing number of shift to the Bitcoin halving and Fed rate cuts.

The latter has historically been a very well-known long-term bullish catalyst for the Bitcoin ticket.

Fed rate cuts possess also historically boosted BTC.

A retest of all-time highs at $69,000 remain on the cards for 2024.

Source : cryptonews.com