Bitcoin Price Prediction: Hits $40,000 Amid ETF Moves & IRS Update

Bitcoin Impress Prediction: Hits $40,000 Amid ETF Moves & IRS Change

In a market teeming with job, Bitcoin’s most contemporary surge to $40,000, marking a practically 1% amplify on Thursday, has merchants and analysts revisiting their Bitcoin label predictions. This uptick comes amidst a flurry of worthy developments: Chinese merchants, spurred by stock market dynamics, are an increasing selection of taking part with Bitcoin despite its prohibited position in the nation.

In a parallel pattern, the IRS has revised the tax get questions pertaining to digital resources, signaling a shift in direction of greater regulatory clarity. Further adding to the ecosystem’s transparency, Arkham has published the onchain addresses associated with four main Bitcoin ETFs, a switch that would doubtlessly reshape investor sentiment and market dynamics.

Chinese Market Trends Power Bitcoin Engagement

Amidst the nation’s economic recession, an increasing selection of Chinese merchants are taking a ogle to cryptocurrencies, specifically Bitcoin, as a exact haven. Investors are getting access to cryptocurrencies via unconventional potential and working in a regulatory grey field as a outcomes of the stock and true property markets’ downturn. Folks are shopping and selling on net sites like OKX and Binance despite China’s prohibition on cryptocurrency shopping and selling and stringent cash circulation guidelines.

Taking revenue of Hong Kong’s more welcoming climate for cryptocurrencies, the Hong Kong branches of worthy Chinese financial establishments, equivalent to Financial institution of China and China Asset Management, are investigating ventures linked to cryptocurrencies.

Prognosis:Bruised by stock market, Chinese race into banned bitcoin https://t.co/Qcfje82xga pic.twitter.com/zPzTJXHiIa

— CNA (@ChannelNewsAsia) January 25, 2024

Which potential of economic uncertainty, more Chinese merchants are turning to digital resources like Bitcoin, seeing its capacity in the face of barriers in the usual market. This pattern might perchance seemingly get a fair appropriate invent on Bitcoin costs.

IRS Revises Digital Asset Stance in Tax Kinds

All United States taxpayers must yarn profits related to digital resources on their federal tax return for 2023 as a outcomes of updates and expansions made by the Inner Income Service (IRS) to the digital asset query on profits tax forms. The up so far query, which is now expose in four more tax forms, specializes in transactions that incorporate digital resources like stablecoins, cryptocurrencies, and non-fungible tokens (NFTs).

The extension of the digital asset inquiry to many tax forms—equivalent to firms, partnerships, estates, and trusts—highlights the IRS’s elevated emphasis on cryptocurrency tax compliance.

The IRS has issued a reminder that taxpayers must resolution a digital asset query on 2023 tax returns, as neatly as speak all digital asset related profits after they file their 2023 federal profits tax return. https://t.co/V5XJa4pWdp

— Forbes (@Forbes) January 24, 2024

Even whereas the news mostly impacts taxpayers’ reporting requirements, greater oversight and regulatory actions in the cryptocurrency industry might perchance seemingly get an affect on investor mood, market dynamics, and cryptocurrency costs.

Arkham Boosts Transparency with Bitcoin ETF Onchain Files

Four location Bitcoin replace-traded funds (ETFs) related to financial firms Blackrock, Constancy, Bitwise, and Franklin Templeton get been learned by Arkham Intelligence. With a highlight on blockchain intelligence, the firm has now known half of of the ETFs readily available in the US market.

The ETFs that get been known are the Bitwise BITB fund, the Franklin Templeton EZBC ETF, the Blackrock IBIT ETF, and Constancy’s Luminous Starting up set apart location Bitcoin ETF (FBTC). The disclosure improves market openness by offering lucid insights into fund holdings and actions.

Breaking: ETF addresses for Blackrock, Constancy, Bitwise, and Franklin Templeton are basically on Arkham.

Arkham has known the on-chain region of 4 of the Bitcoin ETFs. We’re the first to publicly title these addresses.

Links and holdings breakdown beneath: pic.twitter.com/gFJAIklwtc

— Arkham (@ArkhamIntel) January 22, 2024

A more clear bitcoin market is needed to fostering investor self assurance and drawing an authority participation. Though the news mainly impacts ETF transparency, it additionally benefits the integrity of the market as a total and can get an affect on investor mood and Bitcoin costs.

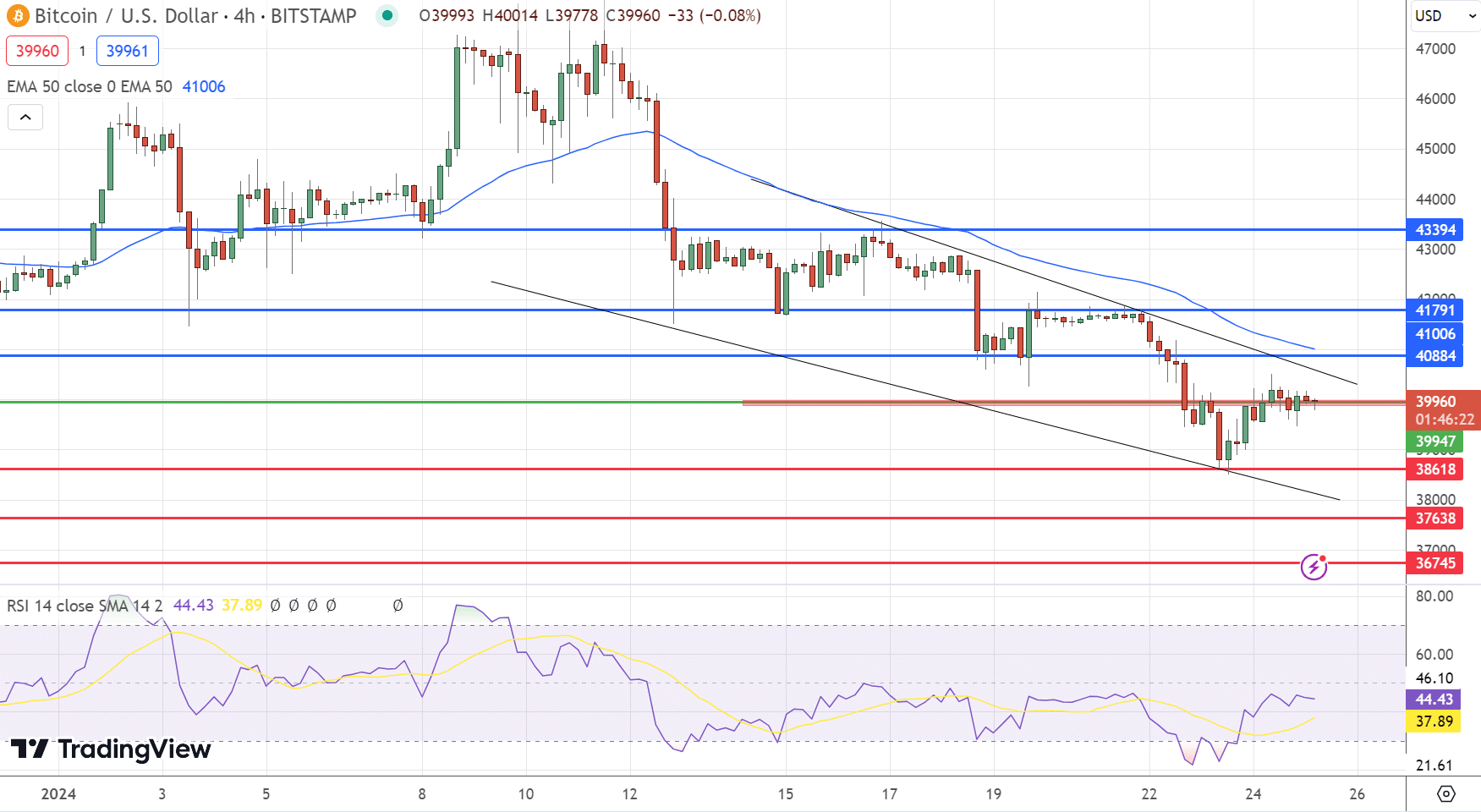

Bitcoin Impress Prediction

Top 15 Cryptocurrencies to Look in 2023

Personal up-to-date with the enviornment of digital resources by exploring our handpicked series of the appropriate 15 alternative cryptocurrencies and ICO initiatives to withhold an stare on in 2023. Our list has been curated by consultants from Industry Talk and Cryptonews, ensuring expert recommendation and serious insights for your cryptocurrency investments.

Take revenue of this opportunity to behold the functionality of these digital resources and abet yourself on the spot.

Disclaimer: Cryptocurrency initiatives on the spot in this article are no longer the financial recommendation of the publishing creator or e-newsletter – cryptocurrencies are highly unstable investments with appreciable possibility, continuously attain your individual analysis.

Source : cryptonews.com