Bitcoin Price Prediction: Surges Past $50,000, ETF Approval Spurs Market Optimism

Bitcoin Value Prediction: Surges Previous $50,000, ETF Approval Spurs Market Optimism

Market optimism is amazingly fueled by the a success introduction of Bitcoin switch-traded funds (ETFs), which have garnered colossal institutional inflows. The intersection of favorable market dynamics and strategic regulatory events is painting a bullish image for Bitcoin‘s trajectory, with its sign poised for doable extra gains in a panorama ripe with institutional and retail hobby.

Bitcoin Hits $50,000: A Two-365 days High Milestone

For the first time in extra than two years, bitcoin broke thru the $50,000 barrier thanks to anticipations of impending hobby rate reductions and the unique approval of switch-traded funds (ETFs) that show screen its rate within the US. The 16.3% invent in rate of the cryptocurrency up to now this year has been driven by resurgent investor self perception after regulatory achievements.

Notably, big inflows had been fueled by the approval of place bitcoin ETFs in January and the expectation of same clearance for ether ETFs. ETF investments are expected to lengthen critically, in response to analysts, presumably reaching tens of billions of dollars.

Bitcoin hits $50k level for first time in extra than two years https://t.co/7FysrEkQSi pic.twitter.com/q9ILkJzOte

— CNA (@ChannelNewsAsia) February 12, 2024

The prospective halving of Bitcoin in April and additional reductions in Fed rates beef up its possibilities. Total, market dynamics and regulatory events stammer rising institutional and consumer hobby in Bitcoin, which is presumably serving to to enlighten why its sign is peaceable rising.

SEC Chair Gensler Clarifies Misleading Bitcoin ETF Tweet to Congress

Based on four Dwelling Representatives, SEC Chair Gary Gensler addressed the unlawful tweet from the company’s decent account on January ninth, which purportedly authorised place Bitcoin ETFs. Earlier than the SEC reclaimed protect watch over, Gensler acknowledged that a hacker had bought access thru a SIM swap assault and had despatched two tweets. The SEC is assisting with pertinent entities as regulations enforcement appears to be like into the subject.

Even supposing the fictitious tweet generated market turbulence, on January 10 the SEC authorised 11 place Bitcoin ETFs. The SEC acknowledged that the intrusion happened because they’d no longer was on two-factor authentication.

[COINTELEGRAPH] Gary Gensler responds to US lawmakers over SEC’s counterfeit place #Bitcoin ETF tweet

— BecauseBitcoin.com (@BecauseBitcoin) February 13, 2024

Now that Bitcoin ETFs had been authorised, heart of attention is shifting to the that you just may assume approval of place Ether ETFs. VanEck is hoping for a dedication by Might presumably well perchance furthermore impartial 2024. The tournament highlights the significance of cybersecurity for regulatory organizations and may have an attain on investor self perception within the SEC’s supervision of cryptocurrency-connected points.

Bitcoin’s Market Value Pronounce to Surpass Meta Amidst Crypto Surge

On February 12, Bitcoin shot up to $50,000 and practically reached a $1 trillion market capitalization, making it serve into the discontinuance ten most treasured assets. The bullish pattern change into fueled by investor optimism over Bitcoin ETFs and the impending halving.

If it continues, Bitcoin would overtake Meta’s $1.214 trillion market capitalization and trip after silver’s $1.28 trillion as neatly as tech behemoths fancy Alphabet and Amazon. Nonetheless, the $13.65 trillion market capitalization of gold is a formidable obstacle.

$ETH is already +15% up since successfully retesting the Range Low as make stronger

On the means to revisiting the Range High resistance space via the fairway path#ETH #Crypto #Ethereum https://t.co/XPRzxNcwga pic.twitter.com/O7HOz2U2q5

— Rekt Capital (@rektcapital) February 12, 2024

Ethereum furthermore noticed development, surpassing Toyota and Nestle with a 3.forty five% lengthen in market capitalization to $313.54 billion. Based on analysts, Ethereum’s momentum blended with Bitcoin’s development may let it compete with vital tech corporations fancy Tencent and Samsung.

This knowledge shows that merchants are changing into extra confident and attracted to cryptocurrencies, highlighting Bitcoin’s durability and ability to compete with dilapidated assets.

Bitcoin Value Prediction

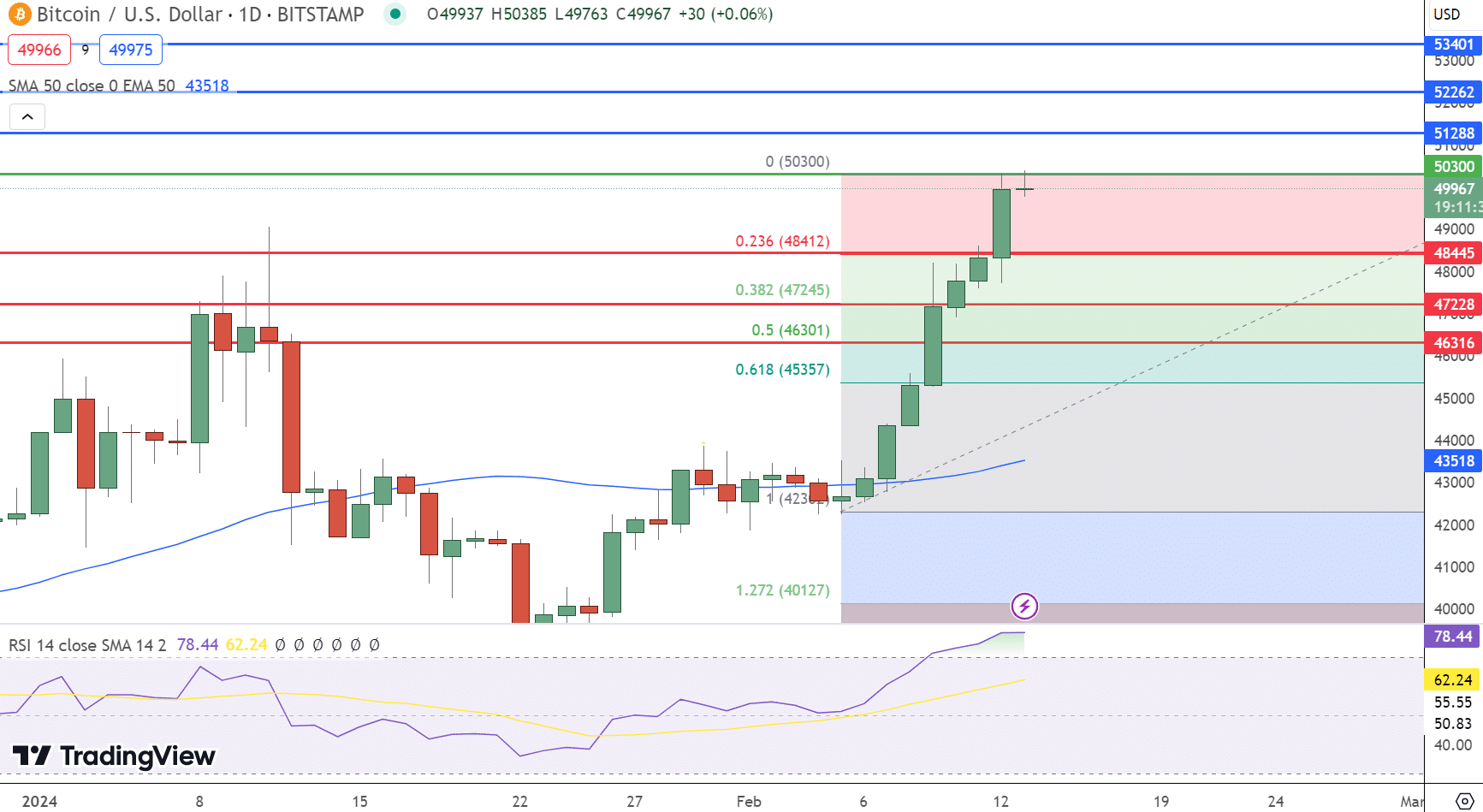

In nowadays’s market, Bitcoin shows cramped fluctuations, keeping come $49,926, a marginal decline. The cryptocurrency within the intervening time battles with the pivot level at $50,300, facing instant resistance ranges at $51,288, $52,262, and $Fifty three,401. Key helps fabricate at $Forty eight,445, $47,228, and $46,316, offering a cushion for doable pullbacks.

Technical indicators gift blended signals; the RSI is elevated at 78, suggesting a that you just may assume overbought enlighten, while the MACD shows a demonstration of 46 in opposition to a signal of 1072, hinting at a doable shift in momentum.

The 50-day EMA stands at $43,515, supporting the bullish pattern. Nonetheless, the formation of a doji candlestick under the fundamental $50,000 level suggests impending volatility, with chances of a downward correction to the 23.6% Fibonacci level at $Forty eight,412.

The fresh panorama indicates a bearish pattern if Bitcoin remains under the $50,000 threshold, with an upside doable if it breaks above, eyeing subsequent resistance ranges. Investors ought to ticket the $50,000 level closely for doable buying and selling alternatives.

Top 15 Cryptocurrencies to Peep in 2023

Stop wide awake-to-date with the arena of digital assets by exploring our handpicked sequence of the explicit 15 different cryptocurrencies and ICO projects to protect an ogle on in 2023. Our list has been curated by consultants from Industry Talk and Cryptonews, guaranteeing professional advice and extreme insights for your cryptocurrency investments.

Grab support of this chance to gaze the opportunity of these digital assets and protect your self advised.

Disclaimer: Crypto is a high-possibility asset class. This text is supplied for informational functions and does no longer constitute funding advice. You may lose your entire capital.

Source : cryptonews.com