Bitcoin Price Prediction as BTC Eyes Surpassing Meta in Total Market Cap – $1 Million BTC Incoming?

Bitcoin Mark Prediction as BTC Eyes Surpassing Meta in Complete Market Cap – $1 Million BTC Incoming?

As of Wednesday, Bitcoin’s shopping and selling imprint quite of declined to $49,540, marking decrease than 1% decrease. This fluctuation comes amidst a backdrop of mighty trends within the crypto residence and broader monetary markets. Notably, contemporary experiences from the Monetary Crimes Enforcement Community (FinCEN) highlight the challenges of cryptocurrency misuse in illegal actions, casting a shadow over Bitcoin’s broader acceptance.

Concurrently, elevated crypto income from platforms adore Robinhood alerts increasing market enthusiasm, doubtlessly buoying Coinbase’s drawing shut earnings. Amid these contrasting dynamics, Bitcoin imprint predictions change into extra and further complex, balancing optimism with regulatory and moral issues.

This intricate interplay between market optimism and regulatory scrutiny shapes the landscape for Bitcoin’s future valuation and its feature in the digital financial system.

FinCEN Document: Bitcoin Linked to Little one Exploitation, Human Trafficking

The U.S. Treasury’s Monetary Crimes Enforcement Community (FinCEN) printed an uptick in cryptocurrency employ, in particular Bitcoin, for illicit actions similar to child sex trafficking and human trafficking. Between 2020 and 2021, monetary establishments reported 2,311 instances spirited cryptocurrencies in these crimes, totaling spherical $412 million.

The bulk of those instances eager the synthetic of cryptocurrency for materials related to child sexual abuse, usually facilitated via darknet markets and cryptocurrency kiosks.

A U.S. monetary watchdog has flagged the employ of bitcoin in human trafficking and child exploitation. Primarily the most common @FinCENnews yarn notorious that crypto become usually feeble to “despicably exploit adults and formative years for monetary form.”@jesseahamilton reportshttps://t.co/guKL13M4ln

— CoinDesk (@CoinDesk) February 13, 2024

Even when monetary establishments savor grown extra vigilant, the continual topic of curbing such illegal actions underscores the complexities within the cryptocurrency market, doubtlessly impacting Bitcoin’s repute and drawing regulatory scrutiny.

Robinhood’s Crypto Income Boost Signals Upside for Coinbase Earnings

Robinhood witnessed a 10% amplify in cryptocurrency income in the fourth quarter, reaching $43 million because of heightened shopping and selling assignment. This surge aligns with market optimism and the increasing acceptance of Bitcoin situation ETFs in the U.S., driving an 8% upward push in transaction-primarily based revenues.

This efficiency suggests a promising outlook for Coinbase’s upcoming earnings, given its the same dependence on shopping and selling volumes. Having a study ahead to 2024, Robinhood aims to achieve better its market piece and race world, with CEO Vlad Tenev reporting exceptional first-quarter say that exceeded expectations and resulted in a 15% amplify in piece imprint, despite regulatory hurdles.

[COINDESK] Robinhood’s Elevated Crypto Income Could be Sure for Coinbase Earnings$HOOD $COIN

— BecauseBitcoin.com (@BecauseBitcoin) February 14, 2024

This pattern means that elevated cryptocurrency shopping and selling on platforms adore Robinhood might maybe possibly maybe additionally vastly impact the Bitcoin market, bettering substitute volume and investor sentiment.

Coinbase and Ledger Partnership Simplifies Crypto Purchases

Coinbase and Ledger’s collaboration streamlines the cryptocurrency shopping and transferring route of, integrating Ledger Stay with Coinbase Pay for seamless asset motion straight to Ledger units.

This initiative reduces errors by eliminating the complex steps of transferring sources from exchanges to self-custody wallets. Ledger’s Chief Trip Officer, Ian Rogers, likens this integration to Skyscanner’s revolution in reserving mosey, aiming to back self-custody accessibility for learners to the crypto sphere.

Ledger to simplify crypto purchases with Coinbase integration https://t.co/9cRY1k65We

— James Rule XRP 👊😎 (@RuleXRP) February 13, 2024

Following the beginning of situation Bitcoin ETFs, Ledger’s plan is to stress self-custody as the essence of cryptocurrency possession, doubtlessly boosting the market as investors seek catch storage choices for their digital sources.

NZ Central Monetary institution Chief Critiques Money Printing, Stirs Bitcoin Community

Adrian Orr, Governor of the Fresh Zealand Reserve Monetary institution, humorously critiqued the essence of central banking alongside with his commentary, “It’s a huge industry to be in, where you print money and other folks trust it,” all the tactic via a parliamentary committee assembly on February 12.

Bitcoin enthusiasts, appreciating Orr’s candidness, savor ignited discussions spherical his comments. Advocates argue that Bitcoin’s decentralized nature offers a viable different to politically managed money, highlighting issues over central bank digital currencies (CBDCs) doubtlessly ensuing in greater centralization and lowered monetary freedom.

“It be a huge industry to be in, Central Banking, where you print money and other folks trust it” – Adrian Orr, Governor Reserve Monetary institution of NZ

He says this whereas the say imposes valid refined regulations, and myriad banking and AML regulations. “Belief”? or coercion?pic.twitter.com/J68QrTuLzK

— Stephan Livera (@stephanlivera) February 13, 2024

Orr expressed skepticism in direction of decentralized currencies, citing an absence of intrinsic monetary properties. This debate underscores ongoing discourse on the advance forward for money and the disruptive likely of cryptocurrencies in opposition to feeble banking gadgets.

Bitcoin Mark Prediction

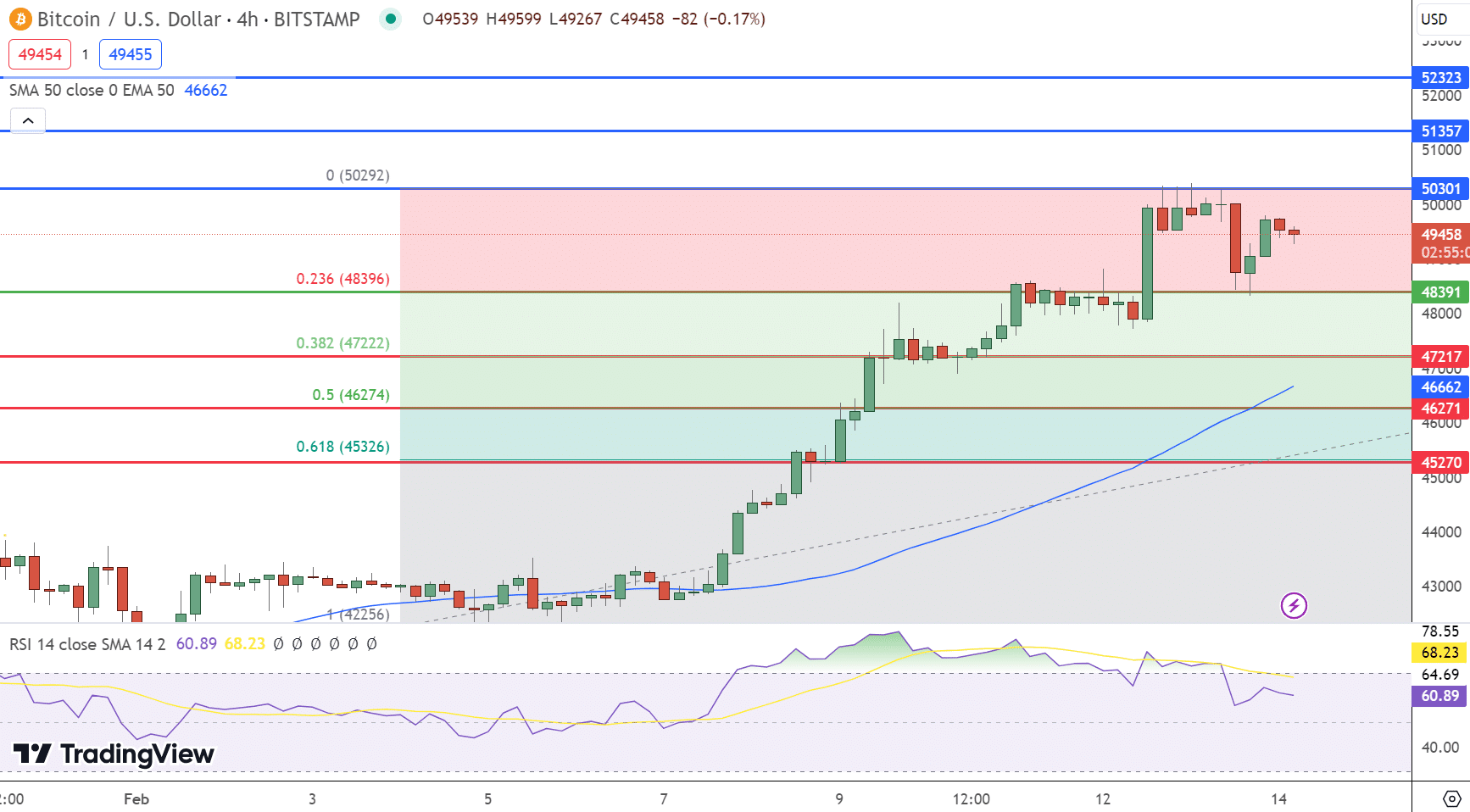

On February 14, Bitcoin (BTC) is positioned above its pivot point of $48,391, suggesting a doable for bullish momentum if it maintains above this degree. Key resistance aspects are identified at $50,301, $51,357, and $52,323, which Bitcoin wishes to surpass to verify extra upward trends. Conversely, back phases are attach at $47,217, $46,271, and $Forty five,270, extreme for buffering any downward shifts.

Technical indicators say a Relative Strength Index (RSI) of 60, indicating a a tiny bit bullish sentiment without venturing into overbought territory. The 50-day Exponential Inspiring Practical (EMA) stands at $46,662, extra supporting the bullish outlook.

Moreover, Bitcoin’s steadiness above the 23.6% Fibonacci retracement degree shut to $48,400 suggests shopping curiosity at and above this threshold. Given these components, the total pattern for Bitcoin appears to be like bullish above $48,391, pointing in direction of a definite market disposition.

Top 15 Cryptocurrencies to Peep in 2023

Stop conscious-to-date with the sector of digital sources by exploring our handpicked sequence of the finest 15 different cryptocurrencies and ICO initiatives to back an inquire on in 2023. Our checklist has been curated by experts from Industry Direct and Cryptonews, guaranteeing expert advice and extreme insights to your cryptocurrency investments.

Take profit of this different to hunt the probability of those digital sources and back your self advised.

Disclaimer: Crypto is a high-threat asset class. This article is equipped for informational capabilities and does no longer constitute investment advice. You might maybe possibly maybe lose your complete capital.

Source : cryptonews.com