Bitcoin Post-Halving Price Consolidation Isn't Over Yet: Bitfinex

Bitcoin Submit-Halving Mark Consolidation Isn’t Over But: Bitfinex

Analysts at cryptocurrency replace Bitfinex predict the value of Bitcoin would perhaps per chance most likely also consolidate for as much as 2 months post-halving.

The most up-to-date version of the Bitfinex Alpha market report launched on April 29 well-known that Bitcoin would perhaps per chance most likely also continue to be the value action benchmark for the crypto market in Also can and the main indicator for the entire cryptocurrency market cap.

Bitcoin’s Mark Serene Has Room for Increase

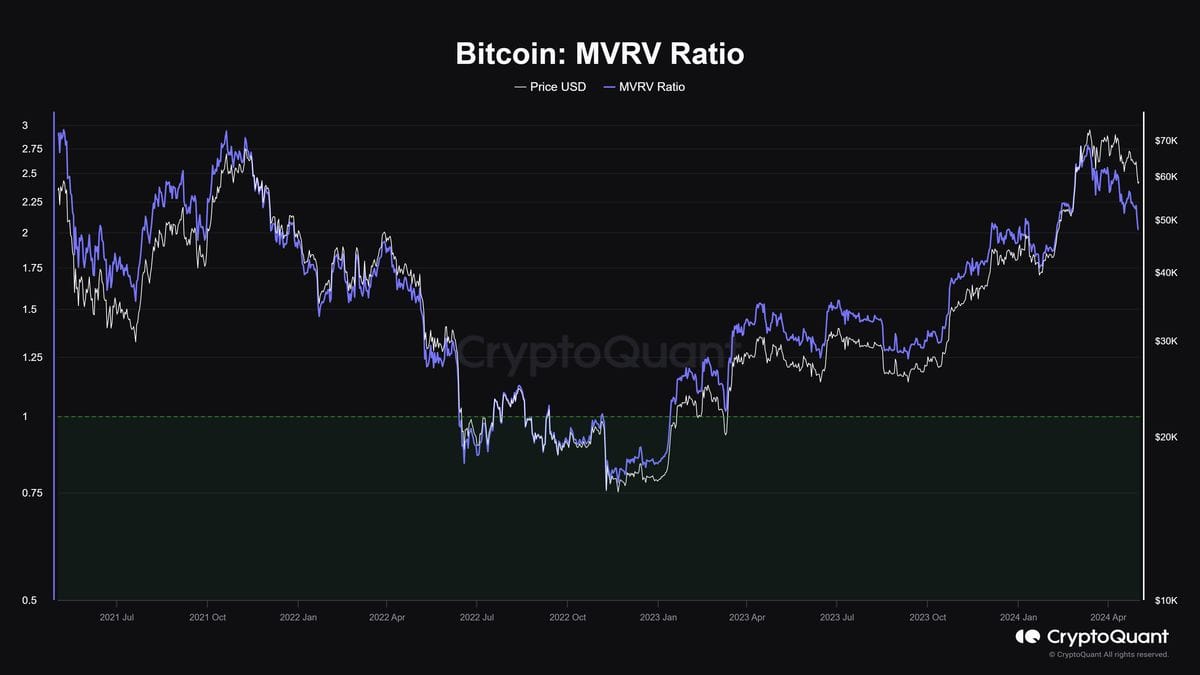

Bitfinex acknowledged Bitcoin is undervalued. The Market Value to Realised Value (MVRM) ratio is currently at 2.21.

Binfinex well-known this as a doable entry level for investors, severely as historical patterns uncover huge returns when MVRV dips below its 90-day average.

“Unique on-chain signals we’re seeing maintain historically coincided with a bottom for BTC,” they well-known.

No matter this, Bitcoin dominance is experiencing a decline, with Ethereum and different altcoins outperforming BTC.

“In most cases, post-halving intervals watch a shift in investor focal level to altcoins, browsing for doubtlessly increased returns,” the report continued.

This shift in investment patterns stems from a federal economic report highlighting slower-than-anticipated exclaim within the US economic system. As demonstrated by the exact Glum Home Product (GDP) annual payment, which plummeted to 1.6 p.c within the main quarter of 2024, down from 3.4% within the closing quarter of 2023.

Bitfinex Blames Macroeconomic Factors

The slowdown within the US economic system’s exclaim is primarily which ability of microeconomic components. Bigger interest charges discourage investors from allocating funds to volatile assets equivalent to Bitcoin, preferring extra trusty ideas.

The Fed’s key inflation gauge, the non-public consumption expenditures (PCE) index, saw no swap in March, maintaining regular at a 0.3 p.c develop month-over-month.

On a year-on-year foundation, PCE is at 2.7 p.c, which is above the Fed’s 2% inflation target and exceeds consensus forecasts.

This aggregate of slowing exclaim and accelerating inflation has reignited fears of stagflation, a instruct whereby economic exclaim stalls as costs continue to upward push.

Per CME’s FedWatch tool, traders estimate the probability of a June payment lower to handiest 11.8%, when compared with 56.5% for September.

No matter this, Bitfinex believes the macroeconomic atmosphere is extra resilient than in previous years.

Additionally, the analysts acknowledged that identical previous patrons and firms are “better ready and told” in regards to the thunder of the underlying economic system when when compared with previous crypto market cycles.

“This ability that, we hang we would perhaps per chance most likely also conception a 1-2 month consolidation in Bitcoin costs, procuring and selling in a range with swings of $10,000 on either side,” the report concluded.

Merchants Flip to Altcoins as Bitcoin ETF Flows Dry

This shift in the direction of Altcoins is extra emphasised by most up-to-date US Bitcoin position ETF inflows.

Following the SEC’s inexperienced gentle of Bitcoin ETFs in January, the cryptocurrency won a total new target audience. These ETFs allow investors to get publicity to Bitcoin with out proudly owning it straight.

Since then, these ETFs maintain won in style adoption, with roughly $12 billion flowing into them. These kinds of inflows took place closing quarter, main to a surge within the Bitcoin label to new all-time highs. Nonetheless, that they had lost momentum by April.

“After initial novelty hype, ETF flows have a tendency to drag out except costs continue rising—which they maintain got now no longer done since early March,” 10x Evaluation Founder Markus Thielen predicted.

Thielen’s prediction has been supported by the Hong Kong Bitcoin Converse ETFs launched on April 30 and saw underwhelming inflows, with correct $11.2 million on its first day.

Per a Bloomberg report, here’s a much declare from the anticipated $300 million. Merchants are now no longer confident within the present thunder of the market, begging the quiz of how long Bitcoin can preserve “oversold.”

Source : cryptonews.com