$30 Billion RIA Platform Carson Group Approves Only 4 Bitcoin ETFs

$30 Billion RIA Platform Carson Team Approves Simplest 4 Bitcoin ETFs

Carson Team, the registered investment handbook (RIA) platform managing $30 billion in sources, has selected very best four put Bitcoin replace-traded funds (ETFs) for its customers.

According to a up to date document by Bloomberg, the four out of 10 SEC-permitted ETFs integrated BlackRock’s iShares Bitcoin Believe (IBIT), Fidelity’s Radiant Origin Bitcoin Fund (FBTC), Bitwise’s BITB, and Franklin Templeton’s EZBC.

Carson Team’s Chosen Bitcoin ETFs

The platform’s different of the four Bitcoin ETFs develop into once at the starting put driven by a spotlight on funds that have demonstrated prominent boost and popularity.

As an instance, Carson’s Vice President and Investment Strategist Grant Engelbart defined that “fundamental asset boost” develop into once a key ingredient for including BlackRock’s and Fidelity’s Bitcoin ETFs within the platform’s choices.

“We in actuality feel it is a long way well-known to present these products as a result from two of an fundamental asset managers within the industry,” stated Engelbart.

As for the much less well-known funds supplied by Bitwise and Franklin Templeton, the corporate became its shift to the products with the bottom deliberate expenses of 0.2% and 0.19%.

“Bitwise and Franklin Templeton have committed to being the bottom-tag suppliers within the apartment, and have also seen huge inflows and purchasing and selling volumes,” Engelbart acknowledged.

“Every corporations also have established in-apartment digital asset be taught groups and expertise that we in actuality feel are priceless to the continuing boost and management of the products,” stated Engelbart. “As well as handbook be taught and training.”

Platform Approvals and Handbook Endorsements

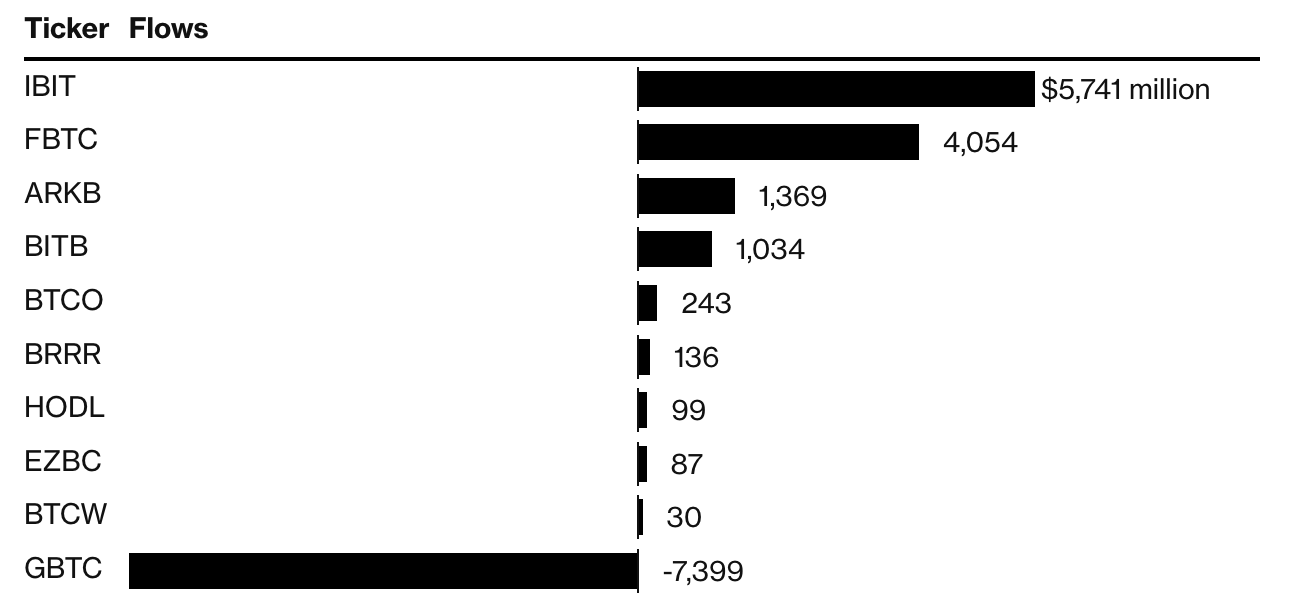

The prosperity of put Bitcoin ETFs genuinely relies on the restful merchants and the inflows they devise to the products. While Grayscale’s Bitcoin Believe (GBTC) recorded one of the crucial crucial bottom outflows over the past few days, all suppliers have endeavored to blueprint extra audiences.

Bitwise co-founder and CEO Hunter Horsley pointed out that approvals from platforms and financial advisors would per chance even be a “enormous catalyst” for boost.

Carson Team, one of an fundamental US financial advisory corporations, has permitted four Bitcoin ETFs for purchasers https://t.co/Qqa6nyPDCH

— Bloomberg Crypto (@crypto) February 23, 2024

“Over half of US wealth is fragment of a platform and would per chance per chance very best speak a product once it’s permitted,” stated Horsley.

“We typically hear ‘I desire win admission to to Bitcoin nonetheless our platform hasn’t permitted the leisure yet. The platforms are busy nonetheless now that there are ETFs and some over a billion AUM, they’re doing the work.”

Source : cryptonews.com