Bitcoin Price Below $80,000 At Halving Could Trigger Miner Losses – Fidelity

Bitcoin Mark Beneath $80,000 At Halving May perhaps moreover Trigger Miner Losses – Constancy

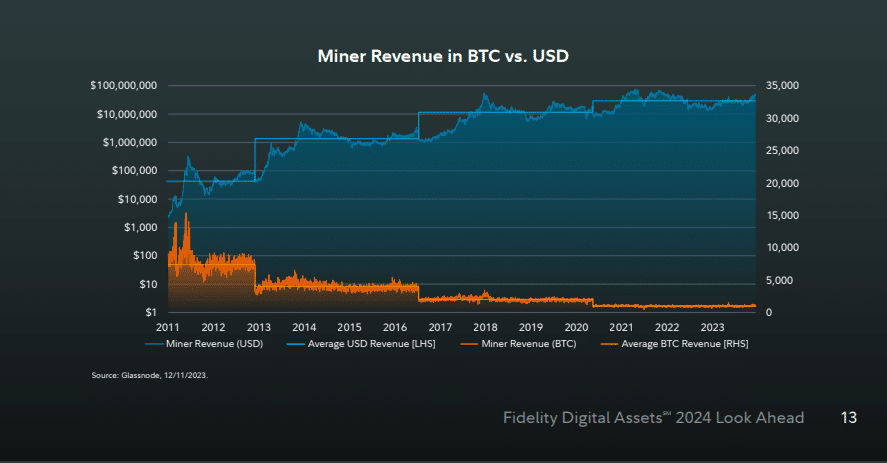

Constancy Digital Sources speculates losses for some miners if the Bitcoin mark stays below $80,000 after the upcoming halving in April.

The company launched its 2024 market outlook, highlighting the growth recorded to this point in Bitcoin, the voice of miners, and that which that you just can well perhaps be imagine perspectives for the attain future.

Bullish narratives had been on the rise in the previous several months, as Latin American adoption is rising and the US SEC accepted role Bitcoin ETFs.

On the other hand, analysts at Constancy imply that which that you just can well perhaps be imagine miner losses if the Bitcoin mark does not hover over $80,000. The following halving expected in April will look block rewards diminished by 50%, ensuing in a reduce in revenues.

Light, since halvings are linked with bullish momentum around the cycle, the mark of the asset is expected to hover post-halving to duvet losses.

Bitcoin miners faced a turbulent season leading up to the halving year earlier than the novel mark surge. The 2022 endure market occasioned a 55% mark descend that took miners underwater.

The frigid weather resulted in miners promoting their Bitcoin reserves, pivoting to Man made Intelligence (AI) computing, and promoting tools to preserve afloat.

Region ETF Approval Had a Particular Quit on Bitcoin Mark

In a turn of events, the institutional inflows recorded in Q2 2023 on the heels of an coming near near role BTC ETF approval resulted in mark upticks.

Miners moved back into the green zone and are hedging property to secure ability for the upcoming reward reduce.

On the 2d prices above $Forty five,000, miner revenues are at $40 million, up $10 million on life like. On the other hand, for demonstrate income to reside, the Bitcoin mark desires to hover to $80,000. It would possibly maybe well perhaps abet the role quo after the halving, scuffling with promoting pressures from miners.

Per Constancy:

“In a scenario the assign the mark does not upward push to $80,000 earlier than the halving, some miners will inevitably be mining at a loss. The mining industrial is accustomed to small margins due to the difficulty adjustment tends to act as a governor on margins, preserving the price of manufacturing conclude to the role mark, absent of any beautiful mark movements.”

Bitcoin Ordinals Build Miners’ Earnings

Though role Bitcoin approvals obtain sparked bullish momentum, it’s a long way rarely the totally riding power for miners.

The upward push of Bitcoin Ordinals, no matter the initial backlash, created a unusual income deplorable for miners to bound recovery.

Constancy Digital suggests that 2024 will look more hobby in Ordinals effectively elevating miner expenses. Analysts added that Ordinals demonstrate a gain definite for the network.

The difficulty of blockchain congestion stays in the spotlight thanks to the mempool clog final year that very a lot increased transaction expenses. While heightened squawk is correct for miners and transaction charges, critics cite its capacity to hike charges.

“While its squawk case for transferring digital art work or text would possibly well perhaps not abet hobby over the long scuttle, the technology itself gifts unusual capabilities that weren’t previously notion that which that you just can well perhaps be imagine. The additional price income is seemingly a welcome peek to miners as nicely.”

Source : cryptonews.com