Bitcoin Price Prediction as 'Buy The Dip' Sentiment Floats It Above $43K – Can It Sustain the Momentum?

Bitcoin Designate Prediction as ‘Aquire The Dip’ Sentiment Floats It Above $43K – Can It Retain the Momentum?

Within the realm of Bitcoin imprint prediction, the premier digital forex just no longer too lengthy ago saw a dip below the $43,000 imprint, impacted by a downturn in the US stock market and Coinbase shares’ efficiency.

Despite these headwinds, Bitcoin demonstrated resilience, buoyed by a ‘buy the dip’ sentiment among customers, and managed to preserve above $42,000.

🚨 An sharp data for #Bitcoin bulls.

Bitcoin balance on exchanges is on the lowest level (yellow) despite #BTC procuring and selling above 42K.

Why ⁉️

Whales storing their BTC in chilly wallets and looking forward to hire imprint in future with #ETFs on hand.

I myself procure no longer trust #BTC will procure… pic.twitter.com/7QMtkeWcH9

— Zia ul Haque (@ImZiaulHaque) February 6, 2024

This steadiness persists despite rising US Treasury bond yields and comments from Federal Reserve Chair Jerome Powell, which moderated expectations for a March rate decrease.

Amid these economic indicators, influential figures admire Cathie Wood offer their outlook on Bitcoin, whereas regulatory changes in Hong Kong signal probably shifts in the cryptocurrency’s valuation and market dynamics.

Cathie Wood’s Outlook on Bitcoin

Cathie Wood, CEO of ARK Make investments, believes Bitcoin may well change into more precious than gold. She sees it as “digital gold” because it’s viewed as a safe dwelling to put cash at some stage in unsure times.

In a most up-to-date interview, Wood and ARK’s Brett Winton talked about how Bitcoin has been doing better than gold no longer too lengthy ago, in particular at some stage in tense economic times.

Even when other investments were struggling, Bitcoin went up by 40% at some stage in a regional monetary institution crisis in March 2023.

Despite a momentary fall in Bitcoin’s imprint after ETF approval, Wood thinks this would well possibly preserve growing, in particular as more of us can invest through Build Bitcoin ETFs, which may possibly well well attract substantial customers.

CRYPTO BREAKING NEWS

ARK Make investments CEO Cathie Wood Believes Bitcoin Will Overtake Gold, Here’s Why. ARK Make investments Chief Executive Officer (CEO) and Chief Files Officer (CIO) Cathie Wood, has expressed her optimism about Bitcoin’s capabilities … test us out @… pic.twitter.com/H3cfpyhNTK— InnovatekMobile (@Neome_com) February 6, 2024

Cathie Wood’s constructive outlook on Bitcoin as ‘digital gold’ and its ability to preserve stable at some stage in crises may well make customers more confident.

This is able to well possibly consequence in the imprint of Bitcoin going up, even supposing there are united states of americaand downs in the short term.

Hong Kong’s Crypto Regulation Impact on BTC Designate

Hong Kong’s monetary regulator, the Securities and Futures Payment (SFC), wants all crypto exchanges to procure a license by February 29 or face closure by Would possibly possibly possibly well 31. This follows a world development of stricter guidelines for cryptocurrencies.

The SFC advises of us to make employ of licensed platforms. Handiest two, HashKey and OSL, absorb licenses, whereas 14 others, admire Bybit and OKX, are ready.

Hong Kong wants to preserve watch over crypto however peaceable be friendly to it. They are also eager about making it more straightforward to approve Bitcoin ETFs.

Harvest Fund Hong Kong has already utilized. This reveals Hong Kong wants to be a major assign of abode for digital assets in Asia-Pacific.

HONG KONG REGULATOR WARNS CRYPTO EXCHANGES TO GET LICENSE

Hong Kong’s Securities and Futures Payment (SFC) has issued a warning to crypto exchanges, instructing them to post a license application by February 29 or terminate operations in the assign by the live of Would possibly possibly possibly well.

Source:… pic.twitter.com/wlzsrm5H2y

— Crypto Metropolis Corridor (@Crypto_TownHall) February 6, 2024

Therefore, the decrease-off date for crypto commerce licenses in Hong Kong may well procure some uncertainty at the initiating. Nonetheless, it reveals that regulators are starting to acquire and preserve an eye on cryptocurrencies more significantly.

This is able to well possibly come what may make Bitcoin more legit and stable in the lengthy shuffle, which may possibly well well positively impact its imprint.

Bitcoin Designate Prediction

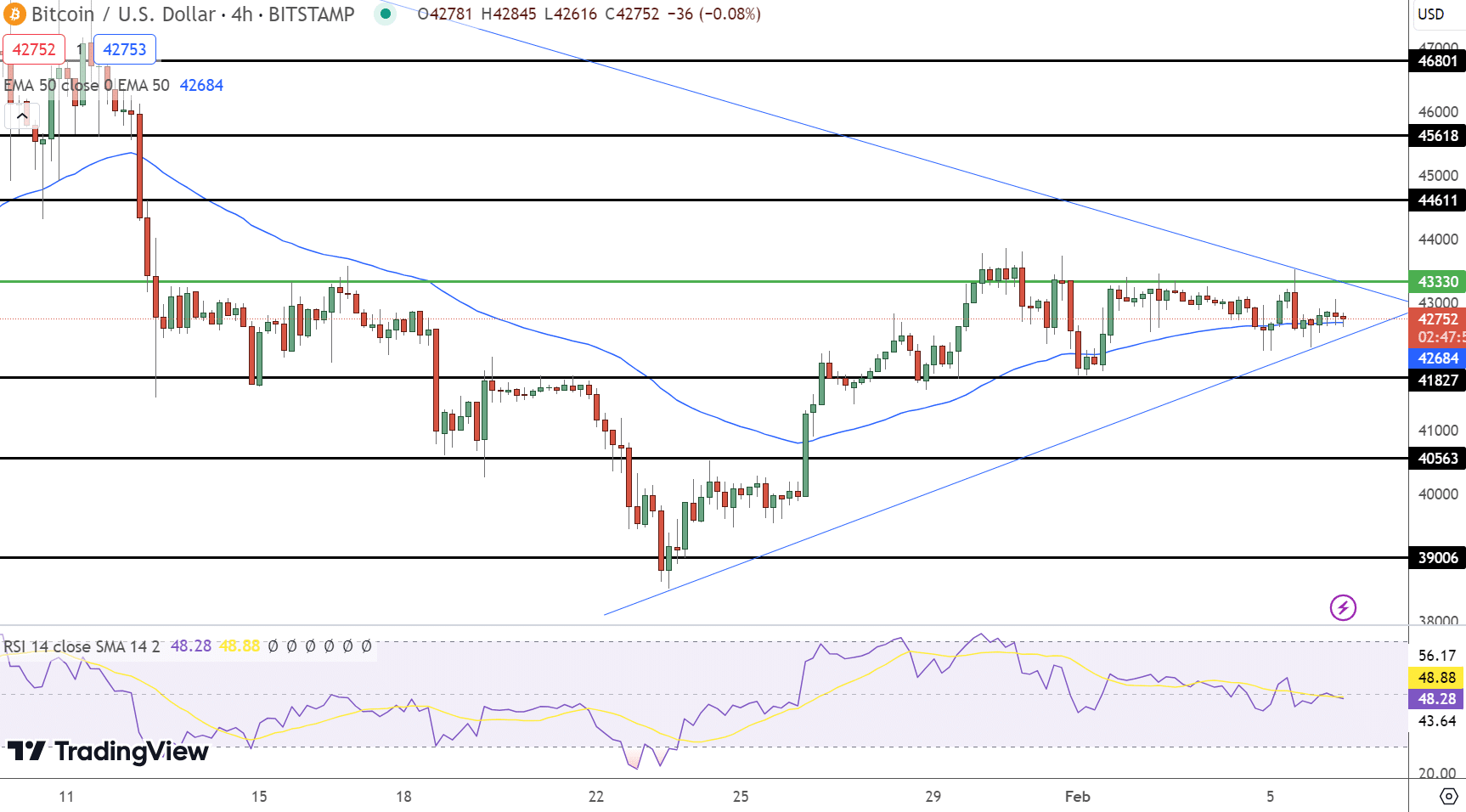

As of February 6, Bitcoin hovers across the $43,000 imprint, underscoring a pivotal moment as mirrored in the 4-hour chart diagnosis. The pivot level, dwelling at $42,208, serves as a barometer for rapid market direction.

The cryptocurrency faces resistance at $42,895, $43,704, and $44,727, marking thresholds that will well well venture bullish advances. In inequity, improve phases established at $41,444, $40,532, and $39,541 provide a buffer in opposition to imprint dips.

Technical diagnosis yields a nuanced perspective. The Relative Strength Index (RSI), at 47, signifies a balanced market dynamic, neither overbought nor oversold.

Bitcoin’s imprint motion is extra delineated by the Transferring Moderate Convergence Divergence (MACD), which, at a price of -37 below the signal line’s -31, subtly hints at bearish strain.

Meanwhile, the 50-day Exponential Transferring Moderate (EMA) at $42,895 emerges as a serious resistance zone, suggesting a battleground for bullish persistence.

For the time being, Bitcoin’s imprint task, navigating the fluctuate between $43,000 and $42,000, indicators a market exercising warning. The final sentiment tilts in direction of optimism above the $42,200 pivot, implying a probably uplift must peaceable Bitcoin abet or exceed this diploma.

High 15 Cryptocurrencies to Survey in 2023

Now no longer sleep-to-date with the enviornment of digital assets by exploring our handpicked assortment of basically top-of-the-line 15 replacement cryptocurrencies and ICO tasks to abet an thought on in 2023. Our list has been curated by professionals from Replace Discuss and Cryptonews, guaranteeing expert advice and serious insights for your cryptocurrency investments.

Rob advantage of this likelihood to scrutinize the likelihood of these digital assets and preserve your self informed.

Disclaimer: Cryptocurrency tasks endorsed on this text are no longer the monetary advice of the publishing creator or e-newsletter – cryptocurrencies are extremely unstable investments with appreciable possibility, constantly procure your absorb learn.

Source : cryptonews.com