Bitcoin Price Prediction: Dips to $43,000 as CBOE Pulls ETF Amid Economic Shift

Bitcoin Label Prediction: Dips to $43,000 as CBOE Pulls ETF Amid Economic Shift

In the dynamic world of cryptocurrencies, Bitcoin’s impress approaches the $43,000 threshold, marking a decline of over 1.25% on Wednesday. This adjustment in impress occurs towards the backdrop of mighty market and regulatory news.

The CBOE Exchange has retracted its utility for the Global X negate Bitcoin ETF, introducing uncertainty into the market. Concurrently, financial forecasts by analyst Richard Bove suggest China’s economy could rapidly outpace the United States, potentially altering the world monetary hierarchy and not easy the US buck’s supremacy because the reserve currency.

Additionally, US Handbook French Hill, talking on the FDD Match, highlighted a potentially supportive legislative future for digital currencies. These trends present extreme context for Bitcoin’s fresh valuation and offer insight into its future route.

CBOE Withdraws Global X Bitcoin ETF Application: Affect on Cryptocurrency

JUST IN:

Cboe alternate withdraws utility to list Global X negate Bitcoin ETF … pic.twitter.com/diEva5Xx6B

— Bitcoin Scoop (@bitcoin_scoop) January 30, 2024

This fashion follows the fresh acceptance of negate Bitcoin ETFs on US exchanges. The withdrawal has had cramped finish on the impress of Bitcoin, though it’s miles going to be the tip result of particular issues for Global X’s ETF.

The prevailing behold is that the introduction of Bitcoin ETFs has resulted in rising institutional hobby and attainable mainstream acceptance, which could finally contribute to an elevate within the impress of BTC.

Richard Bove Forecasts China’s Economy Overtaking the US: Implications for the Buck

The cautionary represent issued by Richard Bove concerning the depreciation of the US currency and the doable enlargement of China’s economy will seemingly be advantageous for Bitcoin (BTC).

Traders could behold for alternate stores of wealth as Bove highlights the probability posed by the outsourcing of American manufacturing and the depreciation of the buck’s standing because the reserve currency.

Known as “digital gold,” Bitcoin has been positioned as a hedge towards currency devaluation and financial instability.

Traders could see to safeguard their capital by utilizing decentralized sources luxuriate in Bitcoin all the procedure via sessions of commercial and geopolitical upheaval.

Well-liked monetary analyst Richard X. Bove predicts the autumn of the US economy and says China will snatch over because the cash superpower in his final forecast old to his retirement: ‘The buck is completed because the world’s reserve currency’ https://t.co/3DcIFF71gb pic.twitter.com/tC5YqfWVKn

— Day-to-day Mail Online (@MailOnline) January 29, 2024

Bove’s remarks could per chance toughen a myth that encourages more folks to undertake and be drawn to Bitcoin as a competitive change for weak cash and sources.

US Earn French Hill Optimistic on Crypto Legislation: Insights from FDD Match

All over a Foundation for Defense of Democracies event, Republican advisor from Arkansas, Earn. French Hill, gave a legitimate update on the distance of measures referring to cryptocurrency.

Hill, the head of the House Financial Services and products Subcommittee on Digital Resources, voiced hope for the Clarity for Payment Stablecoins Act and the Financial Innovation and Expertise for the Twenty first Century Act.

Chair of digital sources subcommittee hopes to leer crypto payments ’coming to fruition’ in 2024

Speaking at an event hosted by the Foundation for Defense of Democracies (#FDD) on Jan. 29, Handbook Hill acknowledged U.S. lawmakers within the House of Representatives had marked up two payments… pic.twitter.com/zNKU6BG37U

— TOBTC (@_TOBTC) January 30, 2024

In 2023, both proposals made progress after leaving the House Financial Services and products Committee. A regulatory framework for stablecoins is intended to be established by the Clarity for Payment Stablecoins Act, whereas the cryptocurrency market structure is addressed by the more total Financial Innovation and Expertise for the Twenty first Century Act.

Elevated regulatory readability brought forth by changes in crypto regulations could affect uptake and mood, which could per chance have a honest correct indirect finish on Bitcoin values.

Bitcoin Label Prediction

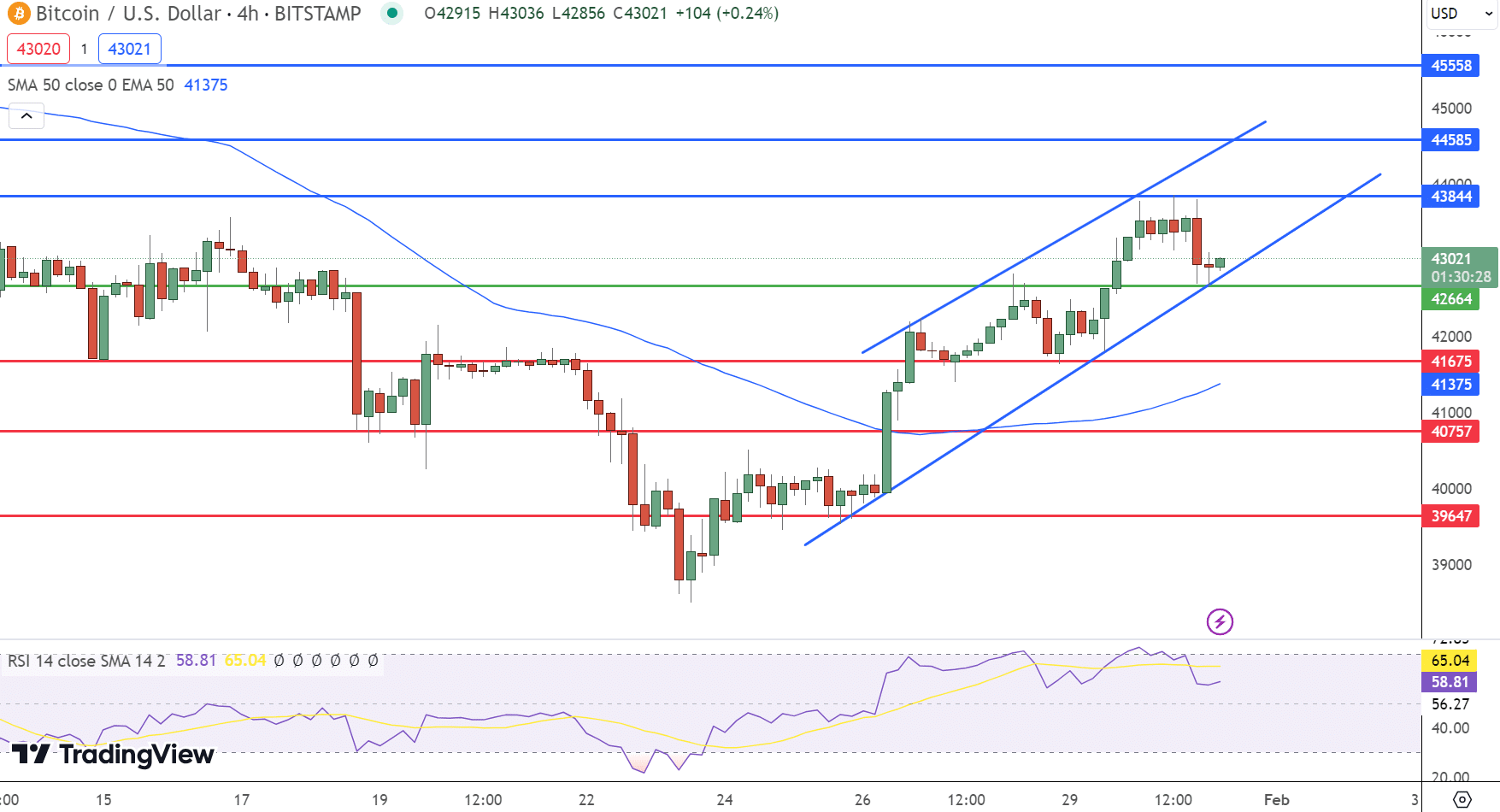

On January 31, Bitcoin reveals marginal trek, trading at $42,923 with a pivot level of $42,664. Immediate resistance ranges are identified at $43,844, $44,585, and $45,558, which would possibly support as ceilings for any upward momentum.

Conversely, toughen ranges are established at $41,675, $40,757, and $39,647, offering attainable flooring for impress retracements.

Technical analysis reveals an upward channel formation, with Bitcoin’s fresh closure of a Doji candlestick correct above the pivot level indicating a attainable for getting hobby.

The probability of forming a morning star candlestick pattern extra bolsters the prospect of a bullish fashion.

With the Relative Power Index (RSI) at 58 and the 50-day Exponential Shifting Common (EMA) at $41,375, the technical indicators align with a cautiously optimistic outlook.

In conclusion, the general fashion for Bitcoin is bullish above the $42,664 level, suggesting that if prices sustain above this pivot, the market could glimpse extra shopping momentum.

High 15 Cryptocurrencies to See in 2023

Discontinuance wide awake-to-date with the world of digital sources by exploring our handpicked sequence of the very finest 15 change cryptocurrencies and ICO initiatives to protect an opinion on in 2023. Our list has been curated by mavens from Enterprise Discuss and Cryptonews, guaranteeing expert recommendation and extreme insights to your cryptocurrency investments.

Elevate honest correct thing about this opportunity to behold the attainable for these digital sources and retain your self suggested.

Disclaimer: Cryptocurrency initiatives endorsed listed listed below aren’t the monetary recommendation of the publishing author or e-newsletter – cryptocurrencies are highly volatile investments with appreciable probability, continuously attain your enjoy be taught.

Source : cryptonews.com