Expert Take: Rising DeFi TVL is Silencing the Doubters

Expert Rob: Rising DeFi TVL is Silencing the Doubters

As its TVL rises, commerce insiders recount that DeFi is seeing increasing interest once extra. DeFi is sturdy and can continue to amplify, the experts recount, adding that 2024 will almost definitely be a thrilling year for this growing sector.

DeFi is Resilient, TVL On The Upward push

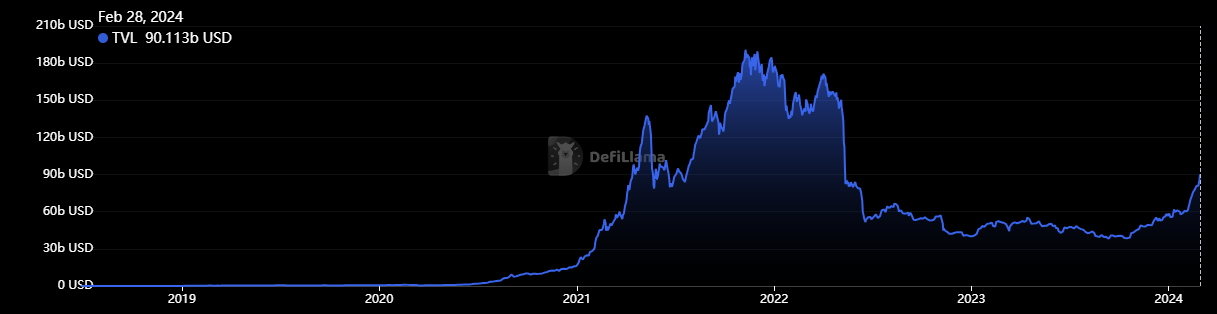

The total place locked in decentralized finance (DeFi) has surpassed $80 billion. It’s the first time it has breached this threshold since the inappropriate drop of the Terra stablecoin almost two years previously.

In conserving with DefiLlama, TVL is at this time $90.113 billion. The last time it stood at this level became Could per chance per chance 2022.

An amplify may perchance well moreover moreover be viewed initiating October 2023, selecting up tempo in January 2024.

Between October 28, 2023, and February 28, 2024, TVL has elevated by 108.3%.

Blockchain platform Swarm Markets’ co-founder Timo Lehes commented that,

“The tip of the Crypto Winter has led to an amplify in investor self belief, which has filtered thru into the DeFi market. We depend on this pattern to continue, especially if the costs of successfully-identified crypto assets continue to upward thrust.”

He illustrious that the DeFi sector is at probability of “the vagaries” of the wider market as most other sectors are.

On the opposite hand, the above-mentioned amplify proves that the DeFi sector is moreover resilient.

Furthermore, DeFi tasks added extra than $42 billion in assets over the previous few months. This truth “proves the doubters unpleasant,” Lehes argued.

Therefore, DeFi will entirely amplify in numbers and size in the arrival years, he concluded.

Heaps to Be Angry About

Barney Mannerings, DeFi skilled and Founding father of Vega Protocol, a decentralized commerce for futures and perpetuals, stated that we’re witnessing a growing interest in DeFi all every other time.

In a whisper shared with Cryptonews, he argued that there is a new wave of experimentation and innovation in the sector.

Right here’s the of the introduction of fresh primitives to the community, Mannerings explained. They are essentially essentially based spherical Ethereum’s staking and yield functionalities.

Additionally, the hot gains in the crypto market appear like “funneled back into protocols.” We continuously stare this as a comprise market turns bullish, Mannerings stated and added:

“The truth that ETH, which many are speculating will almost definitely be packaged into a new station commerce-traded fund (ETF), is rising so dramatically is entirely supercharging this pattern. But, the spectacular showing of Ethereum Layer-2’s (relish Mantle and Gnosis) over the previous week is showing that boost is going down in sharp areas, too.”

As reported earlier this month, wealth administration firm Bernstein urged that Ethereum may perchance well be the entirely digital asset after Bitcoin to acquire a station ETF approval.

Furthermore, United States investors’ assignment has led to ETH place hikes in contemporary weeks. A critical reason is investors’ anticipation of station Ethereum ETF approvals.

Meanwhile, the “appreciable boost” of fresh DeFi primitives relish Pendle are providing extra reasons to be angry, the Founder argued.

Coupled with the appearance of fashionable derivatives exchanges, relish Vega, “it’s attempting relish a truly moving time for DeFi, and it will almost definitely be sharp to stare what 2024 brings.”

____

Learn extra:

- John Paller, Founding father of ETHDenver, on Present Voice of ETH, and Contrivance forward for DeFi, DAOs, and NFTs

- DeFi Protocol Tranchess Launches Recent Staking Products Offering Fixed and Leveraged Returns

- Extra Institutions Will Uncover to DeFi for Regulated Solutions in 2024

- Ethereum’s TVL Breaches $50 Billion as DeFi Task Ramps Up

Source : cryptonews.com