Bitcoin Spot Trading Volume on CEXes Reaches $34 Billion, Highest Level Since FTX Collapse

Bitcoin Region Buying and selling Volume on CEXes Reaches $34 Billion, Highest Stage Since FTX Give map

The Bitcoin (BTC) put trading volume on centralized exchanges (CEXes) has reached the absolute most realistic level of task since the crumple of FTX.

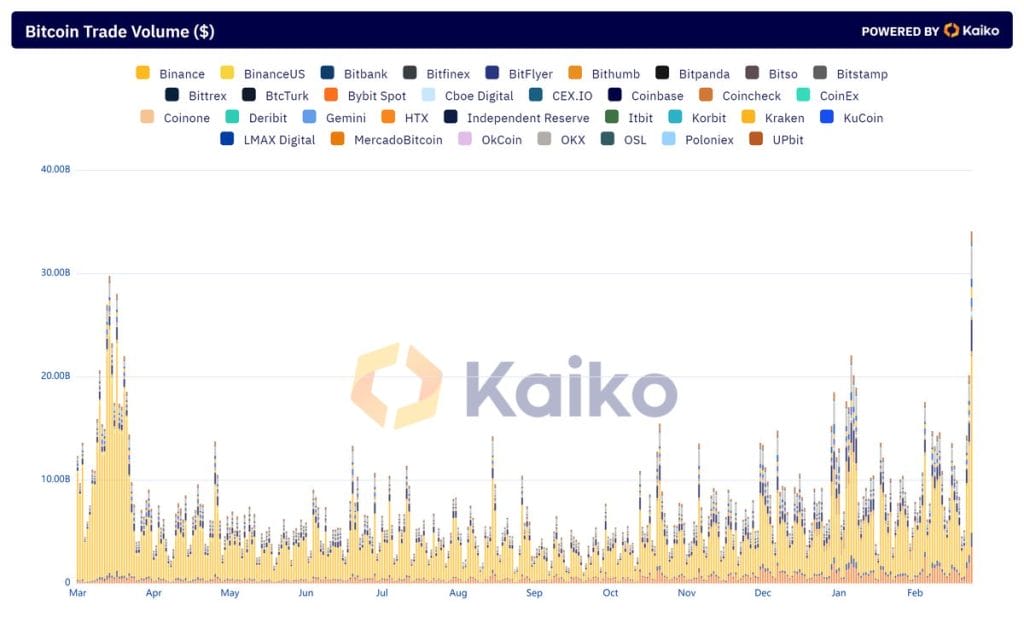

Per files supplied by Kaiko, Bitcoin put trading volume at some level of all predominant CEXes hit an spectacular $34.05 billion on February 28.

Main the cost, Binance accounted for $17.09 billion, solidifying its situation because the dominant force in the crypto trading sphere.

No longer a long way in the aid of, Bybit made a indispensable entry with $3.5 billion, followed intently by Coinbase at $2.98 billion, OKX at $2.92 billion, and Kraken rounding off with $1.05 billion.

Bitcoin Region Volume Rises As BTC Nears $64,000

The indispensable elevate in Bitcoin put trading volume because the main cryptocurrency continues to push increased amid the optimism surrounding put ETFs.

On Wednesday, BTC shoot above $63,000 for the main time since November 2021, in instant touching $64,000 before turning lower.

The flagship cryptocurrency is correct below its all-time high of $68,982.20, which became recorded in November 2021.

With the memoir in certain search for, the market has been a long way more motivated to gaze that level retested.

Bitcoin has soared in terms of 20% this week alone, after every week-long halt of this three hundred and sixty five days’s rally. It’s now up more than 40% for 2024.

“The most modern rally in the crypto market marks a qualitatively contemporary chapter on this planet of cryptocurrencies,” Sergei Gorev, probability supervisor from Web3 fintech platform YouHodler, said in a observation.

“We can explore that, if beforehand most cryptocurrencies had been keen in the identical route, now the supreme quality and actual dynamics are noticed in BTC, the put more liquidity is pouring in on daily basis.”

Gorev added that cash is at show conceal keen from lower-quality altcoins into more established cryptocurrencies.

Furthermore, the extent of margin lending is at a fairly low level, which offers alternatives for additional dispute of BTC.

“Cease now no longer fail to remember about the upcoming BTC halving, which is able to rob situation on April 21, 2024, as well to the truth that in the intervening time, put BTC ETFs purchase 10 conditions more BTC day-to-day than miners assemble day to day,” he eminent.

Declining Buying and selling Volume on CEXes

Final three hundred and sixty five days, crypto researcher CCData reported that centralized exchanges be pleased witnessed a predominant decline in trading volume.

In September, the mixed put and derivatives trading volume on these exchanges dropped by 20.3% to reach $1.67 trillion, marking the lowest month-to-month trading volume recorded since December 2022.

No topic an overall lowering pattern in trading volume at some level of centralized exchanges (CEX), Korean exchanges be pleased managed to elongate their market half and trading volume.

After reaching a high of $forty five billion in entire trading volume in February, the volume experienced a decline, hitting $23 billion in Can even.

Nevertheless, it has since shown an upward trajectory, reaching as high as $37 billion in July. This dispute outpaced that of Binance, demonstrating the relative energy of Korean exchanges in the international market.

If truth be told, when evaluating trading volumes with Binance and Coinbase, the four predominant Korean exchanges continuously showcased increased volumes, indicating their predominant presence in the global panorama.

Over the course of the three hundred and sixty five days, the market half of these exchanges relative to Binance has viewed a indispensable elevate, rising from 7% in March to 16% in September.

Source : cryptonews.com