Coincheck Partners with Circle; USDC’s First Japan Listing Close?

Coincheck Companions with Circle; USDC’s First Japan List Conclude?

Circle, USDC’s issuer, has struck a partnership address Coincheck, one of Japan’s preferrred crypto exchanges – with a discover about to securing the stablecoin’s first list within the nation.

Per a Coincheck press release, the Eastern firm acknowledged that it had taken “steps in opposition to handling USDC.”

Circle, USDC Aiming for Eastern Success

Circle claimed that Coincheck used to be “planning to elongate receive admission to to” its USD-pegged coin. The Eastern firm is elope by Monex Team, a important securities firm that in December last twelve months sold a majority stake within the 3iQ platform.

Nonetheless, regulatory boundaries peaceable stand within the token’s plan. Eastern crypto exchanges own yet to list any predominant USD-backed money.

Regardless, fiat-pegged money enjoy USDC and USDT revel in appreciable reputation for the length of Asia.

To list a coin, exchanges must assemble “Digital Fee Instrument Providers” registration from regulators below the phrases of the Eastern Fee Providers Act.

We’re overjoyed that @coincheckjp is planning to elongate receive admission to to $USDC to Japan! This marks a important milestone in bringing the soundness of USDC to Japan, and is a strategic growth for USDC in Asia.

Read extra relating to the collaboration here: https://t.co/DOdOxe1LgT pic.twitter.com/t93fYPoEl5

— Circle (@circle) February 27, 2024

But in most up-to-date months, Eastern regulators appear to own relaxed their stance on crypto regulation. Exchanges own added an increasing quantity of altcoins to their platforms.

The authorities has also backed Eastern firms of their very own stablecoin bids. This has given upward thrust to projects enjoy megabank Mitsubishi UFJ’s plans to assemble B2B stablecoin issuing companies.

A Coincheck reliable acknowledged that the platform “recognizes that home crypto asset customers own high expectations for the handling of stablecoins.” The firm added:

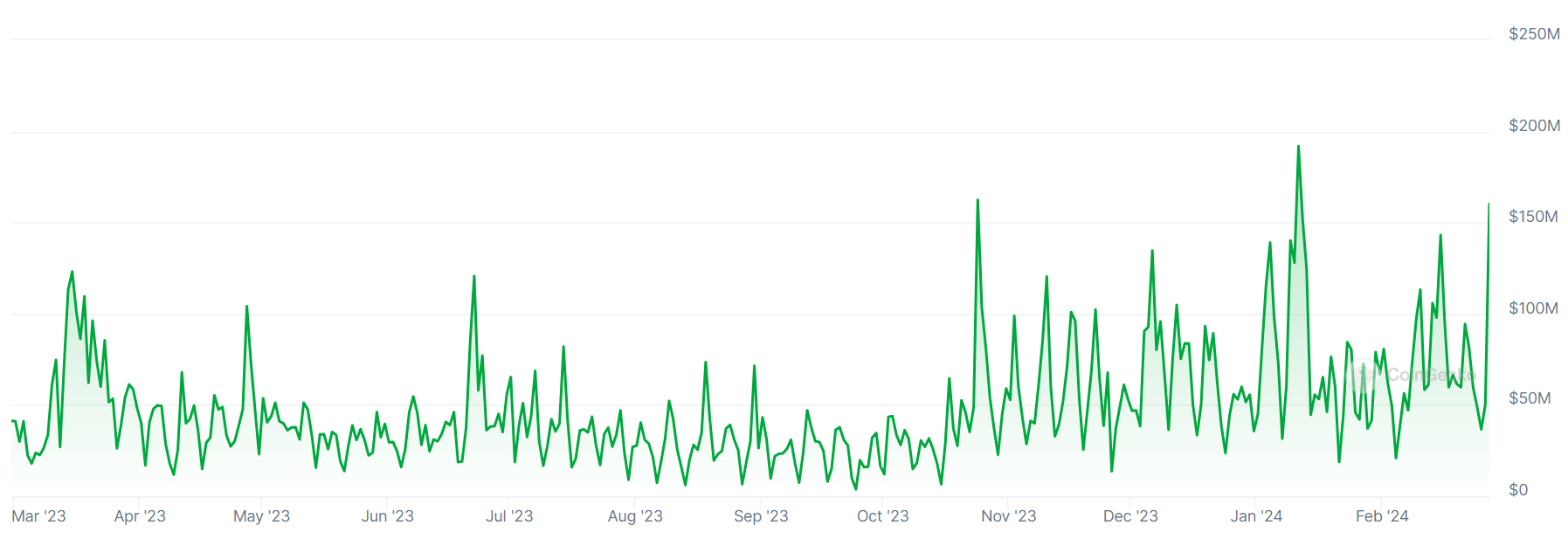

“We ask stablecoins for sing as a settlement currency within the acquisition and sale of cryptoassets and NFTs. This would possibly per chance per chance presumably doubtless lead to an lengthen within the buying and selling volume of NFTs.”

Prime Minister Fumio Kishida and his authorities own previously identified Japan’s NFT sector as a enhance engine for Japan.

The authorities has also unveiled plans to sit down down back guidelines surrounding the plan in which VC firms can spend money on crypto companies.

The Eastern commerce added that “having the capacity to take a step in opposition to handling USDC” used to be “of massive significance to our firm and our customers.”

USD-backed Stablecoins Willing to Take Off in Japan?

Dai Matsumoto, the CEO of Coincheck, acknowledged:

“We’re furious to raise USDC, the global same old for stablecoin tokens, to Japan. We glance forward to working with Jeremy [Allaire, the Co-founder and CEO of Circle] and the Circle crew. Collectively, we thought to additional hang Japan’s crypto market and blockchain ecosystem.”

Allaire acknowledged that Circle’s partnership with Coincheck would be “the foundation for constructing USDC’s balance and credibility within the Eastern market.” He concluded:

“We’re very chuffed with the procedure to work with Coincheck to pioneer a brand novel generation of digital finance in Japan.”

Source : cryptonews.com