Bitcoin Price Prediction: BTC Consolidates Near $42,830 Amid Cathie Wood's Gold Comparison

Bitcoin Price Prediction: BTC Consolidates Come $42,830 Amid Cathie Wood’s Gold Comparability

Bitcoin worth prediction stays bullish as BTC‘s climb to $42,830 ignites discussions, with Cathie Wood championing it as the recent gold, reshaping funding systems in the digital age.

Market sentiment appears to be like cautiously optimistic as influential voices admire Cathie Wood compare Bitcoin’s utility to that of gold, suggesting a paradigm shift in asset allocation systems.

Meanwhile, the market assimilates ProShares’ acknowledgment of a pickle Bitcoin ETF’s have an effect on on futures contracts.

Amidst this, JPMorgan’s critique of Tether underscores the heightened scrutiny on regulatory compliance within the crypto sphere.

Cathie Wood on Bitcoin and Gold

Cathie Wood, ARK Make investments’s CEO, highlights a pivotal shift in funding preferences from gold to Bitcoin, spurred by the launch of pickle Bitcoin ETFs.

She describes Bitcoin as changing correct into a most popular “likelihood-off” asset, in particular renowned for the duration of the regional financial institution disaster in the US in March 2023.

Constancy’s 2023 details shows a fundamental correlation between Bitcoin and gold, peaking at 0.80, underlining the rising investor sentiment that aligns Bitcoin closely with worn safe-haven assets.

Wood stays assured in Bitcoin’s doubtless to eclipse gold, bolstered by the broader adoption of pickle Bitcoin ETFs.

No topic a dip in Bitcoin’s worth post-ETF launch, Wood interprets the market’s reaction as indicative of a protracted-term funding horizon.

ARK Make investments’s dedication is evident by its wide retaining of $705.8 million in Bitcoin within its ETF.

This transfer, in accordance to Wood, is susceptible to foster increased investor engagement and bullish sentiment in direction of Bitcoin’s price.

ProShares Optimistic About Residing Bitcoin ETFs

ProShares, a leading decide in Bitcoin futures ETFs, anticipates obvious outcomes from the US launch of pickle Bitcoin ETFs. Simeon Hyman, ProShares World Funding Strategist, highlights the company’s advantage from the excessive procuring and selling volumes of its ProShares Bitcoin Strategy ETF (BITO).

He notes that irrespective of the presence of pickle ETFs, BITO maintains procuring and selling discontinuance to its accept asset price, with minimal premiums or discounts.

#ProShares embraces pickle #Bitcoin #ETF impact on #BITO futures :

ProShares sees benefits of the launch of pickle Bitcoin ETFs for its Bitcoin futures merchandise, in accordance to a senior funding strategist.On Jan. 11, BITO’s procuring and selling volumes spiked to as excessive as with regards to $2 billion,… pic.twitter.com/4T3MlrOwjM

— TOBTC (@_TOBTC) February 5, 2024

Residing and Futures ETFs: A Synergistic Relationship

Hyman underscores that pickle Bitcoin ETFs are expected to bolster the already solid and regulated Bitcoin futures market, benefiting the full Bitcoin ecosystem.

The initial surge in BITO’s procuring and selling volumes post-pickle ETF launch has stabilized, indicating a rising synergy between pickle and futures Bitcoin merchandise.

This pattern is poised to blueprint extra contributors to the market, doubtlessly elevating BTC prices by increased investor engagement and self assurance.

JPMorgan Highlights Dangers with Tether’s Regulatory Practices

JPMorgan has raised considerations in regards to the cryptocurrency market’s likelihood profile, attributing it to Tether’s perceived shortcomings in regulatory compliance and transparency.

The funding financial institution’s prognosis suggests Tether, when put next to opponents admire Circle’s USDC, faces better regulatory vulnerabilities.

JPMorgan predicts that stablecoins adhering to regulatory requirements would possibly maybe elevate pleasure in tighter oversight, doubtlessly gaining market part in the formula.

JPMorgan Warns of Elevated Threat for Crypto Market Due to Tether’s ‘Lack of Regulatory Compliance and Transparency’ #bitcoin📷 #crypto #CryptoNews #cryptocurrency

— Brandon Lee (@FatexHermit) February 6, 2024

Tether’s Residing and Market Affect

In response, Tether’s CEO Paolo Ardoino has defended the stablecoin’s dominance, arguing that its presence is no longer detrimental to the markets relying on it. No topic a $41 million dazzling by the CFTC for past infractions, Tether has been training better transparency.

On the opposite hand, JPMorgan warns that increased regulatory scrutiny would possibly maybe instantaneous a shift in investments in direction of extra compliant stablecoins, influencing Bitcoin prices and the broader market landscape.

Bitcoin Price Prediction

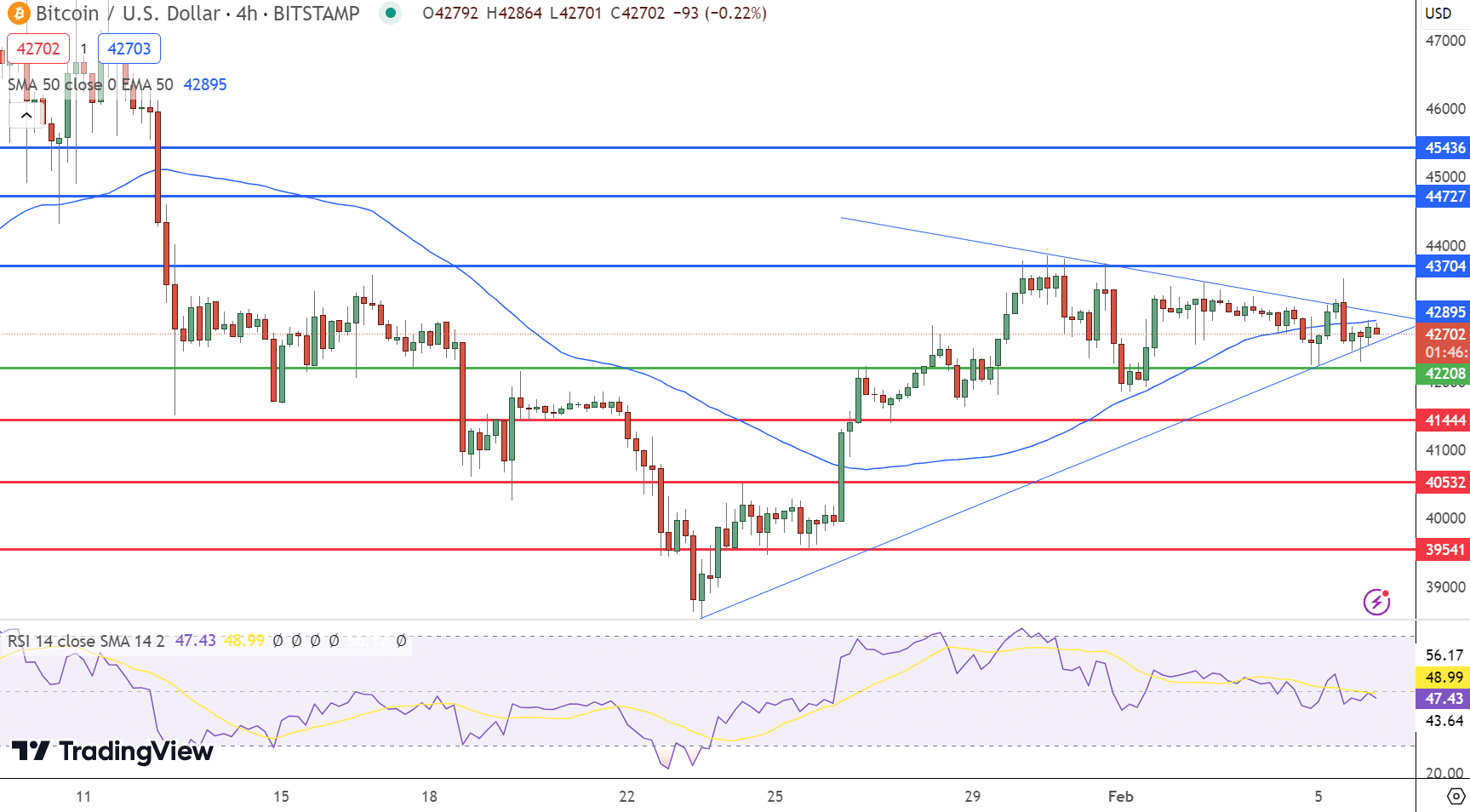

Bitcoin registers a minor setback, procuring and selling at $42,626, marking a 0.8% decline. The 4-hour chart shows a fundamental juncture with the pivot level at $42,208, guiding instantaneous market sentiment.

Resistance ranges are poised at $42,895, $43,704, and $44,727, delineating doubtless hurdles for upward momentum.

Conversely, beef up ranges at $41,444, $40,532, and $39,541 provide foundational beef up for retracements.

Technical indicators camouflage a mixed device. The Relative Energy Index (RSI) stands at 47, suggesting a neutral market stance.

The Transferring Realistic Convergence Divergence (MACD) details a worth of -37 against a signal of -31, indicating a puny bearish momentum as the MACD line trails below the signal line.

The 50-day Exponential Transferring Realistic (EMA) aligns with the first resistance stage at $42,895, hinting at a pivotal resistance zone.

Bitcoin’s present consolidation fragment between the $43,000 and $42,000 marks suggests a cautious market.

The total style leans bullish above the pivot level of $42,200, reflecting doubtless for upward motion if this threshold is maintained.

High 15 Cryptocurrencies to Stare in 2023

No longer sleep-to-date with the arena of digital assets by exploring our handpicked sequence of the fully 15 alternative cryptocurrencies and ICO projects to retain an note on in 2023. Our record has been curated by experts from Industry Talk and Cryptonews, guaranteeing educated advice and serious insights for your cryptocurrency investments.

Rob excellent thing about this alternative to gaze the aptitude of these digital assets and retain yourself educated.

Disclaimer: Cryptocurrency projects endorsed in this text are doubtless to be no longer the financial advice of the publishing creator or newsletter – cryptocurrencies are highly perilous investments with substantial likelihood, repeatedly kind your devour learn.

Source : cryptonews.com