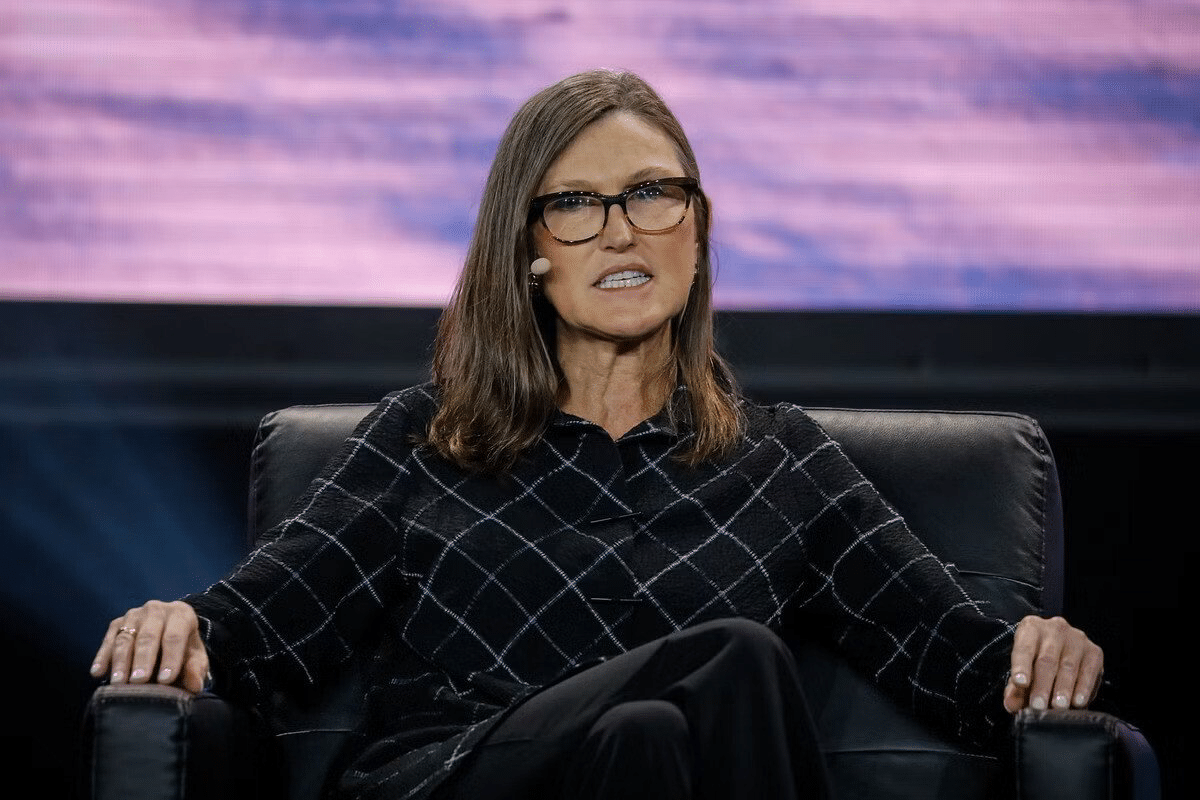

Cathie Wood Says Investors Are Ditching Gold For Bitcoin

Cathie Wood Says Traders Are Ditching Gold For Bitcoin

Ark Invest CEO Cathie Wood believes Bitcoin (BTC) is foundation to change gold on the investment stage because the important steel loses reputation over time.

In a video presentation published by Ark on Sunday, Wood demonstrated how commodities at orderly bear didn’t present a reliable hedge in opposition to inflation over a multi-decade period.

“This day, we’re where we were within the early 80s,” said Wood in reference to the Bloomberg Commodity Index. “Right here’s no longer adjusted for inflation – you would possibly well well per chance handiest imagine how low these commodity prices would be.”

Bitcoin VS Gold: A Historical See

In January 1981, gold traded for $555 per ounce, that scheme it fared larger than other commodities over the next loads of a long time. Its yelp has been somewhat puny since reaching $1,800 in 2011, then again, now procuring and selling for $2030, 13 years later.

Finally of that point, Bitcoin (BTC) rose from $1 in 2011 to $43,000 on the present time, trouncing gold’s performance across when it comes to all timeframes. On yarn of of its decentralized nature and puny provide, Wood illustrious that Bitcoin is frequently in most cases called digital gold.

“Bitcoin shot up 40% because the KRE – the regional financial institution index – became imploding,” Wood illustrious, relating to the U.S. banking crisis in March 2023 provocative many crypto-adjoining banks. Gold also rose on the time, but to no longer the identical stage.

Bitcoin’s Reaction to ETFs

Though Bitcoin experienced a fast decline next to gold after the birth of loads of U.S. discipline ETFs closing month, the asset’s brand has since returned to pre-birth ranges. Gold itself had a unhurried originate when its first ETF launched in 2004, before embarking on an eight-twelve months bull spin from $400 to $1,800.

Cathie Wood on why #Bitcoin is going to $1 Million 🔥

“The extra uncertainty and volatility within the area economies, the extra our self assurance in #bitcoin will increase. It is miles a hedge in opposition to inflation.” pic.twitter.com/vwLIpQHNSZ

— Vivek⚡️ (@Vivek4real_) January 29, 2024

Essentially based mostly on Wood, Bitcoin handiest declined after the ETFs were presented because it became a “promote the news match” – when speculators buy an asset preceding an anticipated particular match, then steal earnings after it truly occurs.

About 15 million BTC out of 19.5 million in circulation are soundless in “robust fingers” – that scheme they haven’t moved on the blockchain interior 155 days.

“This belief that [Bitcoin] is a flight to safety, or a flight to quality, is reasserting itself right here,” said Wood. “There’s now a substitution into Bitcoin, and we advise that’s going to continue now that there is a substantial more straightforward scheme, less friction-filled scheme, to entry Bitcoin.”

Ark Invest became one amongst nine asset managers to birth a recent Bitcoin discipline ETF on January 11.

The ARK 21Shares Bitcoin ETF (ARKB) experienced its very first day of zero obtain inflows on Monday but absorbed one other $8.6 million on Tuesday. To date, it now holds $717 million payment of BTC.

Source : cryptonews.com