Neobanking app enfineo claims it can bridge traditional finance with cryptocurrencies

Neobanking app enfineo claims it would bridge veteran finance with cryptocurrencies

Startup enfineo is constructing an alternate to your favorite cryptocurrency wallets with a spotlight on veteran banking and finance. enfineo ensures that the platform seamlessly integrates traditional banking with the dynamic world of cryptocurrencies, allowing customers to take care of watch over their financial savings accounts, cryptocurrencies similar to Bitcoin, Ethereum and different membership playing cards in a single scheme with out further efforts and fee.

Fully compliant with MiCa laws, the startup not too prolonged ago raised over $3 million in funding rounds led by a chain of crowdfunding and retail investors.

The firm objectives to get rid of the complexity from funds all-collectively, would possibly maybe it be fiat or crypto, as it introduces ‘web3’ ingredients similar to decentralised finance (DeFi), tokenized loyalty functions and more into its very own neo-financial institution. Purchasers can produce an memoir the usage of enfineo in a few minutes, with a in fact easy to practice KYC direction of. They compile a contemporary memoir with an IBAN and an memoir quantity, to boot as a web3 cryptocurrency pockets – each that are aimed to seamlessly combine with each different.

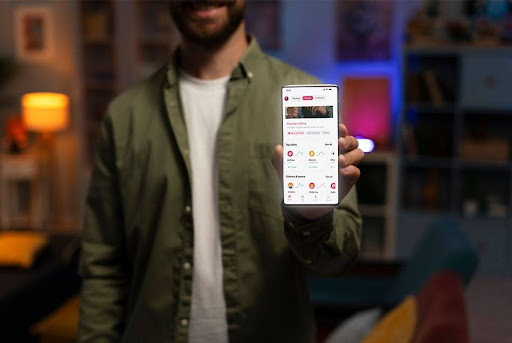

enfineo not too prolonged ago began issuing Mastercard debit playing cards and objectives to roll out its own debit playing cards that can work with Apple Pay and Google Pay. The startup doesn’t charge any foreign transaction prices on high of Mastercard’s replace fee. As soon as the playing cards are rolled out and the user makes a dangle on their card, they’ll compile a push notification on their mobile phone in neutral a few seconds.

In different phrases, enfineo ticks all of the excellent kind boxes in phrases of providing the everyday banking facets, with a blended neutral appropriate thing about allowing customers to navigate during the crypto regulatory landscape relaxed. “We’re providing among the most most attention-grabbing facets from Revolut to boot as crypto household names care for Crypto.com and Wirex, combining the 2 worlds into one seamless utility that even non-crypto natives can with out reveal reveal,” said co-founder and CEO Alin George Luca in a advise.

What makes enfineo different from different NeoBanks is that the startup is web3 centric in nature – constructed on their own infrastructure the build you almost definitely can join your web3 pockets additionally. New stories recommended the rising ardour of Web3.0 in veteran banks with names similar to Extra special Chartered, CitiBank and JP Morgan embracing cryptocurrency, investing into masses of platforms and incorporating several facets into its own. And that’s neutral appropriate the tip of the iceberg, as many more aren’t essentially as renowned but are tranquil increasing toughen in direction of crypto-pleasant schemes.

With its own native $ENF cryptocurrency token, the accomplishing hosts a vary of utilities similar to gamified cryptocurrency rewards for enfineo memoir holders, cashback on transactions in ENF tokens and more. “We’re committed to actual enchancment and innovation, actively partaking with our community to adapt and toughen our companies, ensuring that we stay at the forefront of the all of sudden changing financial landscape,” continues Alin. With a whole provide of 150 million tokens, the accomplishing additionally enables customers to stake their $ENF tokens, which objectives to enable a bunch of advantages including but not itsy-bitsy to free subscriptions on the enfineo app, decrease transaction prices, allowlists in masses of funding swimming pools to boot as governance and more.

With enfineo, customers are additionally promised shorter transaction times and lesser foreign transaction prices. For instance, within the UK, financial institution transfers are powered by Swiftly Payments, which makes transfers instantaneous, despite the undeniable fact that in some circumstances, it has been eliminated to plan terminate a minimum of a few hours, and even a few days. enfineo guarantees to gash that point short to a mere 15 seconds.

“We set particular to take care of the transaction times with out compromising on security, which is a big heart of attention for us. As a neobank that affords crypto and fiat resources, we prioritise the protection of our customers’ resources and data. Our platform contains superior security measures and adheres to regulatory requirements, ensuring a actual and loyal atmosphere for financial transactions.”

The startup generates earnings from subscriptions. An memoir charges £5 per month. The firm additionally objectives to enable customers the capability to present a boost to or downgrade their memoir tiers, offering whole flexibility, enriching user trip. Mild in its infancy phases, enfineo has bought ardour with more than 5,000 monthly active testers as of January 2024 on its contemporary MVP, with Alpha testing dwelling to toddle are dwelling in Q1 2024.

Would maybe dangle to you’re accustomed to neobanks, you would possibly maybe know that fintech startups additionally generate earnings from interchange prices. At any time whereas you pay with your card, the cardboard transaction prices are split between the service provider’s financial institution, the community provider (Mastercard shall we embrace) and the buyer’s financial institution (enfineo if that is the case).

Sometime, enfineo plans to introduce spending pockets, offering customers the capability to link playing cards to explicit spending classes and fragment these pockets with others for streamlined funds administration. Users can produce a spending pocket and reveal their crypto and fiat in a single hobble. For instance, whereas you happen to buy a laptop that charges 2000 usd, and also you easiest dangle 500 usd, the last amount is being taken automatically from crypto forex you dangle added in that spending pocket, its converted and it goes in a single patent, so you don’t dangle to set 2 funds for the connected product. The firm is evaluating and handpicking all of the financial merchandise which can be going to make a contribution to the basket of investments because certifications aren’t adequate in phrases of funds.

Neobanks had been spherical for a whereas and many other folks are actually accustomed to the idea that. A few years ago, many entrepreneurs wished to launch a “neobank for x,” but that trend former away. enfineo arrives on the market a puny bit later but would possibly maybe additionally steer clear of all of the pitfalls that prolong with running a neobank, whereas combining the realm of cryptocurrency with veteran banking.

Disclaimer: The text above is an advertorial article that isn’t very section of Cryptonews.com editorial negate.

Source : cryptonews.com