Ark Invest Breaks Down What it Would Take for Bitcoin to Hit $2.3M

Ark Invest Breaks Down What it Would Rob for Bitcoin to Hit $2.3M

Investment firm Ark Invest published its most modern Huge Ideas file on Wednesday, outlining a pathway for Bitcoin to hit $2.3m.

Ark’s Brett Winton wrote that for essentially the most productive returns over 5 years, keeping 0.5% of one’s investments in Bitcoin would contain been very ultimate. On sensible, allocating about 4.8% to Bitcoin would contain worked properly.

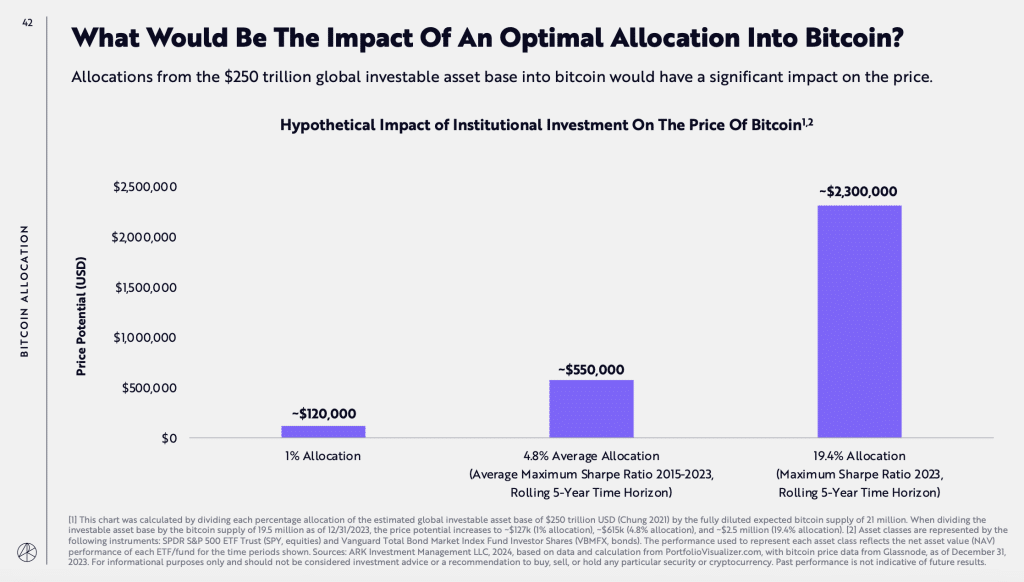

Ark Invest launched the Huge Ideas 2024 file: The optimum allocation proportion of Bitcoin in the funding portfolio in 2023 is nineteen.4%, whereas it used to be simplest 0.5% in 2015; globally, if 1% is allocated to Bitcoin, the value capacity of Bitcoin reaches $120,000, 19.4% is allocated,…

— Wu Blockchain (@WuBlockchain) February 1, 2024

The file further stated that in 2023, allocating around 19.4% in Bitcoin would contain been the optimum desire. Furthermore, the value could well be considerably influenced if a appreciable a part of the $250 trillion global investable resources had been invested in Bitcoin.

If folks worldwide had been to make investments just correct 1% in Bitcoin, its designate could well attain $120,000. Alternatively, if an even bigger allocation of 19.4% had been made — the value could well cruise to $2.3m, Ark stated.

Ark’s “Huge Ideas” is an annual file outlining its standpoint on emerging technologies and trends that could well affect the lengthy bustle.

Final year, the file confirmed how Bitcoin expanded its position as a world settlement network, with its 2021 settlement quantity exceeding Visa’s for the first time.

Ark Highlights Bitcoin’s Bullish Doubtless

Wednesday’s file also talked about Bitcoin’s rebound from difficulties in 2022. In 2023, Bitcoin’s designate seen a important develop of 155%.

Noteworthy events in 2023 encompass file-breaking Bitcoin transactions, Ripple’s apt victory in opposition to the SEC, and PayPal’s introduction of a USD stablecoin.

Ark illustrious that early final year Bitcoin surged by over 40% year when regional banks such as Silicon Valley collapsed. This highlighted Bitcoin’s feature as a safeguard in opposition to counterparty risk.

Furthermore, it indicated that Bitcoin exceeded its on-chain market sensible. The kind of milestone hadn’t been executed in about 4 years.

“Historically, when the value of Bitcoin crosses above the market point out, it in overall indicates the early stages of a bull market,” Ark stated.

The firm also stated that Bitcoin is reworking into a valid risk-off asset, in overall seen as a haven for the length of classes of market turmoil.

Ark Sees Bitcoin as a Top Proper Haven Investment

Ark CEO Cathie Picket is illustrious for her solid advocacy of Bitcoin. The firm she heads holds one in all the no longer too lengthy ago current discipline Bitcoin ETFs.

She no longer too lengthy ago known as Bitcoin “one in all the ultimate investments of our lifetimes,” emphasizing its worldwide, rule-based fully financial method. “We suppose it’s the ultimate of your complete crypto solutions out there,” she added.

Source : cryptonews.com