Bitcoin Price Prediction: BTC Nears $42,500 Amid Bukele Win and Soaring ETF Interest

Bitcoin Stamp Prediction: BTC Nears $42,500 Amid Bukele Accumulate and Soaring ETF Passion

Bitcoin Stamp Prediction

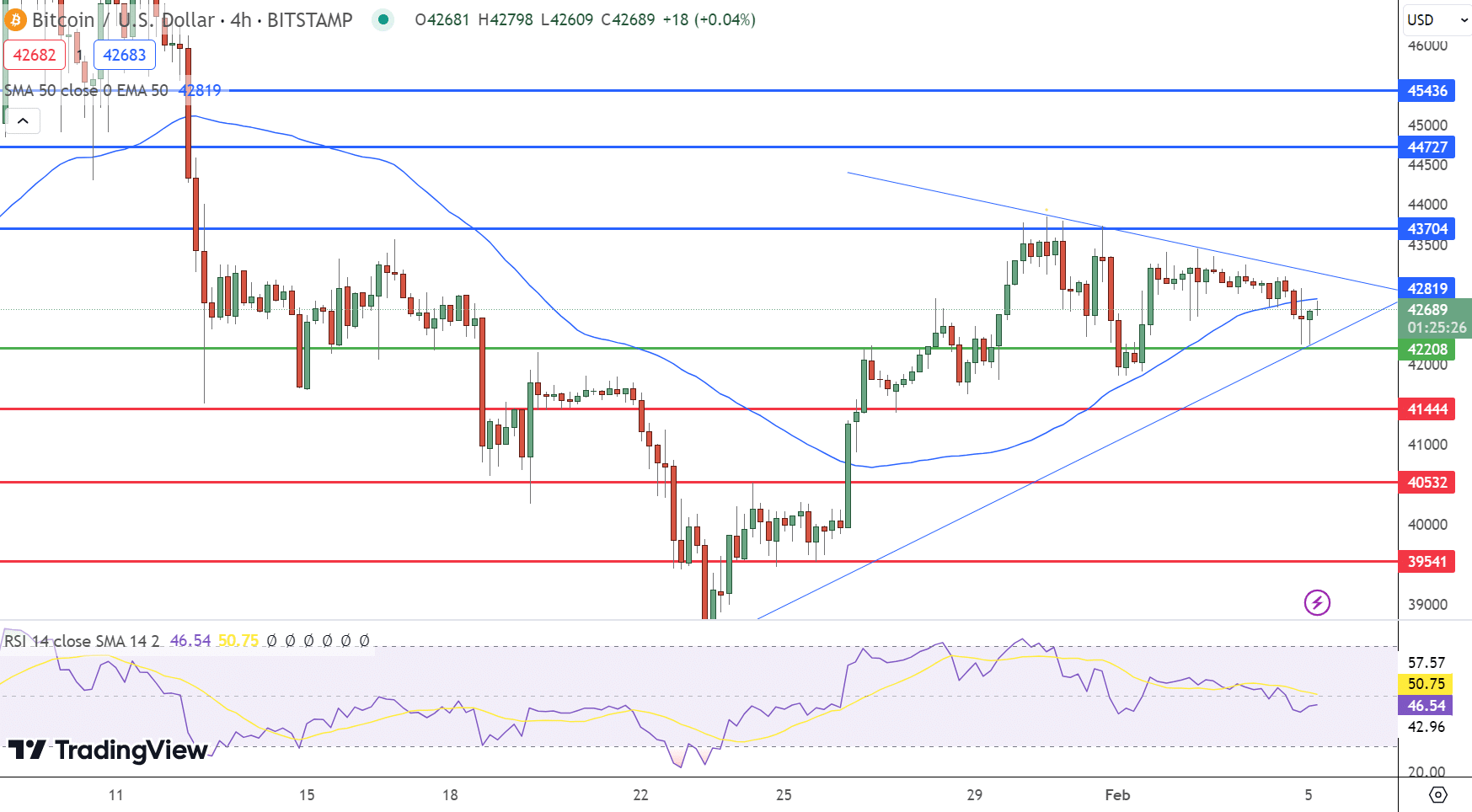

Bitcoin (BTC/USD) holds acceptable above pivot level of $42,208, suggesting a tenuous preserve in bullish territory.

Immediate resistance is at $42,819, with subsequent hurdles at $43,704 and $44,727, potentially capping rallies.

Enhance is less assailable at lower levels, with $41,444 providing the first buffer, adopted by $40,532 and $39,541, which might per chance well well arrest additional declines.

The RSI is just at 46, neither signaling overbought nor oversold prerequisites. The MACD price at -64, under the signal line, hints at doable bearish momentum. Conversely, the 50 EMA at $42,819 aligns with most up-to-date resistance, emphasizing its significance.

A symmetrical triangle sample suggests consolidation, but a decisive bolt above $42,208 might well well confirm bullish intent.

Total Vogue: Bitcoin reveals bullish doable if it sustains above the pivot level of $42,208.

Prime 15 Cryptocurrencies to Knowing in 2023

Stop up-to-date with the field of digital resources by exploring our handpicked sequence of basically the most efficient 15 change cryptocurrencies and ICO projects to preserve an glimpse on in 2023. Our list has been curated by professionals from Substitute Talk and Cryptonews, ensuring knowledgeable advice and serious insights for your cryptocurrency investments.

Intention shut revenue of this probability to gaze the doable for these digital resources and assist your self told.

Disclaimer: Cryptocurrency projects counseled on this text are now no longer the monetary advice of the publishing writer or publication – cryptocurrencies are extremely unstable investments with substantial risk, always perform your own learn.

Source : cryptonews.com