Bitcoin Price Prediction as BTC Consolidates at $62,000, Making 99% of Addresses Profitable – What's Next?

Bitcoin Price Prediction as BTC Consolidates at $62,000, Making ninety 9% of Addresses Successful – What’s Next?

As Bitcoin (BTC/USD) hovers above the $62,000 tag, exhibiting a 1.50% expand on Saturday, the cryptocurrency landscape is abuzz with anticipation.

This pivotal moment makes ninety 9% of Bitcoin addresses worthwhile, sparking a debate on the long experience trajectory of this digital asset.

Analysts, collectively with the neatly-known PlanB, counsel we’re on the cusp of a bull market, predicting a 10-month duration of explosive boost pushed by intense FOMO and bolstered by fresh trends such as the approval of role Bitcoin ETFs.

With predictions inserting Bitcoin’s label between $100,000 and $120,000 by Q4 2024, investors are keenly searching forward to signals in this consolidating market.

Bitcoin Bull Market Ignites: PlanB Predicts 10 Months of Explosive Increase

Bitcoin analyst PlanB forecasts a bullish market, projecting a 10-month surge fueled by intense FOMO. Per PlanB, the cease of accumulation signifies prime market entry, aligning with historical trends following Bitcoin’s halving events.

Cosmic Force feed: Bitcoin analyst PlanB predicts 10 months of ‘face melting fomo’ https://t.co/Fk6o2rmyEm https://t.co/QDsS9aHx9D pic.twitter.com/PEhXBKaIcZ

— Cosmic Force 🎮 Crypto Gold Shuffle ⛏ (@WavemStudios) March 1, 2024

Despite fresh dips, the approval of role Bitcoin ETFs has bolstered investor self assurance, contributing to a 22% label expand over the final week.

Key Highlights:

- 10-month bull market predicted by PlanB

- Situation Bitcoin ETF approvals enhance investor interest

- Bitcoin’s label might perhaps perhaps well attain $120,000 by Q4 2024

The transition of Grayscale’s ETF and the expected influx from passive ETF demand might perhaps perhaps well propel Bitcoin against file highs, with projections between $100,000 to $120,000 by the cease of 2024 and a peak market cap anticipated by 2025.

US Vitality Officials and Crypto Miners Attain Settlement to Scrap Mining Witness Knowledge

In a pivotal switch, US vitality authorities, alongside the Texas Blockchain Council (TBC) and Revolt Platforms, a valuable Bitcoin mining entity, fetch agreed to cease a controversial survey concentrating on cryptocurrency mining operations.

The choice, geared toward addressing issues over the survey’s intrusiveness and attainable financial and innovative repercussions, ends in the deletion of all beforehand silent info.

This resolution averts additional upright disputes by lifting the duration in-between restraining advise and eases the crypto mining neighborhood’s worries about compliance expenses and privacy breaches.

The EIA settled its lawsuit with the Texas Blockchain Council and Revolt Platforms, agreeing no longer to make utilize of any info from the emergency survey on crypto miners, or any future data from it. https://t.co/AYq4Etbs2W

— Cointelegraph (@Cointelegraph) March 2, 2024

Despite the shelving of the survey, the Vitality Knowledge Administration (EIA) retains the likelihood to survey public feedback on revising survey parameters.

This settlement marks a predominant moment for the US cryptocurrency mining sector, illustrating its capacity to barter regulatory challenges while safeguarding its interests, potentially fostering a more stable ambiance for the industry’s future endeavors.

Michael Saylor’s Dauntless Bitcoin Wager Will pay Off with $1.2 Billion Originate

Michael Saylor of MicroStrategy has made a whopping $1.2 billion in pretty three days, attributable to a Bitcoin label surge. Steering MicroStrategy against turning correct into a leading Bitcoin investor, Saylor’s strategy of buying 193,000 Bitcoins since 2020 has paid off handsomely.

MicroStrategy’s Michael Saylor Made $1.2 Billion In 3 Days Following Bitcoin Increase #crypto #cryptocurrency https://t.co/k8XbLfvTVZ

— Crypto News 🌐⚡ (@CryptoAdHocNews) March 2, 2024

The fresh expand in Bitcoin’s cost to $63,918 no longer simplest doubled his preliminary investment however also resulted in a 55% soar in MicroStrategy’s stock cost.

Saylor’s total resources fetch now soared beyond $3.75 billion, reinforcing his self assurance in Bitcoin’s monetary promise.

Key Aspects:

- Saylor’s $1.2 billion abolish from Bitcoin

- MicroStrategy holds 193,000 Bitcoins

- Entire resources exceed $3.75 billion

US Crypto Regulation Jam: Innovation Stifled in Regulatory Quagmire

The fresh US cryptocurrency regulatory framework offers a paradox, embodying a Accumulate-22 where compliance becomes a convoluted assignment attributable to conflicting guidelines.

SEC Chair Gary Gensler’s push for crypto entities to register is hampered by the scarcity of licensed exchanges, limiting trading alternatives for registered coins.

Cosmic Force feed: The Accumulate-22 of U.S. Crypto Regulation https://t.co/4hDkX45yXf https://t.co/QhvW3zK6Bq pic.twitter.com/C9fZ4TWzy7

— Cosmic Force 🎮 Crypto Gold Shuffle ⛏ (@WavemStudios) March 1, 2024

Fintech firms face the same hurdles, reliant on banking partnerships for cost system gather entry to, your whole while navigating stringent regulatory oversight. This lack of a federal licensing framework curtails innovation, despite direct regulations offering some reduction.

Key Level:

- Conflicting guidelines originate compliance challenges.

- Lack of authorized exchanges restricts trading alternatives.

- Federal licensing absence hinders innovation.

- Congressional intervention wanted for obvious regulatory frameworks.

Congressional motion is crucial to craft obvious, supportive regulations for fintech and crypto, making sure their boost and competitive edge in the realm market.

Without resolution, the US risks lagging in cryptocurrency construction, potentially impacting Bitcoin’s cost amid regulatory ambiguities and restricted trading avenues.

Bitcoin Price Prediction

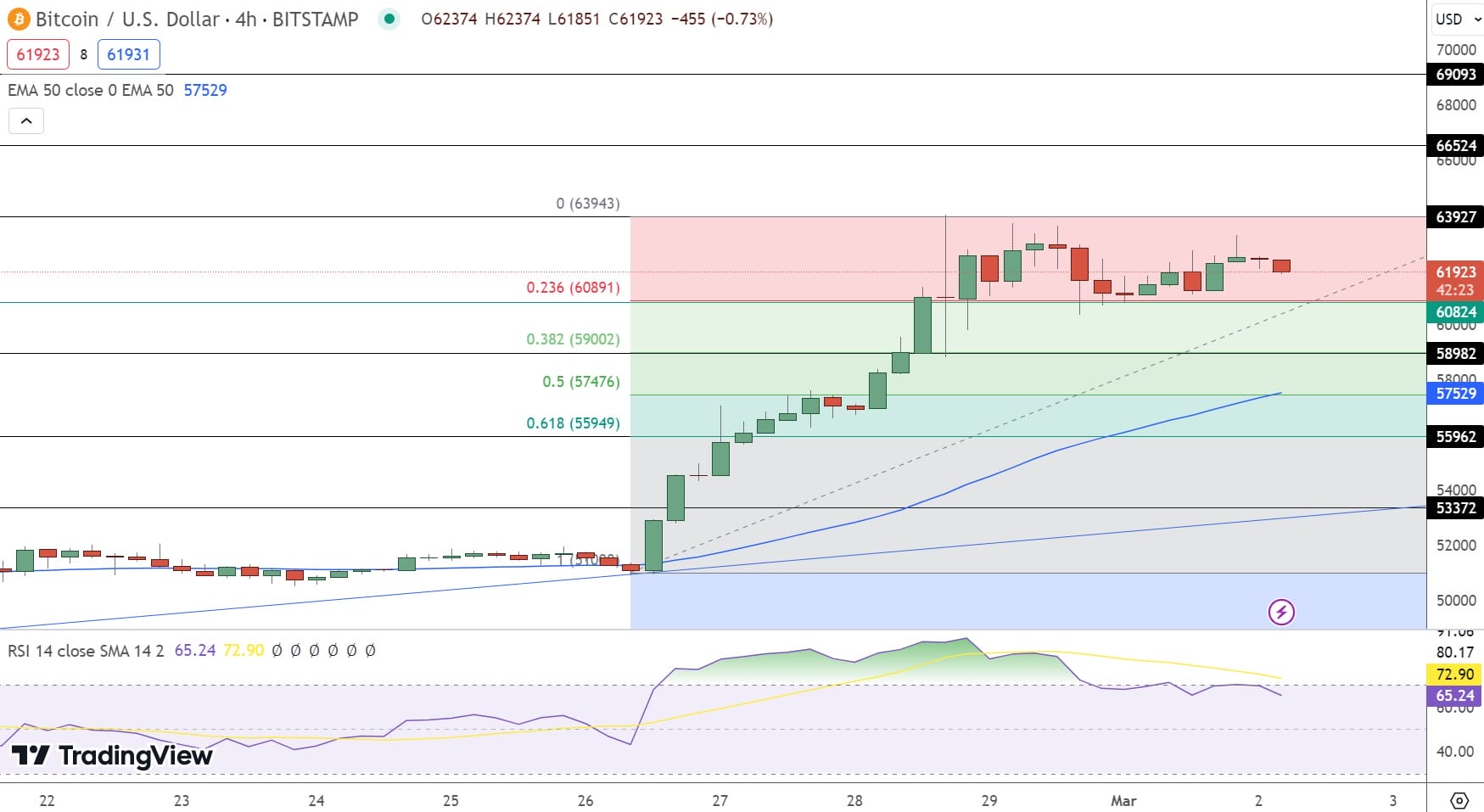

On March 2, Bitcoin (BTC/USD) showcases a compelling technical outlook, navigating between bullish and bearish territories. The pivot point at $60,824 serves as a excessive fulcrum, with resistance and give a raise to ranges framing attainable market instructions.

Immediate resistance lies at $63,927, suggesting a cap on upward actions, while give a raise to at $58,982 affords a fallback in bearish scenarios.

📈 #BitcoinAnalysis: BTC/USD hovers spherical pivot point of $60,825, dealing with resistance at $63,925 to $69,095 & give a raise to at $58,980 to $53,370. RSI at 69 suggests cautious optimism. Procuring and selling above 50 EMA ($57150) indicates bullish sentiment. Gaze for breakouts or supports for trends. pic.twitter.com/BorUmGCFru

— Arslan Ali (@forex_arslan) March 1, 2024

The Relative Strength Index (RSI) at 69, flirting with overbought stipulations, and the 50-Day Exponential Transferring Realistic (EMA) at $56,307, display sustained buying interest.

The market’s fresh stance, oscillating interior $63,350 to $60,800, hints at cautious optimism.

A break above $63,500 might perhaps perhaps well signal additional gains, whereas slipping below this fluctuate might perhaps perhaps also simply suggested a retest of decrease give a raise to ranges, positioning Bitcoin in a bullish direct above $60,825.

Green Bitcoin: Embrace Eco-Pleasant Crypto with Gamified Staking

Green Bitcoin emerges as a pioneering power in the crypto world, merging environmental stewardship with the dynamic nature of digital currencies. Introducing Gamified Green Staking, this initiative no longer simplest guarantees provocative rewards however also affords a double token bonus, emphasizing eco-consciousness in every transaction.

- Presale (40%): Kickstarting the challenge, the presale lays the groundwork for what’s poised to be a dynamic marketplace entry.

- Staking Rewards (27.50%): A wide reserve to honor the dedication of stakeholders, making sure the long-term neatly being of $GBTC.

- Advertising and marketing (17.50%): A devoted fund to craft influential campaigns, very crucial for sustaining the currency’s world footprint.

- Liquidity (10%): An wanted provision for gentle trading, strategically allocated to bolster $GBTC’s presence all the diagram through exchanges.

- Community Rewards (5%): A nod to the core supporters, recognizing and incentivizing neighborhood engagement.

The ‘Green Plan‘ outlines a obvious trajectory for Green Bitcoin, starting with a worth-pushed presale and advancing through strategic initiatives that energize the neighborhood and solidify the token’s market direct.

Take the soar into Green Bitcoin’s realm where your investment does higher than yield returns—it supports a sustainable monetary ecosystem. Stake your claim as of late and be segment of an eco-responsible future.

Web Green Bitcoin Right here

Source : cryptonews.com