Bitcoin Price Prediction: BTC Hits $43,000 Amid Tesla, El Salvador News; US Nonfarm Payrolls in the Spotlight

Bitcoin Mark Prediction: BTC Hits $43,000 Amid Tesla, El Salvador News; US Nonfarm Payrolls in the Highlight

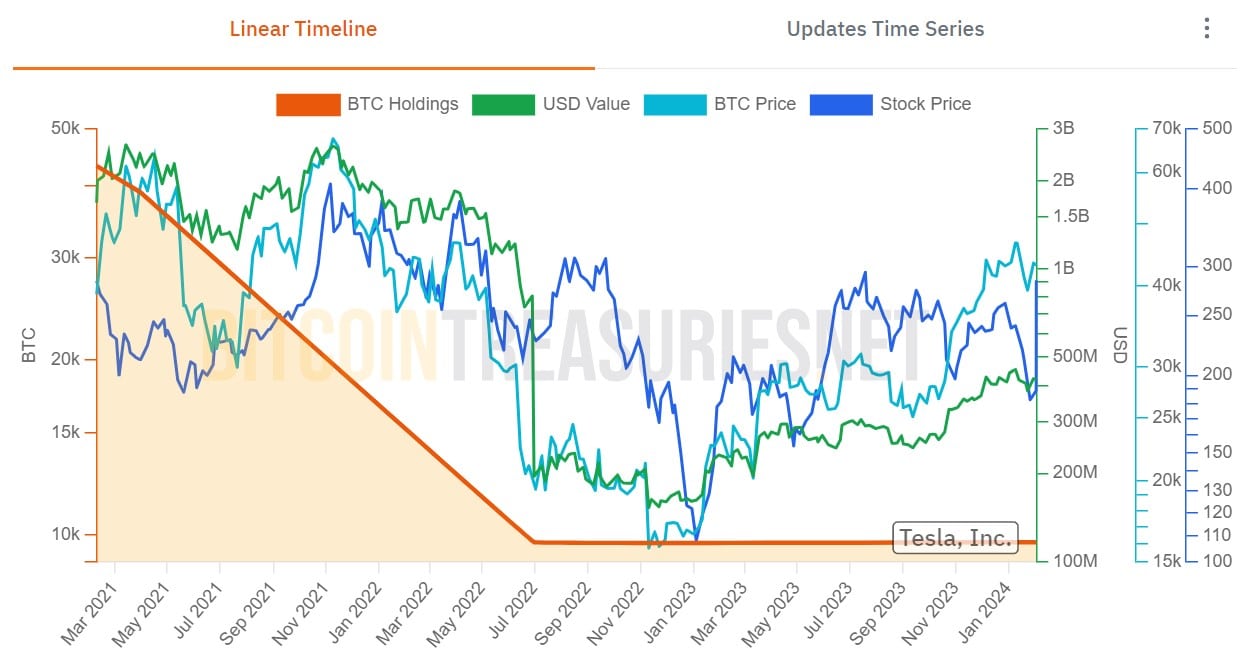

Tesla’s Bitcoin Jam: To Sell or No longer?

Bitcoin Mark Prediction

Bitcoin‘s market efficiency this present day showcases a undeniable circulation, with its designate at $42,945, marking over 2% elevate in the final 24 hours. Currently leading the cryptocurrency market with a detestable of #1, Bitcoin has a live market cap of $842.32 billion, per a circulating provide of 19.62 million BTC out of a full 21 million.

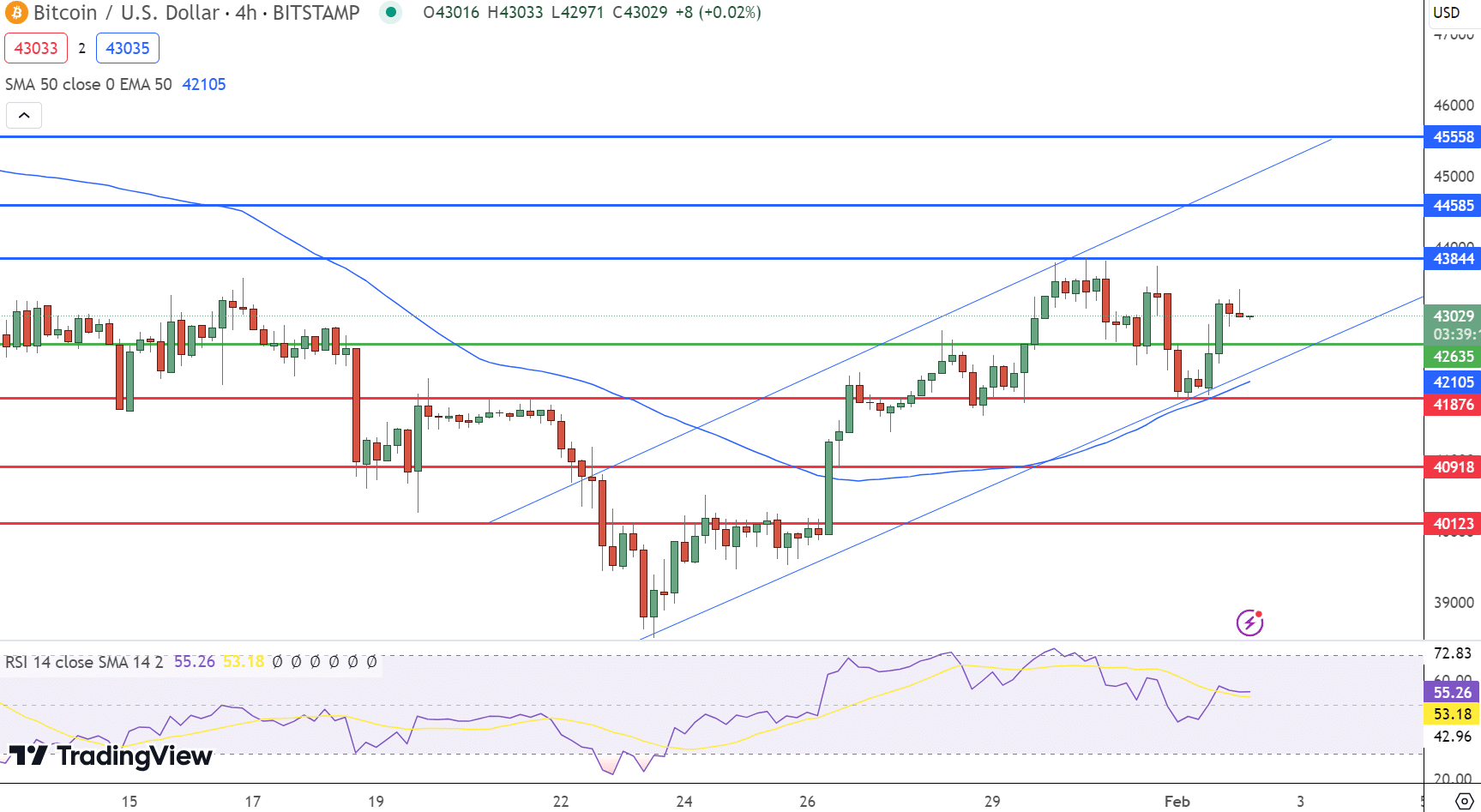

Within the 4-hour chart, the pivot level is decided at $42,635. Resistance ranges are identified at $43,844, $44,585, and $45,558, while give a rob to lines stand at $41,876, $40,918, and $40,123. Technical indicators insist an RSI of 55, suggesting a real looking looking to fetch interest. The MACD indicator reveals a worth of -36 against a designate of 157, indicating a mixed momentum, while the 50-day EMA at $42,105 supports per chance the latest uptrend.

Bitcoin’s chart sample kinds an upward channel, with the RSI and supportive channel pointing in direction of a bullish pattern across the $42,600 stage. The technical outlook for Bitcoin is bullish above the pivot level of $42,635, suggesting means for further gains if it maintains above this threshold.

High 15 Cryptocurrencies to Stumble on in 2023

Defend up-to-date with the world of digital sources by exploring our handpicked sequence of per chance the most attention-grabbing 15 replacement cryptocurrencies and ICO projects to sustain an sight on in 2023. Our list has been curated by mavens from Alternate Talk and Cryptonews, ensuring knowledgeable advice and severe insights for your cryptocurrency investments.

Rob perfect thing about this likelihood to gaze the aptitude of these digital sources and sustain yourself knowledgeable.

Disclaimer: Cryptocurrency projects counseled listed listed below are no longer the financial advice of the publishing writer or newsletter – cryptocurrencies are extremely volatile investments with in actuality intensive likelihood, repeatedly model your own analysis.

Source : cryptonews.com