Wirex CEO Says Money Mules Are a Massive Issue in FinTech and Crypto

Wirex CEO Says Money Mules Are a Massive Project in FinTech and Crypto

In an insightful interview with Cryptonews, Pavel Matveev, CEO and co-founder of current international digital payment platform Wirex, discussed what cash mules are and the absolute best diagram gargantuan of an anguish they pose within the crypto and FinTech industries. The fast reply is: gargantuan.

He extra suggested us how these fraudsters sell true challenger banks’ accounts on the murky web, how Wirex finds them, and what a approach to this anguish will also be.

Matveev also in fast touched on the incoming bull market and Wirex’s plans for this year.

That is what he suggested us.

What’s a Money Mule in Crypto?

Money mules are a neatly-liked anguish in FinTech and banking. And Matveev suggested Cryptonews that this anguish overlaps with crypto.

Money mules are continuously formative years, normally between 18 and 22. They’ve legitimate paperwork, at the side of an ID and proof of location.

Criminals who goal to commit cash laundering rent these young folks to commit fraud and/or cycle cash thru accounts launch in FinTech firms.

Extra normally than no longer, cash mules know what they’re doing. But they cease it anyway:

“per chance because they’re young, or per chance because they need cash, or per chance because they authorized don’t realize penalties.”

It infrequently ever occurs that they are unknowingly pulled into criminal actions, becoming victims themselves.

That stated, challenger banks, similar to Revolut, N26, and Wise, stay their main targets. However, Matveev stated,

“We beget reached a level within the industry the place a lot of FinTech firms beget crypto, in one form or one other.”

Therefore, it’s unsurprising that cash mules beget made their methodology into this new industry as successfully.

However, cash mules can’t ‘cease their commerce’ in crypto by myself: there is continually a connection with fiat. They have to alternate it one day.

That stated, Wirex’s CEO argued that this anguish doesn’t web mighty attention in crypto.

“The crypto industry doesn’t in actuality care mighty about cash mules at this point of time [though] it’s an urgent anguish in FinTech.”

Since Wirex is each a challenger monetary institution and a crypto commerce, cash mules are a urgent anguish.

Scammers Sell Accurate Accounts on the Black Internet

No person knows what number of cash mules there are available within the market.

The main anguish is that they are true folks with true IDs. They provide all the predominant documentation and streak all the exams.

“That’s why it’s very refined to fetch them. They appear for love true customers with true intentions. In command that’s certainly one of the challenges for the industry.”

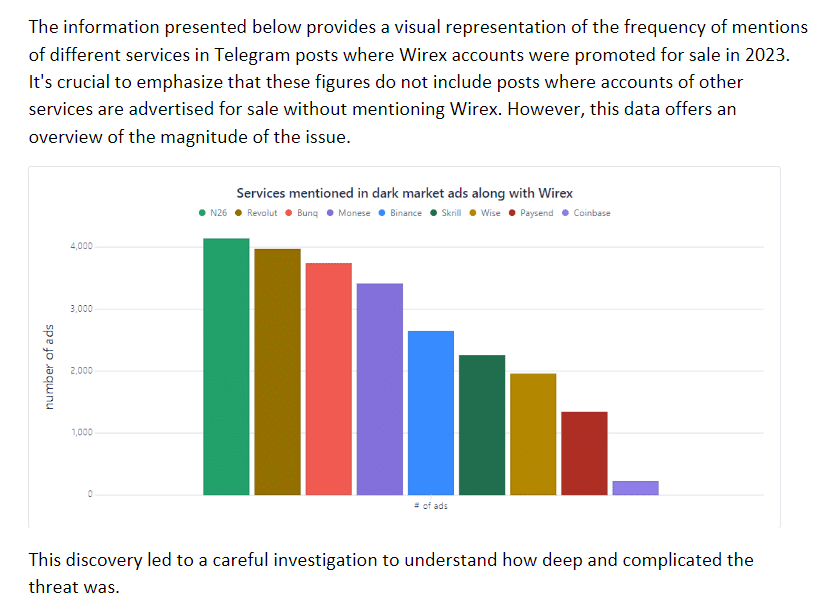

Wirex, on its aspect, employed a number of instruments to analyze the murky web. That is the place true accounts are supplied for sale.

Wirex chanced on accounts made with them, as successfully as with Revolut, Crypto.com, Coinbase, and others. They all beget a excessive form of ads promoting new accounts printed on the murky web.

Therefore, scanning the murky web for Wirex mentions is certainly one of the instruments the corporate employs.

The team also conducted a few exams: they contacted sellers to aquire accounts. This enabled them to see the story, its starting place, the actual person’s nation, time of registration, and reasonably a lot of puny print. These puny print enable them to appear for for same perilous accounts and patterns.

In the period in-between, users within the 18-22 age neighborhood are thought to be as perilous customers that require extra exams.

Furthermore, the corporate does transaction monitoring.

One Money Mule = Diverse Accounts on Diverse Platforms

Money mule movements are interconnected. They soar between reasonably a lot of accounts on reasonably a lot of platforms. This methodology that one particular person can beget a number of accounts to be misused.

That is no longer one company’s anguish but an industry-wide anguish. Therefore, Meteev stated,

“We, as an industry, have to fight cash mules collectively.”

There isn’t any longer any methodology to manipulate or censor the murky web, but it’s predominant to raise consciousness about cash mules and proceed establishing a few instruments to observe the murky web exercise.

Furthermore, exams are predominant to possess the place these accounts are coming from.

Therefore, firms must portion the records they web to end the an identical folks from making a few accounts across a few platforms.

It’s no longer possible to eradicate FinTech cash mules entirely, but “this might maybe be fair to produce an industry-wide formula and a framework.”

Response to COCA MPC Pockets & Card is ‘Very Distinct’

In January this year, Wirex partnered with COCA to launch a Multi-Occasion Computation (MPC) wallet and a non-custodial debit card.

The product has a nil-payment policy. Requested how that formula is winning, Wirex’s CEO stated that COCA is a beautiful young company and is within the meanwhile centered on particular person explain pretty than margin.

He opined that,

“In the future, they will doubtlessly obtain a methodology to monetize the shopper wicked, either thru membership or per chance thru promoting extra services or something love that.”

It has been a month since the wallet and card had been launched, and per Matveev, the response has been “very, very fair” and “very obvious.”

He wired that the application is designed for non-crypto-native audiences and the mass market.

The main payment proposition is that users defend watch over their cash without counterparty hassle.

“If something occurs with your card, it will get lost, stolen, VISA or the card issuer disappears, you quiet like your cash. You proceed to defend watch over your cash.”

Additionally, the wallet permits users to beget interaction with dapps, commerce on DEXes, aquire NFTs, exercise funds, and extra.

Provided that crypto quiet wants to be remodeled to fiat to be spent, the combination of wallet and card is stunning to the mass market.

Matveev suggested us that the integrated IBAN feature would maybe be accessible by the stay of the major quarter. This can enable FinTech users to conduct Euro transactions and web right of entry to banking services.

Getting into the Bull Market

Matveev renowned that the lately accredited space Bitcoin alternate-traded funds (ETFs) had been “a shrimp overhyped” and had been already priced in. However, within the mid-to-long scamper, they’re going to be “a gargantuan gateway for institutional cash.” Ethereum ETFs might maybe be the next gargantuan milestone.

Furthermore, Matveev explained that we’re getting into one other crypto bull market. Every four years, crypto sees a new cycle, “nearly love the Olympics.”

We’re seeing many altcoins’ prices rising, and “it’s authorized the origin.” Per Wirex’s CEO,

“That’s the ideal, basically the most nice looking time within the industry.”

Wirex has “a lot of issues” within the pipeline for this year. By methodology of a product build, he stated, the corporate is engaged on Wirex Alternate. At the second, the product is same to a challenger monetary institution for retail customers. But the corporate plans to enhance the product build to companies, at the side of crypto firms, providing them web right of entry to to Wirex’s banking and card infrastructure, as successfully as cryptocurrencies.

Any enterprise would maybe be in a situation to launch an story on Wirex Alternate the place they will anguish playing cards for staff or subcontractors. The banking infrastructure and playing cards would be historical to pay bills, invoices, and reasonably a lot of prices.

Source : cryptonews.com