Bitcoin and Ethereum Price Prediction as BTC Rallies 10% From Recent Bottom and ETH Sees $5 Billion Flood In – Time to Buy?

Bitcoin and Ethereum Mark Prediction as BTC Rallies 10% From Fresh Backside and ETH Sees $5 Billion Flood In – Time to Buy?

This decided trend in Bitcoin’s valuation coincides with a excessive-ranking representative’s praise of BlackRock’s Bitcoin ETF, hailing it as a “extensive success” across diversified metrics.

Concurrently, the US buck is witnessing a decline in the wake of latest inflation figures, environment a critical stage for the upcoming Federal Reserve meeting next week. These traits collectively paint a complex however spirited listing for Bitcoin’s future in the financial panorama.

BlackRock’s Bitcoin ETF Declared ‘Extensive Success’ by High Reliable

Since its latest inception, BlackRock’s iShares Bitcoin Believe (IBIT) has viewed loyal thunder, and in an interview with Yahoo Finance, U.S. Head Rachel Aguirre expressed pleasure with the final outcome. After receiving permission from the SEC, IBIT’s shopping and selling volume increased to an fabulous $3 billion in impartial two weeks, drawing in $1.6 billion in capital.

Aguirre highlighted BlackRock’s dedication to giving investor’s glean admission to to Bitcoin, praising the product for its three USPs: higher accessibility, the removal of hassles linked to advise Bitcoin possession, and providing excessive-caliber give a enhance to.

BREAKING: The BlackRock iShares #Bitcoin Believe is a extensive success by a pair of metrics, consistent with Rachel Aguirre, U.S. Head of iShares Merchandise. pic.twitter.com/ZOVZEgR3dC

— sunnydecree (@sunnydecree) January 24, 2024

Though Aguirre refuted rumors of a nervousness Ethereum ETF, she praised BlackRock for being sooner than the curve in gauging investor query. BlackRock currently has 16,361 BTC in say to fund IBIT.

The favorable response highlights the increasing hobby of institutions in cryptocurrencies, that are pushing up the cost of Bitcoin.

US Dollar Weakens Post-Inflation Files, Earlier than Fed Meeting

Friday observed a tiny bit decline in the cost of the US buck as December inflation statistics confirmed the market’s expectations of a mid-one year hobby fee drop by the Federal Reserve. Though it would maybe well need won for a fourth week in a row, the buck index fell 0.1% to 103.41.

According to expectations, the Interior most Consumption Expenditures (PCE) rate index increased by 0.2%, combating annual inflation from rising above 3%. Analysts thunder there is no such thing as a clarification for the market to be troubled about inflation anytime soon, which lessens the chance of more tightening.

US buck slips after inflation recordsdata, Fed meeting looms next week – The Economic Times https://t.co/o391aoNCWW

— FOMC Alerts (@FOMCAlerts) January 28, 2024

The buck’s upward thrust is being restrained by mounting disinflationary pressures globally, despite the indisputable truth that U.S. fee futures priced in a 47% chance of a fee decrease in March.

The disaster with Bitcoin (BTC) is popping into higher, and if traders continue to be troubled about inflation, they would maybe well perchance also merely turn out to be more drawn to inflation-resistant resources like cryptocurrencies.

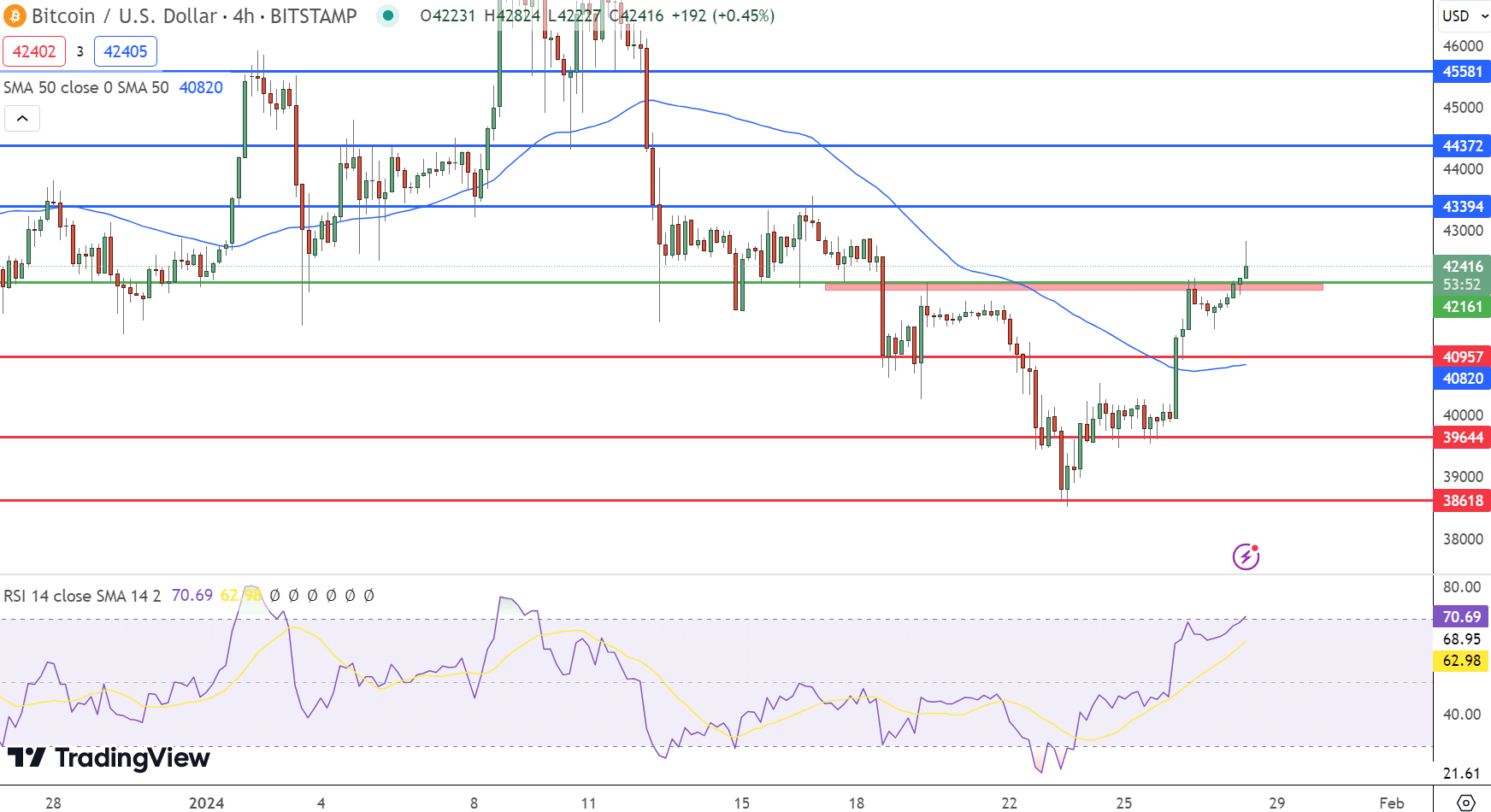

Bitcoin Mark Prediction

High 15 Cryptocurrencies to Glance in 2023

Finish wakeful-to-date with the enviornment of digital resources by exploring our handpicked series of the simplest 15 different cryptocurrencies and ICO initiatives to abet an gape on in 2023. Our checklist has been curated by consultants from Commerce Teach and Cryptonews, guaranteeing professional recommendation and necessary insights for your cryptocurrency investments.

Take perfect thing about this different to stare the likely of these digital resources and abet your self informed.

Disclaimer: Cryptocurrency initiatives endorsed in this article are no longer the financial recommendation of the publishing author or e-newsletter – cryptocurrencies are highly unstable investments with valuable threat, continuously attain your possess be taught.

Source : cryptonews.com