Bitcoin Price Prediction: BTC Nears $43,000; Can ETF Surge & MicroStrategy Buy-In Fuel a $50,000 Rally?

Bitcoin Mark Prediction: BTC Nears $43,000; Can ETF Surge & MicroStrategy Aquire-In Gas a $50,000 Rally?

All the tactic in which during the Asian session, Bitcoin‘s trajectory garners foremost consideration, with the asset flirting with the $43,000 brand. Contemporary developments, in conjunction with BlackRock’s Bitcoin ETF mountain climbing to the elite ranks of ETFs and MicroStrategy’s plentiful acquisition, create larger the discourse around Bitcoin build prediction.

These strategic strikes, coupled with a well-known moderate return for cryptocurrency investors in 2023 and ongoing factual dramas, frame a compelling chronicle. As stakeholders dissect these elements, speculation mounts over whether or no longer these catalysts would possibly perhaps perchance propel Bitcoin in direction of an valorous $50,000 rally.

BlackRock’s Bitcoin ETF Tops 0.2% of All ETFs

With flows over $3.19 billion, BlackRock’s iShares Bitcoin ETF has risen to the cease 0.16% of all US ETFs, even after a seven-day trading pause while it awaited SEC approval. At $2.51 billion, Constancy’s Bitcoin Fund is ranked highly as effectively.

Bitcoin ETFs are aloof gaining repute even though they got a gradual begin up when put next to other ETFs. BitMEX Analysis indicates that Constancy and BlackRock are outperforming Grayscale by contrivance of flows. This pattern indicates an create larger in institutional passion in publicity to Bitcoin.

Resulting from the plentiful capital that these ETFs design, there’ll most definitely be an develop in search records from for Bitcoin and a subsequent create larger in build. Moreover, the conventional withdrawals from Grayscale brand a altering inclination in settle on of ETFs, that can also just elevate the worth of Bitcoin as extra cash enters the market.

MicroStrategy Provides $37M BTC, Now Holds 190,000

In January, MicroStrategy added 850 Bitcoin to its portfolio, valuing its sources at $8.1 billion, or 190,000 BTC. The company’s CFO revealed for the duration of its Q4 2023 earnings name that they bought 56,650 Bitcoin in 2023 at an moderate rate of $33,580. MicroStrategy’s realization of Bitcoin’s doable as an institutional-grade asset class is what resulted in its rep earnings to create larger to $89.1 million.

MicroStrategy adds to its Bitcoin holdings, procuring $37M worth in January, now keeping a total of 190,000 BTC valued at $8.1 billion. #Bitcoin #MicroStrategy

— Ai TPL (@tradepro_labs) February 7, 2024

Chairman Michael Saylor rejects earlier criticism, arguing that the introduction of tell Bitcoin ETFs enhances Bitcoin’s standing as a store of worth. Despite worries about the influence of dilapidated monetary establishments, MicroStrategy is aloof optimistic and anticipates continuing to amass Bitcoin.

This continuous accumulation by a foremost institutional investor reminiscent of MicroStrategy can also just create larger search records from for Bitcoin and relieve build enhance.

Bitcoin Mark Prediction: 2023 Crypto Traders Gape $887 Common Returns

Primarily based on CoinLedger, investors in cryptocurrencies observed an moderate return of $887 in 2023—a foremost enchancment over the $7,102 in losses they observed in 2022. The resurgence of the cryptocurrency market is a outcomes of the alternate’s resiliency following the mess ups of companies reminiscent of FTX. Though there had been disappointments within the past, hope elevated when tell Bitcoin ETFs had been equipped in January 2024.

CRYPTO INVESTORS AVERAGE NEARLY $900 IN NET GAINS FROM 2023 CRYPTO SALES

– Crypto investors, as analyzed by CoinLedger, reaped an moderate of $887.60 in rep beneficial properties from crypto sales in 2023.

– The findings, basically based on reporting from 500,000 users, present insights into the… https://t.co/cTVnO0lEJL pic.twitter.com/8N4oI3KGUU

— BSCN (@BSCNews) February 7, 2024

Primarily based on the learn, these that contain Bitcoin are more liable to withhold onto their holdings, which helps to withhold market balance. This optimistic outlook would enhance investor self perception in Bitcoin, which would possibly perhaps perchance elevate search records from and push costs greater.

Extra cash can also just straggle with the high-tail into the cryptocurrency market, especially Bitcoin, as more investors realize its doable, which would possibly perhaps perchance perchance well protect the worth trajectory of the cryptocurrency.

Bitcoin Mark Prediction

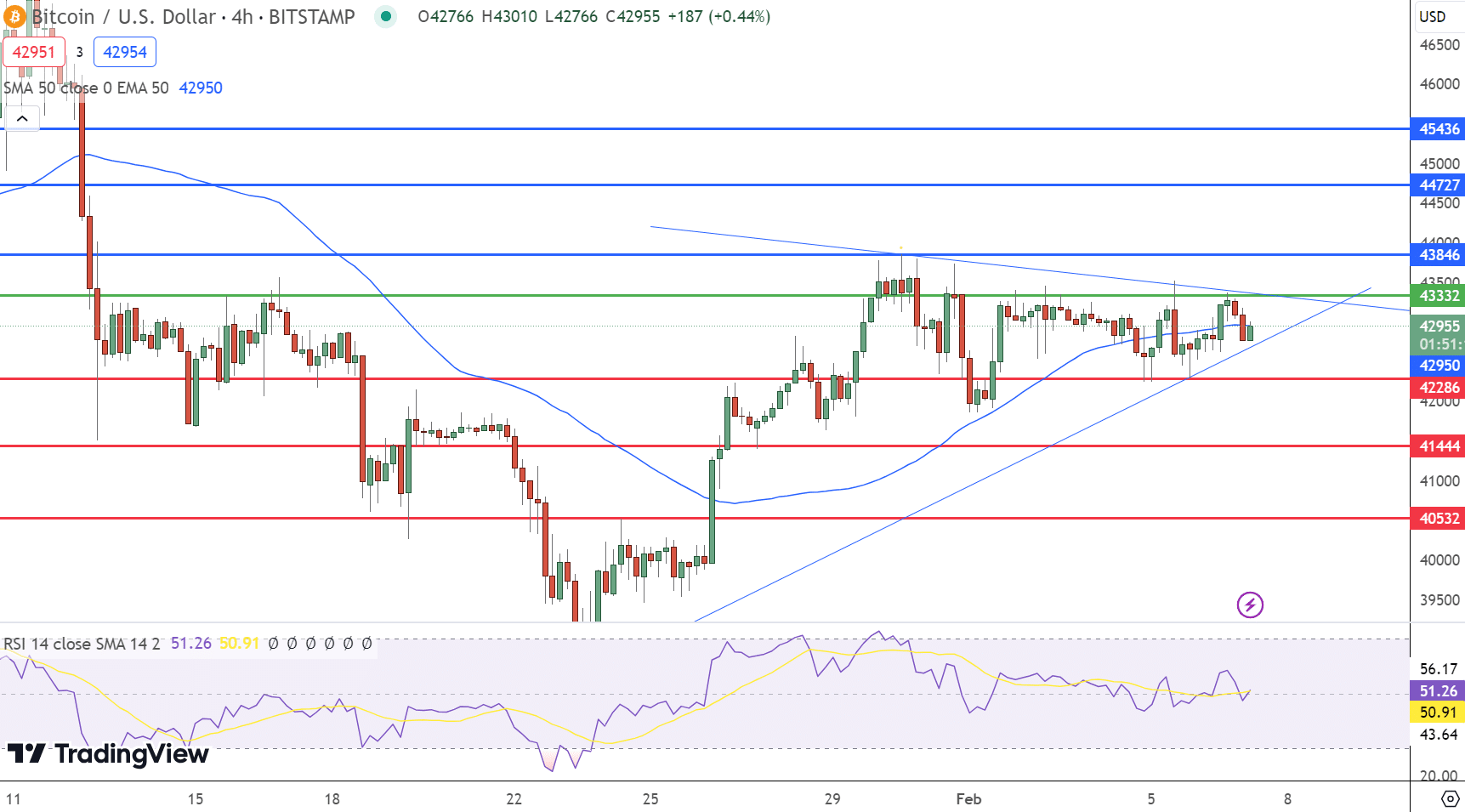

Bitcoin‘s trajectory witnessed a modest decline, slipping 0.47% to stand at $42,895. Amidst this backdrop, our diagnosis zeroes in on serious build thresholds and technical indicators to forecast Bitcoin’s impending movements.

The pivot level, marked at $43,332, becomes a level of interest, with resistance phases staged at $43,846, $44,727, and $Forty five,436. Enhance phases, pivotal for bearish reversals, are delineated at $42,286, $41,444, and $40,532.

Key Aspects:

- Bitcoin hovers at $42,895; eyes pivotal $43,332 for directional cues.

- RSI and 50 EMA signal a balanced, watchful market teach.

- Symmetrical triangle pattern suggests imminent breakout doable.

The Relative Energy Index (RSI) hovers at 51, suggesting a balanced market sentiment, while the 50-day Exponential Transferring Common (EMA) at $42,950 provides extra context to the prevailing market dynamics.

A well-known symmetrical triangle pattern underscores Bitcoin’s contemporary consolidation part, hinting at doable breakouts. Our diagnosis leans in direction of a bullish outlook above the $43,000 brand, contingent on overcoming the symmetrical triangle’s resistance.

Prime 15 Cryptocurrencies to Behold in 2023

Protect up-to-date with the realm of digital sources by exploring our handpicked collection of the finest 15 alternative cryptocurrencies and ICO projects to withhold an eye on in 2023. Our record has been curated by experts from Industry Talk and Cryptonews, guaranteeing knowledgeable recommendation and serious insights to your cryptocurrency investments.

Make one of the most of this opportunity to idea the aptitude of these digital sources and protect yourself steered.

Disclaimer: Cryptocurrency projects counseled listed listed below need to no longer the monetary recommendation of the publishing creator or publication – cryptocurrencies are highly perilous investments with appreciable possibility, repeatedly lift out your contain learn.

Source : cryptonews.com