Bitcoin Price Prediction as Michael Saylor's BTC Holdings Reach $10 Billion – Will He Sell?

Bitcoin Impress Prediction as Michael Saylor’s BTC Holdings Reach $10 Billion – Will He Promote?

MicroStrategy’s Bitcoin investment has soared past the $10 billion rate, owning over 190,000 BTC as Bitcoin’s cost climbs past $50,000. This success underscores MicroStrategy’s self belief in Bitcoin’s long-timeframe prospects and its utility as an inflation hedge.

Since joining the Bitcoin market in August 2020, MicroStrategy’s BTC portfolio has expanded vastly, even amidst the personal market’s challenges in early 2022.

Despite experiencing a downturn in its fourth-quarter revenue and revenue, MicroStrategy, below Michael Saylor’s management, persevered to bolster its Bitcoin holdings, procuring a extra 850 BTC for $37.2 million in January on my own.

MICROSTRATEGY’S BITCOIN HOLDINGS SURPASS $10 BILLION

As Bitcoin’s label nears $53,000, Michael Saylor-led MicroStrategy’s place of 190,000 BTC is valued at over $10B with unrealized earnings of $4B.

Michael Saylor currently announced the agency’s acquisition of a extra 850… pic.twitter.com/FhB1twtdA6

— Crypto Metropolis Hall (@Crypto_TownHall) February 16, 2024

This transfer came even as MicroStrategy’s stock (MSTR) saw a 16% drop following the introduction of Bitcoin ETFs. Saylor, demonstrating his commitment to Bitcoin, expressed willingness to promote his MSTR shares to hang extra BTC.

MicroStrategy’s pivot from govt securities and bonds to Bitcoin modified into motivated by the cryptocurrency’s superior return doable.

Saylor has been a vocal recommend for Bitcoin’s potential to withhold procuring vitality amidst inflation.

Particularly, MicroStrategy’s Bitcoin stash surpasses the holdings of all 9 currently launched Bitcoin ETFs, accounting for with regards to 1% of the entire BTC in circulation, illustrating the corporate’s famous stake in the cryptocurrency panorama.

Bitcoin Impress Prediction

Bitcoin’s market place stays strong, with the cryptocurrency trading at $51,818. The exiguous 0.08% hang bigger over the closing 24 hours reflects a cautious yet optimistic market sentiment. With a market capitalization exceeding $1 trillion, Bitcoin solidifies its dominance in the digital currency situation.

Currently, the circulating supply nears its maximum, highlighting the asset’s shortage and doable cost appreciation.

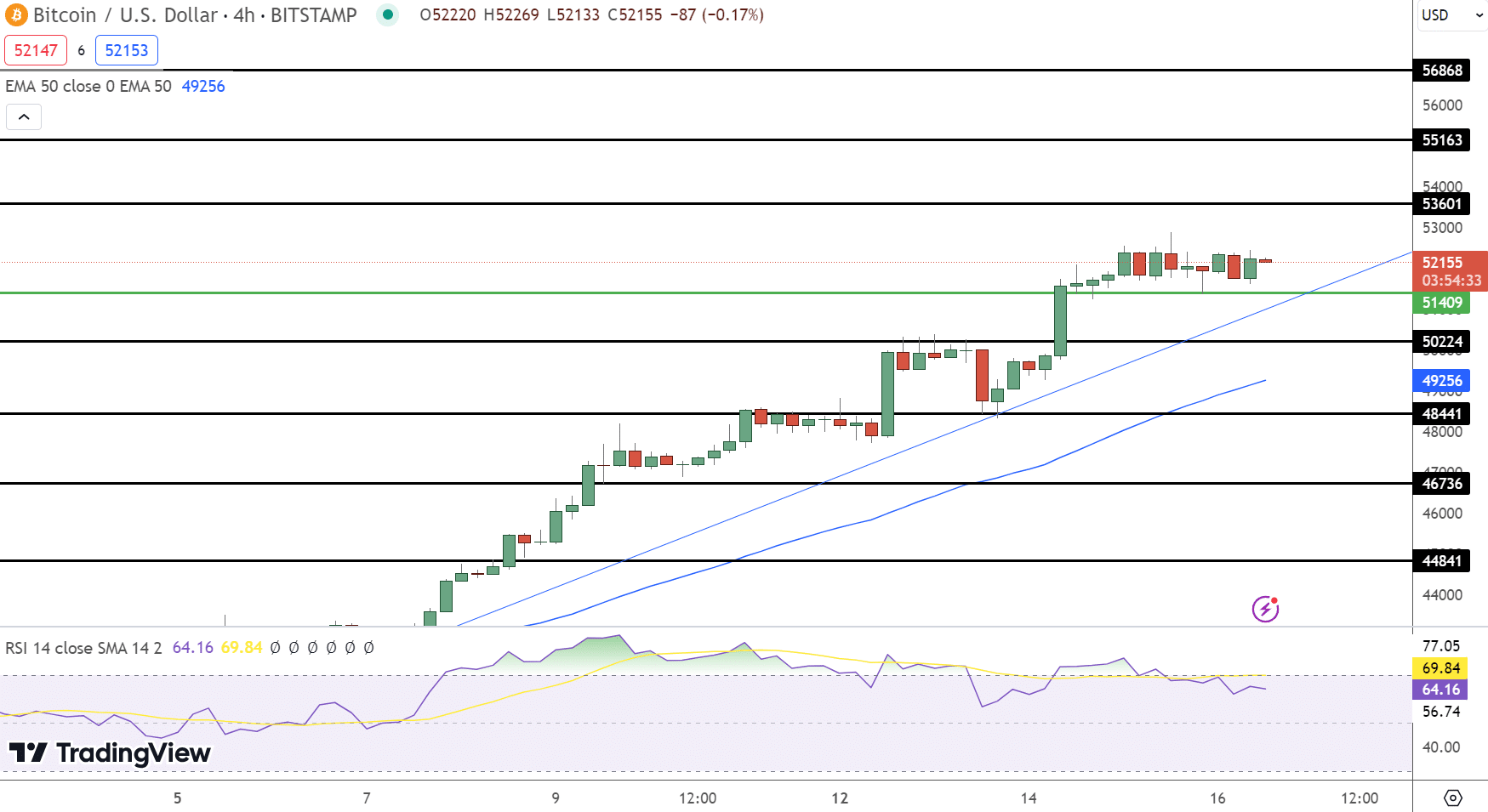

Technical evaluation finds severe levels for Bitcoin’s trajectory. The pivot level at $51,409 serves as a foundation for its most standard balance.

Resistance levels at $53,601, $55,163, and $56,863 account for doable hurdles for upward circulate. Conversely, give a enhance to at $50,224, $Forty eight,441, and $46,736 provides security nets against label declines.

The Relative Strength Index (RSI) at 64 indicators a nearing overbought situation, suggesting a cautious map for merchants. The 50-day Exponential Inviting Common (EMA) at $49,020 reinforces a bullish outlook, indicating sustained shopping stress.

Chart patterns, at the side of an upward trendline and a sideway trading channel, counsel a bullish momentum with Bitcoin’s label discovering give a enhance to end to the $51,800 level. The 50 EMA crossing end to $49,450 extra validates this certain pattern.

In conclusion, Bitcoin’s market pattern is bullish above the $51,410 pivot level, hinting at persevered recount doable.

Non permanent expectations lean in direction of checking out increased resistance levels, declaring the present optimistic market imagine. Investors and merchants must survey these key indicators and levels carefully, as they navigate Bitcoin’s dynamic market panorama.

High 15 Cryptocurrencies to Stumble on in 2023

No longer sleep-to-date with the sector of digital property by exploring our handpicked sequence of the supreme 15 replacement cryptocurrencies and ICO initiatives to withhold an gaze on in 2023. Our listing has been curated by professionals from Industry Focus on and Cryptonews, making certain knowledgeable advice and severe insights to your cryptocurrency investments.

Rob revenue of this chance to witness the skill of these digital property and withhold your self informed.

Source : cryptonews.com