Bitcoin Price Dips as Fed Chair Powell Says March Rate Cut Unlikely – Where Next for BTC?

Bitcoin Mark Dips as Fed Chair Powell Says March Fee Lower Unlikely – The keep Subsequent for BTC?

The Bitcoin (BTC) mark has dipped help underneath $43,000 in wake of hawkish comments from Fed Chairman Jerome Powell, who on Wednesday commented that he doesn’t specialise in it likely the FOMC will likely be assured ample to lower US passion charges as soon as March.

⚠️ Powell: Now not Likely Committee Will Be Confident Ample By March to Lower Charges

— *Walter Bloomberg (@DeItaone) January 31, 2024

His comments come after the Fed launched that it had determined to proceed passion charges unchanged at 5.25-5.5%, as expected.

In its protection announcement, the Fed’s assertion stated that passion rate cuts obtained’t come till the Fed has bigger self belief that inflation is spirited sustainably lower.

The Bitcoin mark used to be final accurate underneath $42,500, down 2.6% in 24 hours as per CoinMarketCap.

The scheme back in the Bitcoin mark comes as merchants pare help on bets for a Fed rate lower in March.

As per a CME instrument, the money market implied probability of a 25 bps lower in March used to be 35.5%.

That’s down from over 40% on Tuesday and virtually 90% as no longer too lengthy ago as one month ago.

Bets that the Fed would possibly possibly likely perchance hang lower passion charges by 25 bps by Might perchance likely well perchance also jumped to 62.9% from underneath 55% on Tuesday.

Meanwhile, money markets are pricing a roughly 32% probability that the Fed cuts passion charges by 50 bps by Might perchance likely well perchance also.

That’s roughly unchanged versus at some point and one week ago, but is down from over 70% one month ago.

In sum, markets suggest a rate lower is no longer any longer likely in March, but stays a solid wager for Might perchance likely well perchance also.

Macro to Dwell a Tailwind

No matter the dip in the Bitcoin mark as markets mark out a March Fed lower, the macro backdrop is more likely to remain a solid tailwind for BTC in 2024, as the Fed will start lowering passion charges and easing monetary prerequisites at some point.

The Fed dropped any hints at likely taking passion charges elevated in its most modern assertion.

That confirms that the quiz is when and how rapid the Fed starts lowering passion charges, no longer if.

Merchants would possibly possibly likely perchance proceed to catch caught offside making a wager on passion rate cuts to come too soon or no longer soon ample.

And this is able to likely perchance well proceed to region off volatility in the Bitcoin mark, accurate fancy that viewed on Wednesday.

Nonetheless easing monetary prerequisites is a broadly acknowledged distinct for cryptocurrencies, accurate fancy it’s for various asset courses, fancy stocks, bonds and gold.

Macro tailwinds are one reason patrons will likely proceed to aquire fundamental dips in the Bitcoin mark.

A good deal of Bullish Narratives For 2024

Nonetheless Bitcoin also has many totally different narratives to again defend its mark underpinned.

Keep Bitcoin ETF approvals earlier this month hang viewed a flood of funding proceed GBTC.

Nonetheless that flood of marketing has considerably eased, and novel ETFs from BlackRock and Fidelity are attracting solid set a question to.

Unique Bitcoin ETFs spy to hang added a significant novel source of set a question to that is comparatively insensitive to rate.

Meanwhile, the upcoming Bitcoin halving in April will considerably minimize promote stress from Bitcoin miners.

Whereas there’ll not be any longer any staunch sample or playbook that the Bitcoin mark follows in the lead-up to and aftermath of a halving occasion, they hang got historically come earlier than unusual pumps to file highs.

If historic past does repeat itself, we are able to be making an strive at a Bitcoin mark above $100,000 by 2025.

And this doesn’t even coast on to level ability US political and monetary tailwinds that can likely perchance well help Bitcoin in 2024.

The keep Subsequent for the Bitcoin Mark?

The Bitcoin mark appears to be like region to shut out January virtually exactly the keep it started the month.

After a bigger than 60% pump in the last four months of 2023, that’s no longer a disagreeable start to the 365 days.

The solid rebound from sub-$40,000 levels suggests the aquire-the-dip mentality stays solid.

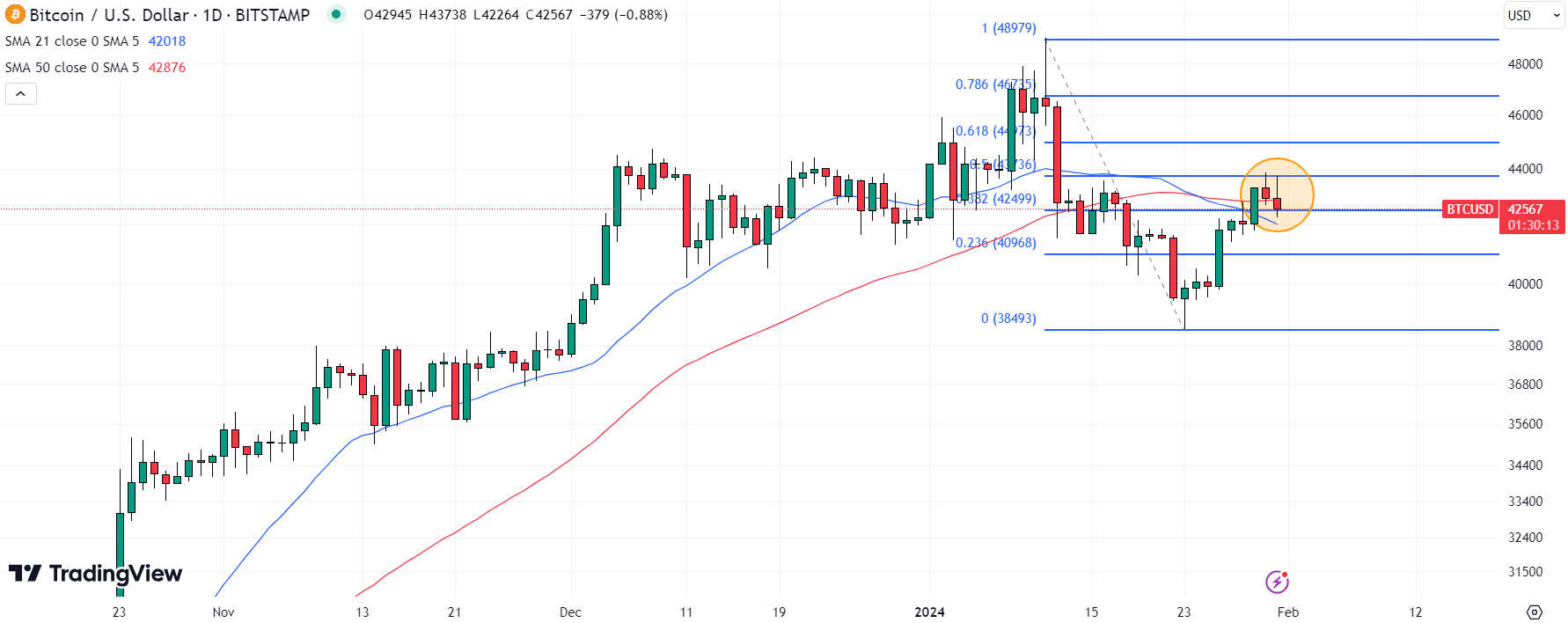

Bitcoin’s very speedy-term outlook is merky, with the cryptocurrency wedged between its 21 and 50DMAs at $42,000 and $42,850 respectively.

The value also stays caught accurate underneath the 50% retracement help from monthly lows to monthly highs.

Rangebound prerequisites would possibly possibly likely perchance prevail in the upcoming months as merchants pause up for the halving.

Any other wild card to scrutinize is the cessation of the Fed’s March 2023 emergency liquidity program that staved off a monetary institution disaster.

A re-emergent US monetary institution disaster would possibly possibly likely perchance be one more tailwind for the Bitcoin mark, accurate as it used to be in March 2023.

All stated, a outing $10,000 elevated to the low $50,000s appears to be like to be extra likely than a $10,000 dip lower to the low $30,000s in the months ahead.

Source : cryptonews.com