Bitcoin Price Growth Could Continue, Says South Korean Analyst

Bitcoin Rate Progress May perhaps presumably perchance perchance Continue, Says South Korean Analyst

Bitcoin impress development may perchance moreover continue, a South Korean crypto analyst has predicted, as “crypto fever” slowly takes withhold in the nation.

In line with Hanguk Kyungjae, the “consensus” among the nation’s “substitute consultants” is that Bitcoin (BTC) prices will shield going up.

The media outlet said that forecasters beget the coin “will continue its upward pattern for the time.” Nevertheless consultants warned of a approaching “non eternal adjustment in prices.”

Bitcoin Rate Progress: Capacity for Additional Rises?

The media outlet quoted Ju Ki-young, the CEO of the Bitcoin on-chain analysis firm CryptoQuant, as saying:

“If the market’s most diploma of overheating is 100, we are currently at around 50.”

Alternatively, Ju famend that retail investors are aloof proceeding with relative warning. South Korean media outlets in 2018 and 2022 had been dominated by tragic tales of crypto investments that went sinful at the pause of the final BTC bull markets.

On-chain momentum signifies ample original capital inflow to start the following #Bitcoin parabolic bull bustle. https://t.co/BrvWO1dbc4

— Ki Young Ju (@ki_young_ju) March 13, 2024

And plenty seem like in two minds about whether or no longer to formula to the markets. Indubitably, many retail investors bear certainly returned, as rising kimchi top rate charges modern.

The kimchi top rate is a phenomenon whereby spiking retail funding in a shallow pool of domestic crypto exchanges drives seek files from larger than supply.

This ends up in South Koreans spending extra per unit of crypto than their counterparts in other parts of the world.

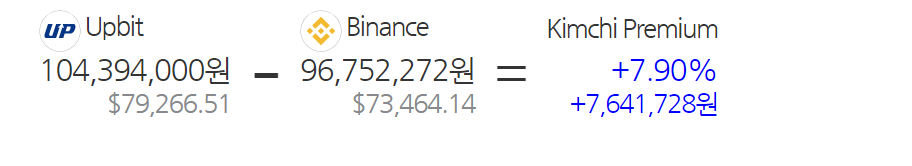

The Bitcoin kimchi top rate dropped from a excessive of 10% earlier this month to factual scared of the 8% impress on March 13, per Cryprice calculations.

Which device that the worth per BTC in South Korea is currently over $6,070 larger than on global crypto trading platforms such as Binance.

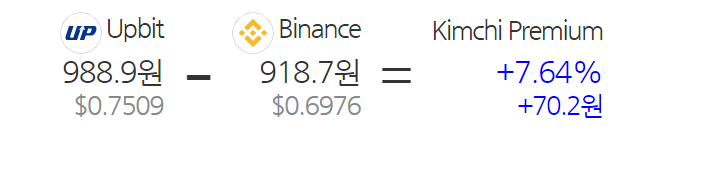

South Korean traders had been paying a identical markup for altcoins fancy XRP, Cryprice’s records indicated.

Kimchi Top rate: Restful a Long Come to Glide Sooner than Fever Pitch?

Alternatively, kimchi top rate charges of 7-10% are a miles train from the 20-30% markups viewed in South Korea for the length of outdated bull runs.

And that will perchance perchance appear to modern some of us are aloof reluctant to formula to a market that has burned them badly in the previous. Ju explained:

“We’re no longer in a misfortune the put everybody appears to be like to be jumping into crypto funding.”

Ju conceded that it became “troublesome to foretell” an accurate impress ceiling for BTC. Nevertheless he added that he anticipated Bitcoin impress development to verify the $114,000 impress. He explained:

“We’re in the center of a bull market, and there is the ability for additional rises in the prolonged bustle.”

Social Media Submit Captures Temper in South Korea?

Within the period in-between, a viral social media put up from the South Korean comic Kim Kyung-jin appears to be like to bear captured the mood of many retail investors.

On March 11, Kim posted a graph on his Instagram online page exhibiting the worth of Bitcoin surpassing the 100 million gained ($76,000) impress on a South Korean alternate impress chart. He mused:

“Bitcoin is imagined to be a rip-off. So why are prices rising fancy this?”

Every other comic, Park Jun-hyung, jokingly requested Kim if he had any BTC holdings.

To this and other feedback, Kim answered that he became “regretful” and “pissed off” – presumably by his failure to put money into the coin.

Source : cryptonews.com