Bitcoin Price Prediction: BTC Surges to $46,000 Amidst ETF Boom & Economic Warnings

Bitcoin Designate Prediction: BTC Surges to $46,000 Amidst ETF Yell & Economic Warnings

As Bitcoin buying and selling around the $46,000 set with a famous 3.50% surge on Friday, the cryptocurrency world braces for the impact of external monetary narratives. Amidst this, MicroStrategy faces a recalibrated label purpose publish-earnings call by BTIG, signaling transferring investor sentiments.

Concurrently, the cryptocurrency sphere witnessed an unparalleled ETF debut month, courtesy of BlackRock and Fidelity’s Bitcoin ETFs, marking a foremost milestone in digital asset investment.

Within the backdrop of these trends, monetary educator Robert Kiyosaki points a grim forecast, pushing apart the alternative of a steady aftermath to the looming world economic downturn, urging investors to reassess the steadiness and future development capability of Bitcoin amidst these tumultuous economic predictions.

Put up-Earnings Reassessment: BTIG Lowers MicroStrategy Designate Target

Following MicroStrategy’s Q4 earnings announcement, BTIG revised the company’s label purpose from $690 to $650, declaring a Buy rating. The company cited document subscriber billings, regardless of falling quick of gross sales expectations, and issued optimistic projections for FY 2024.

With $8.2 billion in Bitcoin holdings, an much like 190,000 BTC, MicroStrategy is exploring the aptitude of leveraging its unrestricted Bitcoin resources. BTIG highlighted that regulatory readability and increased institutional adoption are mandatory for MicroStrategy’s Bitcoin technique.

The company means that bolstering institutional confidence and fervour in Bitcoin might perhaps presumably positively impact BTC costs by doubtlessly using ask and rate appreciation.

File-Breaking Debut: BlackRock and Fidelity’s Bitcoin ETFs Develop Historic past

Kiyosaki’s Prediction: No At ease Descent Amid International Monetary Turmoil

Kiyosaki has doubled down his warning that there is presumably now not any gentle landing. In “Wealthy Dad Sorrowful Dad,” creator Robert Kiyosaki reiterates his issues in regards to the recount of the economy and warns of bank screw ups and a world economic smash.

He expects investor losses amid the impending crisis and promotes safe havens such as gold, silver, and Bitcoin, highlighting the latter’s dwelling as “other folks’s money.” Attributable to Kiyosaki’s prominent position in monetary education, there is an alternative that Bitcoin will become more well-liked and that its label will upward push as other folks become more assured in it as a hedge in opposition to economic uncertainty.

BAIL OUT, BAIL OUT, BAIL OUT: In US Navy Flight Faculty, pupil pilots learn to hover and the blueprint to smash their plane. Monetary losers will lose money due to they stay now not know what to with their money as banks fail and world economy crashes. For a ramification of years I bear warned, “Buy…

— Robert Kiyosaki (@theRealKiyosaki) February 8, 2024

His constant pork up of Bitcoin’s ability to resist authorities interference and the depreciation of fiat currencies might perhaps presumably even entice more investors procuring for safety in decentralized resources, which would lengthen Bitcoin’s long-time frame adoption and rate development.

Bitcoin Designate Prediction

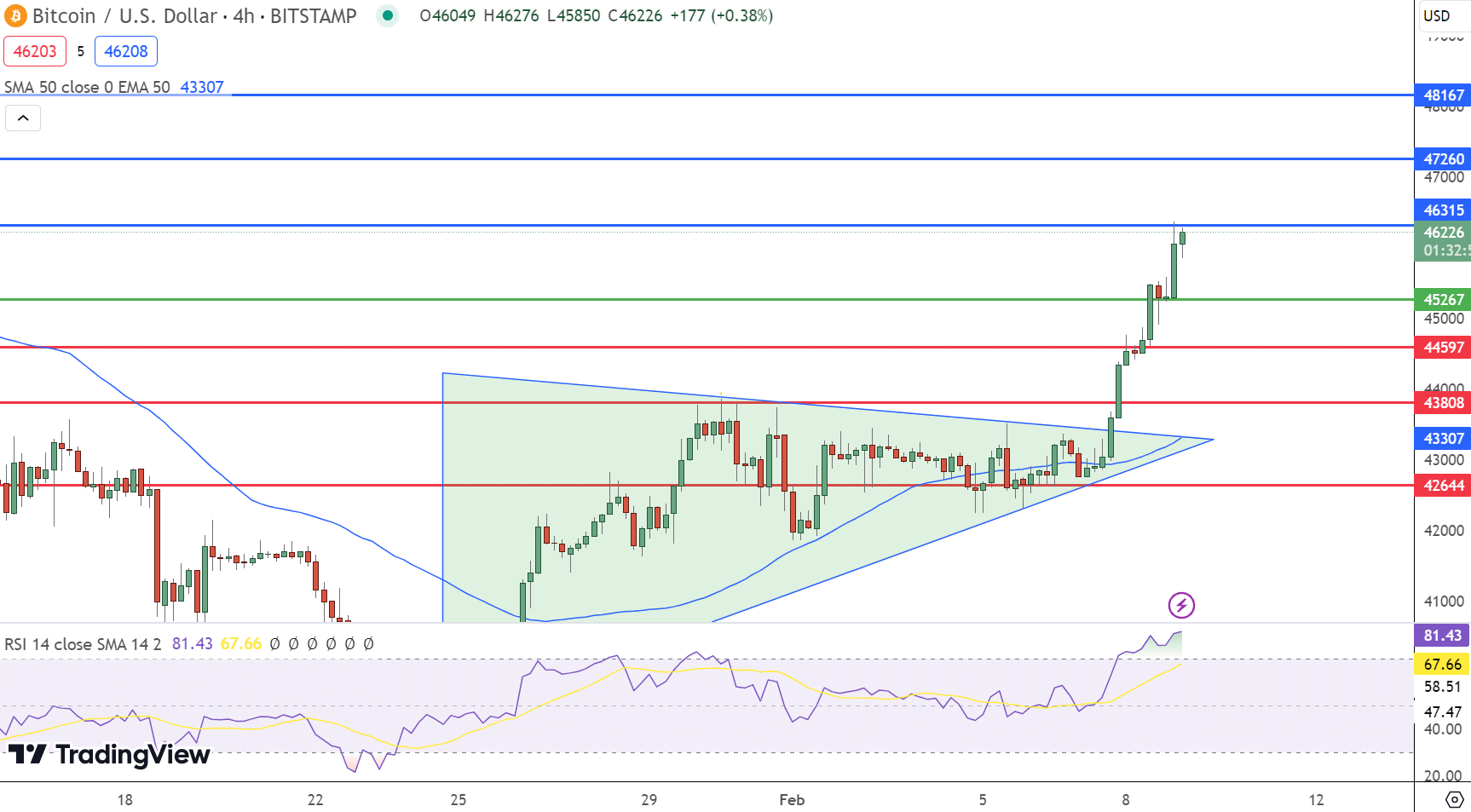

Bitcoin has seriously surged past the $46,000 set, reflecting a bullish momentum within the digital forex market. The asset’s latest buying and selling dynamics design it strongly above the pivotal $forty five,267 set, indicating a robust buying for pattern among investors. Quick resistance stages are identified at $46,315, $47,260, and $forty eight,167, which Bitcoin might perhaps presumably even test if the upward pattern continues.

Conversely, pork up stages at $44,597, $43,808, and $42,644 present a safety gain in opposition to capability pullbacks. Technical indicators extra bolster the bullish outlook, with the Relative Energy Index (RSI) at an elevated 81, suggesting solid buying for tension.

The MACD’s hump divergence, marked by a label of 258 and a signal of 768, reinforces the aptitude for persisted upward momentum. Moreover, Bitcoin’s breach of the symmetrical triangle sample and the presence of bullish engulfing candles underline the chance of sustained positive aspects.

In summary, Bitcoin’s latest technical panorama is decidedly bullish, with the aptitude to contrivance back increased resistance stages so long because it remains above the $forty five,265 threshold.

Top 15 Cryptocurrencies to Ogle in 2023

Deal with up-to-date with the area of digital resources by exploring our handpicked sequence of the ideal 15 alternative cryptocurrencies and ICO projects to bear an look for on in 2023. Our listing has been curated by experts from Industry Discuss and Cryptonews, making certain educated recommendation and severe insights to your cryptocurrency investments.

Rob perfect thing about this alternative to search the aptitude of these digital resources and bear yourself told.

Disclaimer: Cryptocurrency projects instructed listed here aren’t the monetary recommendation of the publishing creator or e-newsletter – cryptocurrencies are extremely volatile investments with unprecedented possibility, consistently stay your possess research.

Source : cryptonews.com