Digital Asset Spot Trading Volumes Rise for the Fourth Consecutive Month + More Crypto News

Digital Asset Region Trading Volumes Upward push for the Fourth Consecutive Month + Extra Crypto Recordsdata

Score your daily, chunk-sized digest of blockchain and crypto news – investigating the reviews flying below the radar of on the present time’s news.

In on the present time’s model:

- Digital Asset Region Volumes Upward push for the Fourth Consecutive Month

- Paxos Adopts Chainlink’s PayPal USD Impress Feed

- The Hashgraph Association and Ministry of Investment of Saudi Arabia Launch $250M Deeptech Enterprise Studio

__________

Digital Asset Region Trading Volumes Upward push for the Fourth Consecutive Month

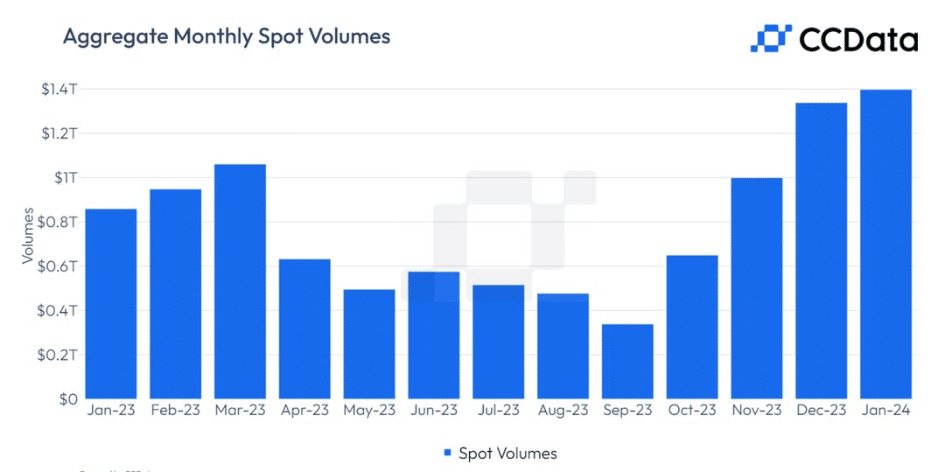

In January, the digital asset put of living trading volumes on centralized exchanges elevated by 4.forty five% to $1.4 trillion, recording the fourth consecutive amplify in month-to-month put of living trading volumes, in line with the latest market file from on-chain analytics firm CCData.

The last time the digital asset sector skilled a identical development became in Would possibly perhaps perhaps 2019, it added.

Binance kept its put as the largest put of living trading trade, with volumes rising 2.73% to $437 billion. It recorded a market allotment of 31.3%.

The 2nd-largest put of living trade, OKX, seen its trading volumes plunge 5.22% to $ninety 9.1bn. Attributable to this fact, its market allotment dropped from 7.81% to 7.09%.

Also, Coinbase recorded a rise in its market allotment rise for the third consecutive month to 5.42%.

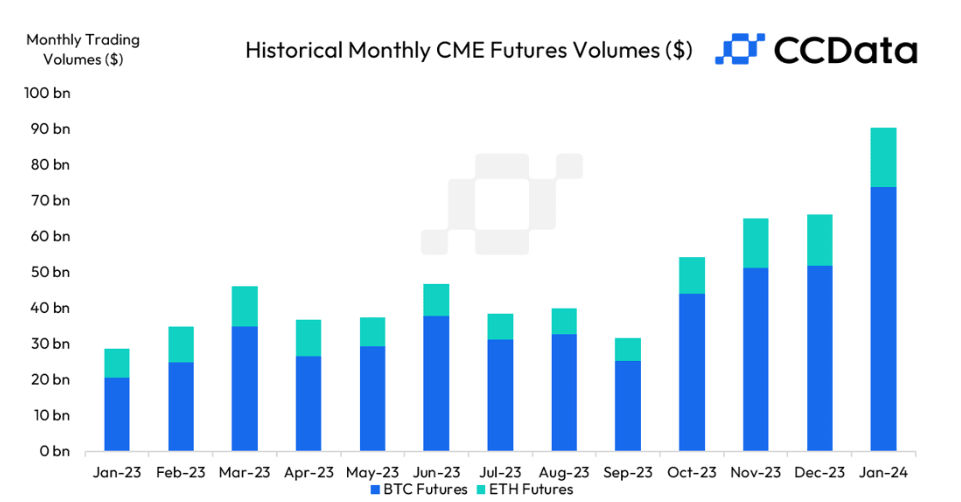

Meanwhile, the complete derivatives trading quantity on the CME rose 35.2% to $94.9 billion. This is the ideal quantity since October 2021.

The trading quantity for BTC futures on the trade rose 42.4% to $73.9 billion. This came about as institutional merchants harm down their positions after the approval of the put of living Bitcoin ETFs within the US, the file stumbled on.

The starting up curiosity of BTC futures on the CME trade currently surpassed the starting up curiosity on Binance. However, it “has now reversed its development.” It fell 8.50% to $4.42 billion.

BTC alternate options traded on the trade also fell 29.9% to $1.57 billion.

Meanwhile, the trading quantity for ETH futures on the trade rose 15.6% after the attention rapid shifted to a probable ETH ETF approval, with seven candidates waiting for the SEC decision later this year, CCData said.

Paxos Adopts Chainlink’s PayPal USD Impress Feed

Regulated blockchain infrastructure and tokenization platform Paxos joined hands with the decentralized computing platform Chainlink to streak up the adoption of PayPal USD (PYUSD).

In step with the click free up, Chainlink now helps a PYUSD Chainlink Impress Feed on the Ethereum mainnet.

The recent PYUSD Impress Feed enables customers to peep honest, legit, and decentralized market knowledge for PYUSD on the blockchain.

This permits customers to acquire the bolt within the park they must wait on develop exact markets spherical PYUSD and undertake it as their most well liked stablecoin to facilitate on-chain payments, said the announcement.

It added that,

“By securely delivering honest PYUSD knowledge on-chain, Chainlink Impress Feeds wait on PYUSD to entice initial liquidity and kickstart ecosystem-wide adoption.”

Chainlink Impress Feeds present a bunch of aspects, equivalent to high-quality knowledge, exact node operators, financial system of scale, decentralized network, and transparency.

Meanwhile. PYUSD is an starting up and programmable stablecoin backed by dollar deposits, US treasuries, and cash equivalents. It’s issued by Paxos.

Furthermore, the stablecoin is transferable on Ethereum, the put it serves as collateral for DeFi initiatives and facilitates payments.

“Together, Chainlink and Paxos are advancing the use of tokenized exact-world sources (RWAs) and helping scale on-chain finance to billions of customers at some stage within the globe,” the click free up said.

The Hashgraph Association and Ministry of Investment of Saudi Arabia Launch $250M Deeptech Enterprise Studio

The Hashgraph Association, the non-earnings group accelerating the big adoption of the DLT network Hedera, has equipped the signing of a strategic partnership with the Ministry of Investment of Saudi Arabia (MISA) to inaugurate a “DeepTech Enterprise Studio” in Riyadh value $250 million over 5 years (2024-2028).

Per the click free up, The Hashgraph Association became phase of the Swiss Financial Delegation traveling to Saudi Arabia below the patronage of Guy Parmelin, Head of the Department of Financial Affairs, Education and Study (EAER).

The custom-designed DeepTech Enterprise Studio will enable local Saudi companies and international portfolio companies looking for to set operations within the nation to originate revolutionary alternate options, leveraging deep tech equivalent to AI, DLT, Robotics, IoT, VR, and Quantum Computing.

The studio goals to onboard over 500 companies throughout the 5-year program. This might perhaps perhaps rep dedicated enhance from the Ministry by the facilitation of entrepreneurial licenses and the doorway of companies below Saudi guidelines and regulations. This entails connecting with key government stakeholders, strategic partners, and investors, the announcement said.

The initial allotment (Part A) of the Enterprise Studio will level of curiosity on ramping up local operations inner 300 and sixty five days and onboarding the first batch of 100 initiatives.

The 2nd allotment (Part B) will level of curiosity on accelerating the Enterprise Studio over 24 months, guaranteeing regular-pronounce operations, and onboarding and investing in a recent batch of 200 initiatives.

The 5-year program’s last allotment (Part C) will level of curiosity on scaling up the Enterprise Studio operations into recent strategic markets globally and onboarding the last batch of 200 initiatives.

Startups qualifying for the program will rep as a lot as $250,000 in conducting capital investment, with enterprises receiving as a lot as $500,000.

Source : cryptonews.com