Bitcoin and Ethereum Price Prediction as BTC Surpasses $42,000 Resistance and ETH Turns Red

Bitcoin and Ethereum Tag Prediction as BTC Surpasses $42,000 Resistance and ETH Turns Pink

In the dynamic world of cryptocurrencies, Bitcoin and Ethereum continue to be essentially the most primary gamers with their most trendy trace movements catching the dignity of traders. Bitcoin, the trailblazer of the crypto market, has just no longer too lengthy ago rebounded, breaking thru the $42,000 resistance stage and registering a recent trace of $42,292. This nearly 0.50% amplify within the final 24 hours coincides with the total crypto market valuation at $1.63 trillion, no topic a small 0.15% drop.

Bitcoin’s surge is linked to favorable inventory market traits and the primary fulfillment of BlackRock’s Bitcoin ETFs gathering over $2 billion in Property Below Management. This bullish constructing in Bitcoin’s trace is a focal level for trace prediction analyses.

#GM $BTC at 42k today!📈#CoinHome #Bitcoin #Ethereum $btc $eth pic.twitter.com/0P07r30Ccg

— CoinHome (@CoinHomePro) January 29, 2024

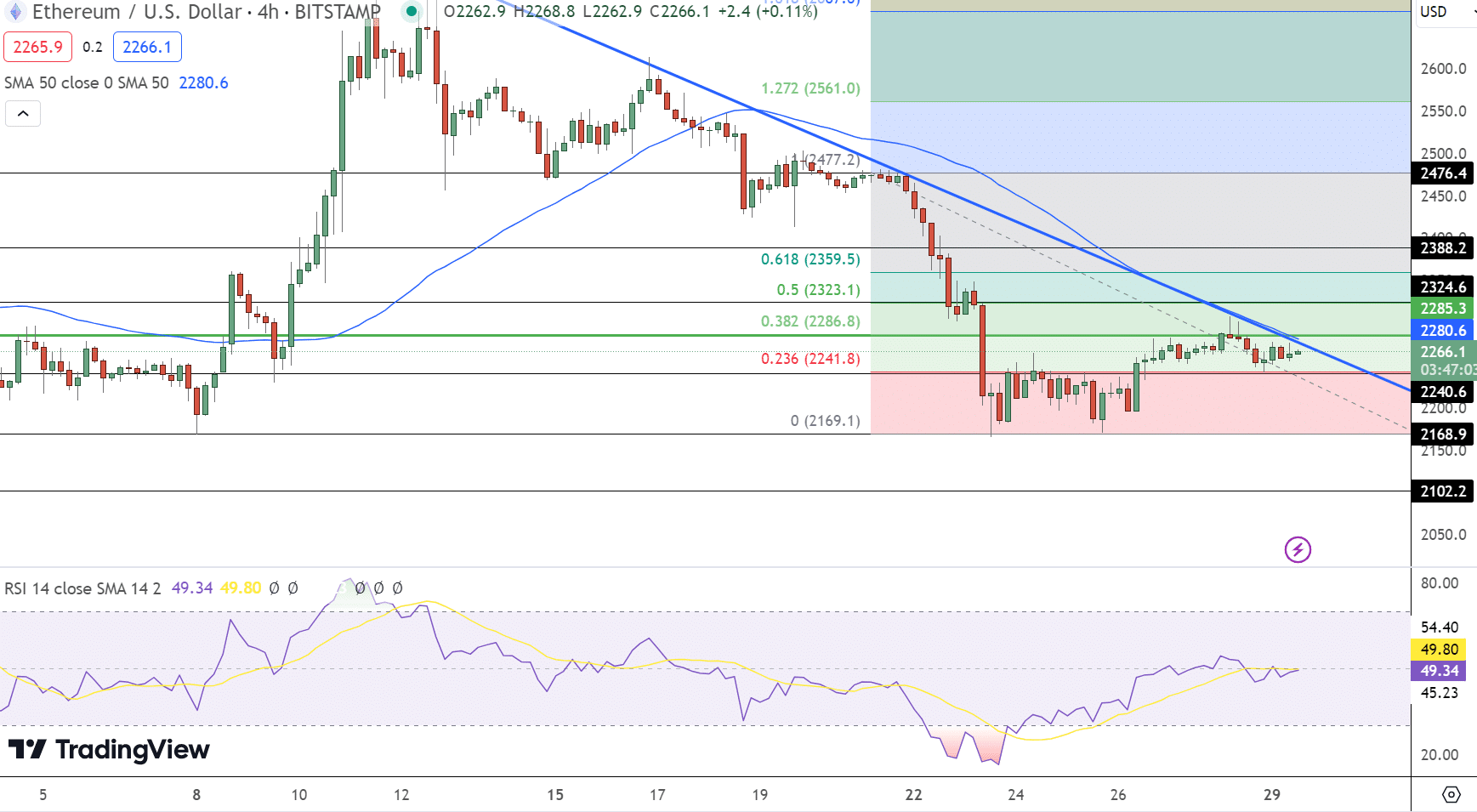

On the unreal aspect, Ethereum, the 2nd most critical cryptocurrency, has considered a minor setback, trading at $2,269 with nearly 0.50% decline. On the unreal hand, the excitement all the diagram thru the skill approval of a spot Ethereum ETF, as prompt by analyst James Seyffart, signals an optimistic future for Ethereum. The approval, anticipated in May per chance presumably presumably, can also attract more investment, influencing Ethereum’s trace positively.

Furthermore, the worldwide passion in cryptocurrencies is evident with traits like Harvest Hong Kong’s application for a Bitcoin ETF and a Binance witness revealing rising crypto acceptance in Europe. These factors collectively contribute to the evolving epic of Bitcoin and Ethereum trace predictions.

Harvest Hong Kong’s ETF Uncover: A World Enhance for Bitcoin’s Worth

Harvest Hong Kong, a outstanding Chinese fund firm, has formally submitted an application for a Bitcoin place replace-traded fund (ETF) with the Hong Kong Securities and Futures Price.

The approval of this ETF, which is poised for initiating after the Lunar Novel three hundred and sixty five days vacation on February 10, would tag Hong Kong’s first Bitcoin place ETF. This initiative follows the winning introduction of place Bitcoin ETFs within the US, igniting worldwide passion.

China’s Monetary Huge Files First-Ever Bitcoin Predicament ETF Utility in Hong Kong#bitcoin #BTC #tafouio #cryptonews pic.twitter.com/5xgGBkHtDj

— tafou.io (@tafouio) January 29, 2024

Rachel Aguirre of BlackRock has acknowledged the spectacular efficiency of the U.S. ETF, which has surpassed expectations. China’s entry into this sector provides a prime dimension to the dynamic panorama of digital asset investments, signaling a transformation in investor preferences.

Thus, Harvest Hong Kong’s application for a Bitcoin ETF reflects increasing global passion. Its most likely approval can also extra elevate Bitcoin’s trace by attracting extra traders and reinforcing its legitimacy in mainstream financial markets.

Binance List: Rising Crypto Acceptance in Europe and Bitcoin’s Potentialities

Binance’s most trendy witness presentations an increasing acceptance of cryptocurrencies in Europe, pushed by their most likely for prime returns, decentralization, and proper innovation. The scrutinize indicates that 73% of Europeans care for a obvious peep of digital currencies, with 55% utilizing them for regular transactions. This constructing aligns with the worldwide amplify in cryptocurrency ownership, which soared from 432 million in January to 580 million by December 2023.

Some truly obvious findings from our #Binance witness all the diagram thru Europe.

73% of respondents had been optimistic in regards to the diagram in which ahead for crypto & with MiCA applied soon, there’s loads to be within the suppose!

Extra primary aspects from @Finbold here 👇https://t.co/gE3l6e5MtT

— Rachel Conlan (@RachelConlan) January 25, 2024

Regardless of a non eternal decline in adoption following the FTX replace factors in leisurely 2022, self belief rebounded, partly due to the the U.S. Securities and Exchange Price’s (SEC) approval of 11 Bitcoin ETFs. High-profile sponsorships, collectively with Crypto.com’s collaboration with the LA Lakers and OKX’s partnership with Manchester Metropolis, extra enhanced belief within the sector.

Which skill, the optimistic sentiment in Europe, highlighted by Binance’s witness, can also positively impact Bitcoin’s trace. The rising adoption, coupled with heightened optimism and utilization, can also attract more traders, doubtlessly elevating the cryptocurrency’s market value.

Seyffart’s Forecast: Ethereum ETF Approval in May per chance presumably presumably May per chance presumably presumably Elevate ETH Worth

Bloomberg Intelligence analyst James Seyffart sees a 60% likelihood of a spot Ethereum ETF getting authorized in May per chance presumably presumably. Regardless of most trendy delays for BlackRock and Grayscale proposals, Seyffart marks May per chance presumably presumably 23 as a first-rate date, searching at for the SEC’s resolution spherical that time. The SEC, having authorized Bitcoin ETFs, is now curious about proposals from BlackRock, Grayscale, Ark 21Shares, and VanEck.

The Avenue Forward: A Search for on ETH Predicament

Right here is supposed to be a deep dive into the contemporary panorama for crypto place ETFs most regularly with emphasis on ETH. Will enact this in 4 formula for ease of reference.

1 – Basic Roadmap

2 – Threshold Self-discipline

3 – BTC Predicament Approval

4 – ETH Prognosis

🧵— Scott Johnsson (@SGJohnsson) January 25, 2024

Seyffart is hopeful but acknowledges the SEC’s capability to lengthen decisions. Grayscale targets for a summer season 2024 SEC resolution on turning its Ethereum Belief into an ETF. As May per chance presumably presumably approaches, Seyffart retains an look for on filings, with May per chance presumably presumably 23 as a key date for most likely updates. In consequence, the likelihood of a spot Ethereum ETF approval, highlighted by James Seyffart, can also positively impact ETH trace.

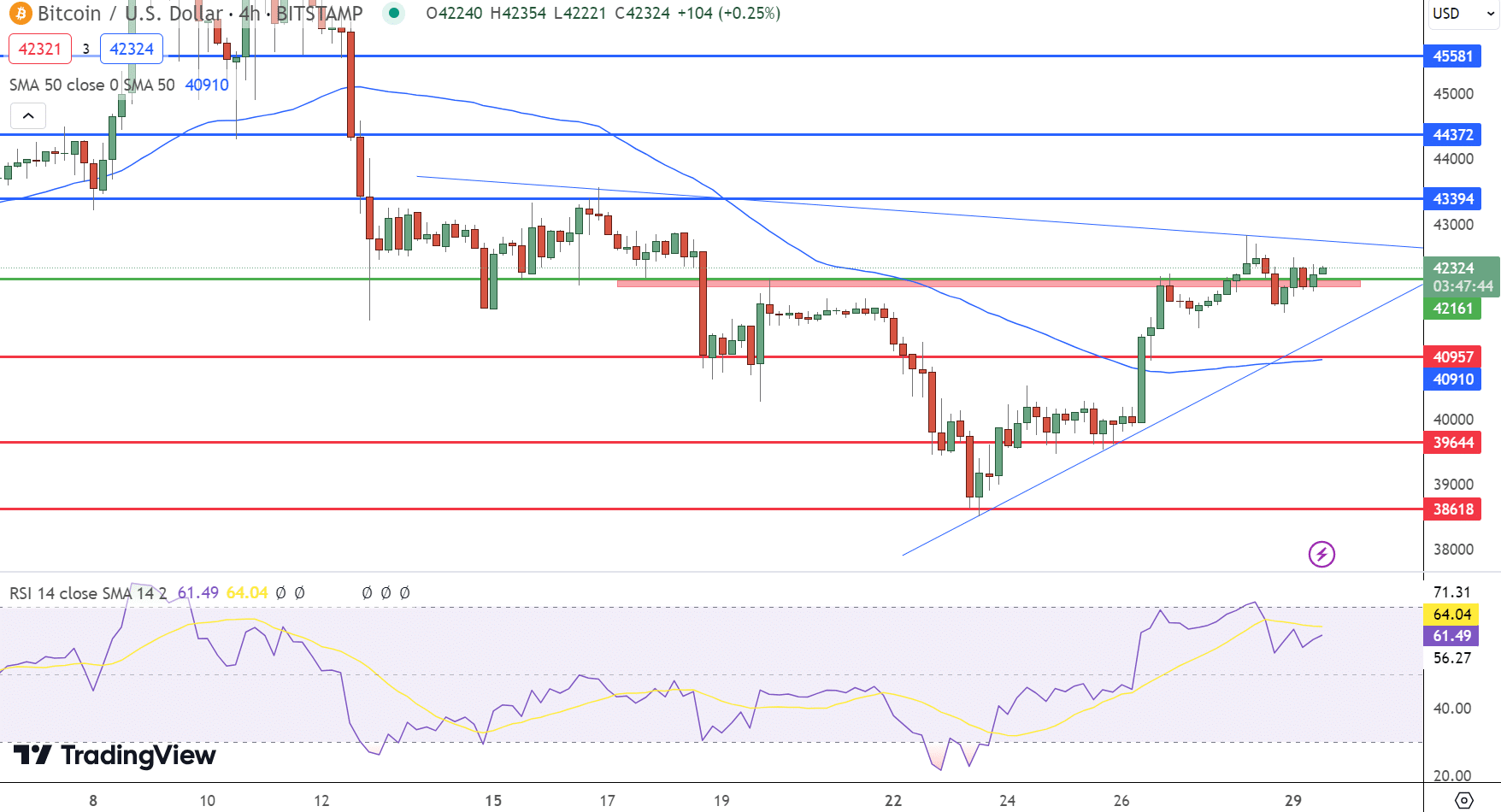

Bitcoin Tag Prediction

Top 15 Cryptocurrencies to Peek in 2023

Finish wide awake-to-date with the area of digital assets by exploring our handpicked assortment of essentially the most attention-grabbing 15 substitute cryptocurrencies and ICO initiatives to shield an look for on in 2023. Our list has been curated by professionals from Industry Talk and Cryptonews, making sure expert advice and extreme insights for your cryptocurrency investments.

Rob support of this likelihood to secret agent the skill of these digital assets and shield yourself told.

Disclaimer: Cryptocurrency initiatives prompt in this article will no longer be the financial advice of the publishing creator or publication – cryptocurrencies are highly unstable investments with substantial risk, continuously enact your accept as true with learn.

Source : cryptonews.com