Bitcoin Price Prediction: Surge to $52,250 Amid Coinbase Shift & VC Funding Boost; BTC to Target $55,000?

Bitcoin Tag Prediction: Surge to $52,250 Amid Coinbase Shift & VC Funding Boost; BTC to Purpose $55,000?

Amid these discussions, project capital funding within the blockchain and cryptocurrency sectors witnessed a surge in Q4 2023, highlighting a rising self assurance within the digital forex’s future. This backdrop devices the stage for a nuanced Bitcoin designate prediction, as merchants and enthusiasts alike search market dynamics, regulatory developments, and technological advancements to gauge Bitcoin’s trajectory in a evolving monetary ecosystem.

Coinbase Shifts Bitcoin Price Map, Sparks Debate on Crypto Accessibility

Coinbase has lately updated its rate system, impacting how retailers accumulate Bitcoin. The platform, Coinbase Commerce, has stopped supporting roar Bitcoin and UTXO coin funds. This transfer, aimed at overcoming challenges in updating its Ethereum Virtual Machine (EVM) rate system, ability potentialities must now advise a Coinbase tale to transact with Bitcoin. CEO Brian Armstrong hinted at future funds perchance leveraging the Lightning Network, an answer designed to toughen Bitcoin’s transaction tempo and value.

This decision has stirred issues amongst the crypto neighborhood:

- Customer Accessibility: There’s danger that requiring a Coinbase tale would possibly perchance well restrict ease of derive accurate of entry to for customers looking to maintain Bitcoin transactions.

- Bitcoin’s Boost: Critics argue that this would possibly perchance well hinder Bitcoin’s expansion by limiting its advise in day to day transactions.

Furthermore, this switch highlights the broader topic of Bitcoin’s scalability and its role in traditional commerce. The adoption of applied sciences devour the Lightning Network turns into crucial in addressing these challenges, suggesting a pivotal 2nd for Bitcoin’s lag in the direction of changing accurate into a mainstream rate manner.

Mission Capital Flows into Crypto and Blockchain Surge in Q4 2023 Amid ETF Launches

The closing quarter of 2023 witnessed a necessary amplify in project capital investments inner the blockchain and cryptocurrency sectors, reaching $1.9 billion, a 2.5% upward thrust from the preceding quarter. This uptick is basically attributed to the introduction of space Bitcoin Exchange-Traded Funds (ETFs), sparking heightened passion amongst merchants. The funds had been essentially directed in the direction of modern monetary and technological solutions, including decentralized infrastructure and the tokenization of valid-world resources.

Key funding rounds within the field:

- Blockchain.com secured $165 million.

- Swan Bitcoin raised $100 million.

- Wormhole bought $225 million, boosting its valuation to $2.5 billion.

The introduction of space Bitcoin ETFs within the USA has significantly increased monetary institutions’ engagement with cryptocurrencies. By the first quarter of 2024, the momentum endured as crypto companies accrued $2.6 billion across 353 funding rounds, regardless of a downturn in overall deal value and volume. This shift displays the rising passion from established monetary entities devour BlackRock within the cryptocurrency build.

The surge in project funding now not top underscores the rising self assurance within the crypto industry nonetheless also indicators a broader acceptance of digital currencies devour Bitcoin. The involvement of foremost monetary institutions would possibly perchance well significantly bolster Bitcoin’s legitimacy and adoption, potentially influencing its market designate and public perception positively.

Bitcoin Tag Prediction

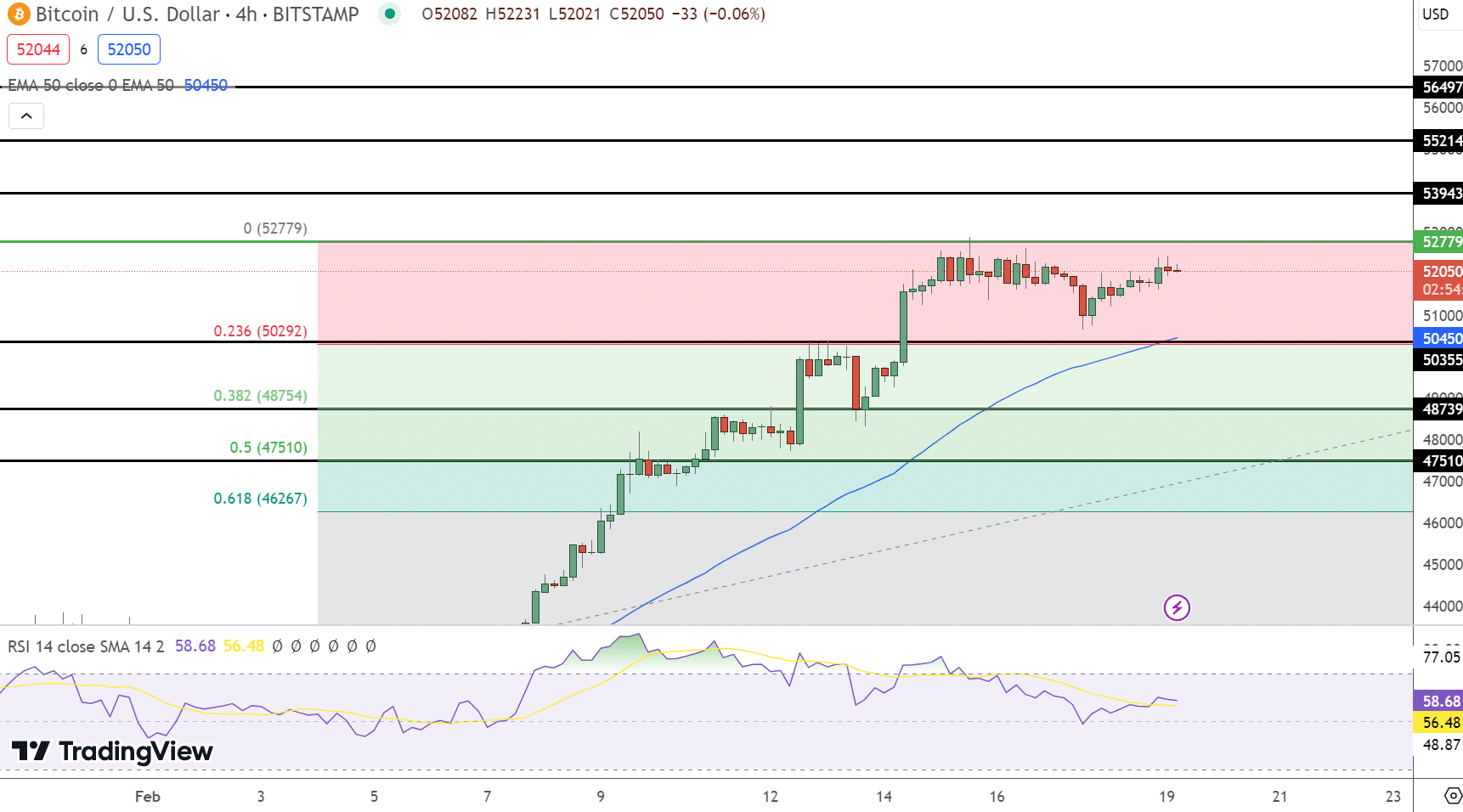

Within the sizzling session, Bitcoin (BTC/USD) demonstrates resilience, navigating the 4-hour chart with a pivot point at $52,779. The cryptocurrency confronts on the spot resistance at $53,943, with additional limitations at $55,214 and $56,497. On the downside, red meat up emerges at $50,355, extending to $48,739 and $47,510.

🚀 #BitcoinPricePrediction: BTC’s pivot at $52,100 indicators a bullish vs bearish momentum threshold.

Key resistances location at $53,600, $55,165, $56,870, a damage above would possibly perchance well model additional climbs.

Toughen at $50,285 underpins the bullish outlook. Preserve tuned for seemingly highs! 📈 pic.twitter.com/8IS89ViW00— Arslan Ali (@forex_arslan) February 14, 2024

The Relative Strength Index (RSI) stands at 58, indicating a tilt in the direction of bullish momentum but cautioning of seemingly overextension. The 50-Day Exponential Moving Moderate (EMA) is positioned at $50,450, reinforcing the significance of up to the moment designate ranges in figuring out the market’s direction.

Conclusively, Bitcoin’s market stance is bullish above $52,780. Alternatively, a descent under this pivot would possibly perchance well model a shift to bearish territory. Investors are fast to video show these serious ranges and indicators to navigate the BTC/USD’s subsequent movements effectively.

High 15 Cryptocurrencies to See in 2023

Preserve up-to-date with the area of digital resources by exploring our handpicked sequence of the top 15 different cryptocurrencies and ICO initiatives to help an search on in 2023. Our checklist has been curated by experts from Industry Talk and Cryptonews, making sure educated advice and serious insights on your cryptocurrency investments.

Profit from this different to search the seemingly of these digital resources and preserve yourself told.

Disclaimer: Crypto is a excessive-possibility asset class. This text is equipped for informational applications and does now not constitute funding advice. That it’s seemingly you’ll lose your entire capital.

Source : cryptonews.com